The world’s top 10 solar inverter providers accounted for 86% market share in 2022, a year where the market saw a 48% increase in size year-on-year (YoY).

According to research group Wood Mackenzie (WoodMac), last year saw 333GWac of inverter shipments globally, driven by increased demand in Europe, the US and Asia-Pacific and easing supply chain challenges over the course of the year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

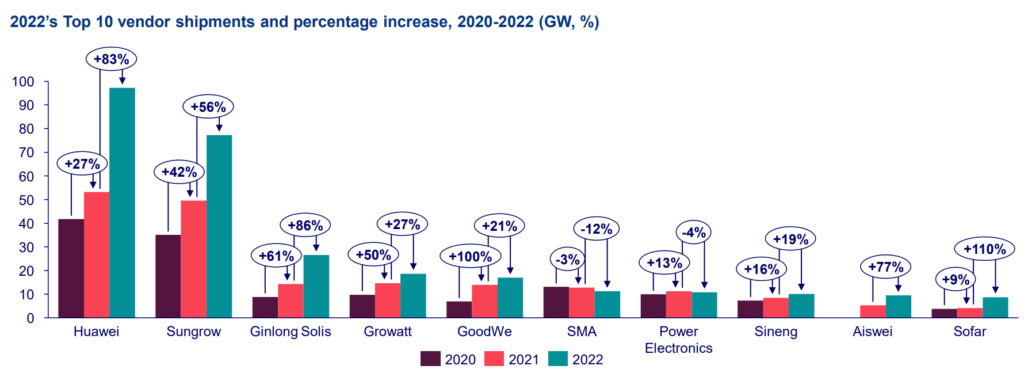

WoodMac found that the top five vendors grew their market share by 8% in 2022 to 71%, shipping over 200GW between them. Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in shipments respectively compared with 2021. Last year’s market breakdown can be read here.

In 2023, Sungrow has announced supply deals for some of the largest PV projects in the world, notably two Saudi installations that both exceed 2GW capacity. The ‘world’s largest’ solar farm will deploy 2.1GW of Sungrow’s inverters, and the NEOM green hydrogen project will use 2.2GW.

Ginlong Solis, Growatt and GoodWe rounded out the top five vendors list in 2022. Ginlong is the only one of these three to have seen an increase in YoY growth, up 86% in 2022, whilst both Growatt and Goodwe’s growth slowed down compared with 2021.

Goodwe enjoyed significant growth in 2021, rising four positions in the top 10 ranking to its number five position with a 100% increase in shipments. Its growth slowed in 2022, however, to 21%.

Only SMA and Power Electronics of the top 10 companies saw small decreases in shipments, down 12% and 4% respectively.

In terms of market breakdowns, the Asia-Pacific (APAC) market accounted for 50% of global share last year, with a 44% YoY increase in shipments to 130GWac. Of this, 78% were directed to projects in China as it continues its massive solar rollout. India was the second largest APAC market, but fell 25% YoY; in 2022 India missed its PV deployment targets substantially, laying down 12.8GW of its target 20GW.

Europe accounted for 28% of global market share last year and had an 82% increase YoY, the highest of any global region. 92GWac of inverters landed in Europe in 2022 as it looks to meet its 2050 targets set out in the Green Deal Industrial Plan.

The US saw 42GWac shipped to its projects, just 13% of the market. Earlier this year, Enphase Energy announced an expansion of its US microinverter supply operations.