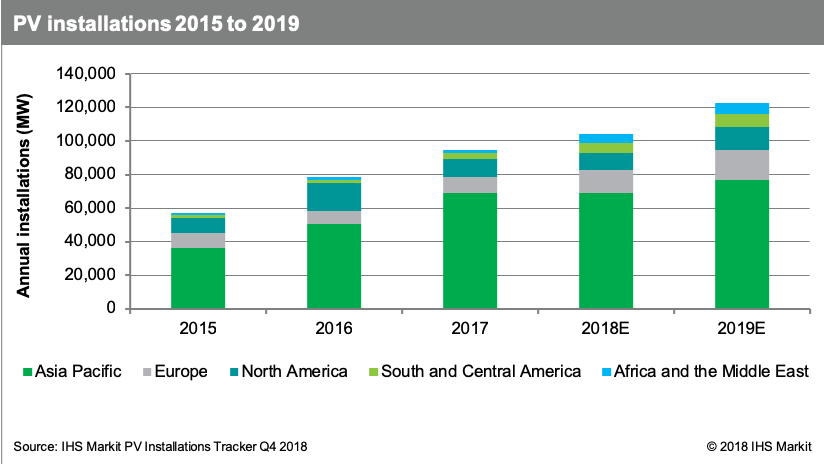

According to IHS Technology, the three leading North American megawatt-scale PV O&M providers accounted for 44% of the regional market in 2015.

First Solar paced the North American solar sector with 25% of the market, followed by SunEdison at 11% and SunPower at 7%. With SunEdison’s bankruptcy and potential sale of its assets in North America, an opportunity arises for other O&M providers to build up their portfolios.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In total, megawatt-scale PV operations and maintenance (O&M) market revenue in North America was estimated by IHS to be US$300 million in 2015 — a sum which is expected to grow to US$1 billion in 2020.

As utility-scale PV projects become larger, operators will have to follow higher standards regulated by the North American Electric Reliability Corporation (NERC). IHS expects that over 7GW of PV currently under development from 2016 to 2017 in North America is likely to fall under NERC regulation.