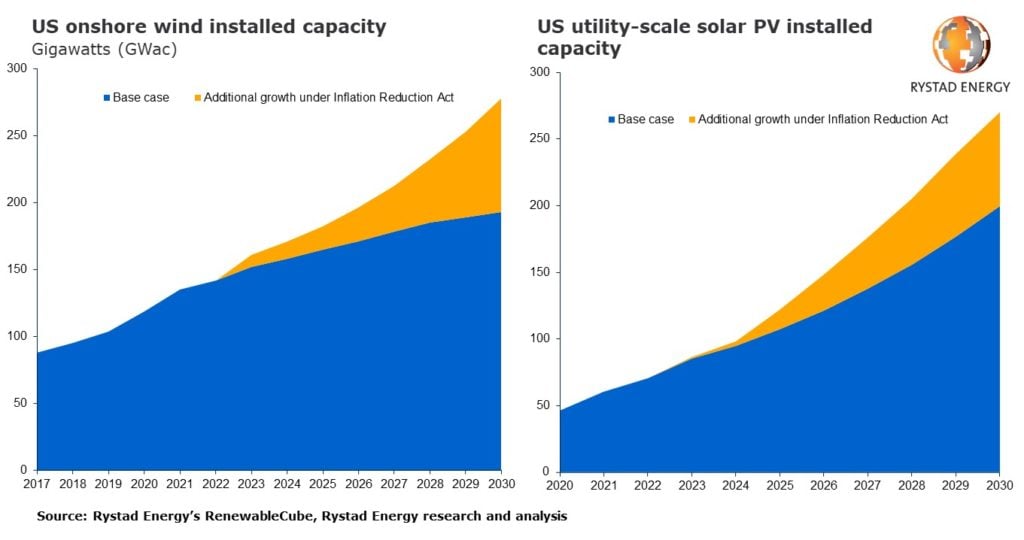

The Inflation Reduction Act (IRA) is expected to add an extra US$110 billion in investment for utility-scale solar in the US by 2030, increasing the country’s utility-scale deployment by more than 70GW.

That is according to consultancy Rystad Energy, which now expects the US to hit 270GW of utility-scale PV by 2030, from from 200GW, due to the incentives contained within the IRA.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The act will have a significant positive impact on the US solar industry, Rystad said, but the effects will not be immediate as the sector still grapples with recent headwinds, such as the anti-dumping and countervailing (AD/CVD) investigation, the ban on polysilicon coming from Xinjiang and vast interconnection queues across the US.

The effects of the new incentives will be fully felt in 2024, according to the consultancy.

Marcelo Ortega, renewables analyst at Rystad Energy, said: “The Inflation Reduction Act is a game changer for the US wind and solar industry. The tax credits in the bill will strengthen the economic feasibility of new project developments and boost the wind and solar markets’ growth trend this decade and beyond.”

Moreover, the new legislation will make the production tax credit (PTC) – which has earmarked US$30 billion to help boost domestic clean energy manufacturing – available for solar projects, with developers able to choose between this and the Investment Tax Credit (ITC).

Meanwhile, the internal rate of return (IRR) – a measure that evaluates the profitability of project investments – will increase by one or two percentage points for solar and wind project, Rystad said.

“We estimate that for a 250MW utility-scale solar project, the PTC will be the most beneficial tax credit until a 7.5% discount rate is achieved, after which the ITC will be the preferred tax credit,” said Rystad Energy.