Credit: Scatec Solar

After years of not living up to its solar potential, Brazil is on the cusp of a solar boom. A confluence of factors has led to rapid investment and deployment in the country, but a few hurdles still need to be overcome, writes Sean Rai-Roche.

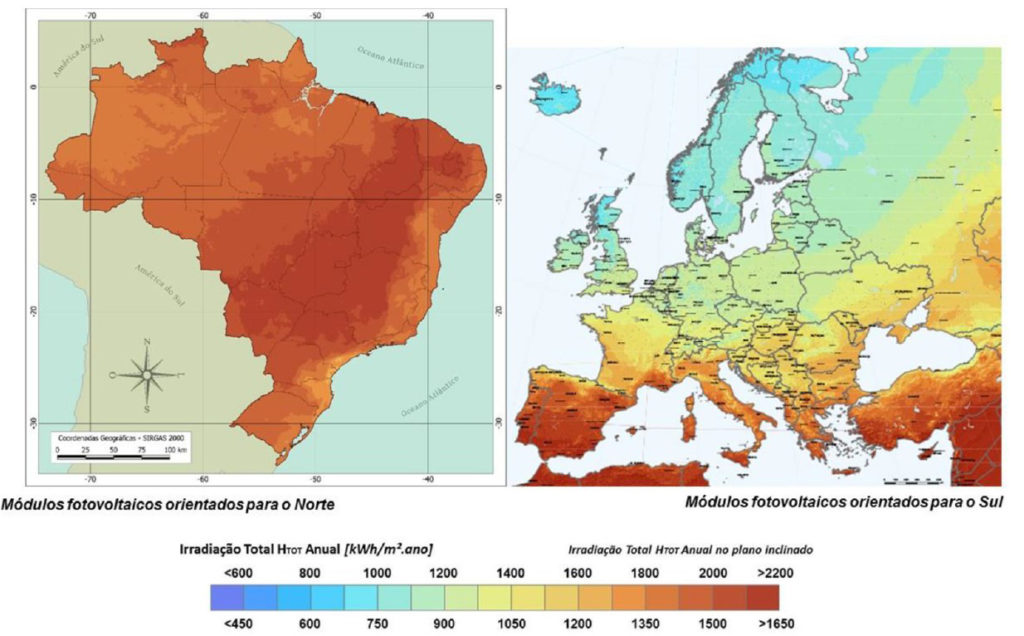

Brazil has some of the best solar irradiation in the world, with the average solar PV system generating twice as much electricity as the same one in Germany. And yet, Brazil tails the European country when it comes to installed solar capacity by more than 40GW. While it’s the biggest market in Latin America, there is a sense of underachievement in the Brazilian solar sector so far. Things are, however, changing and optimism abounds the future of Brazilian solar.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

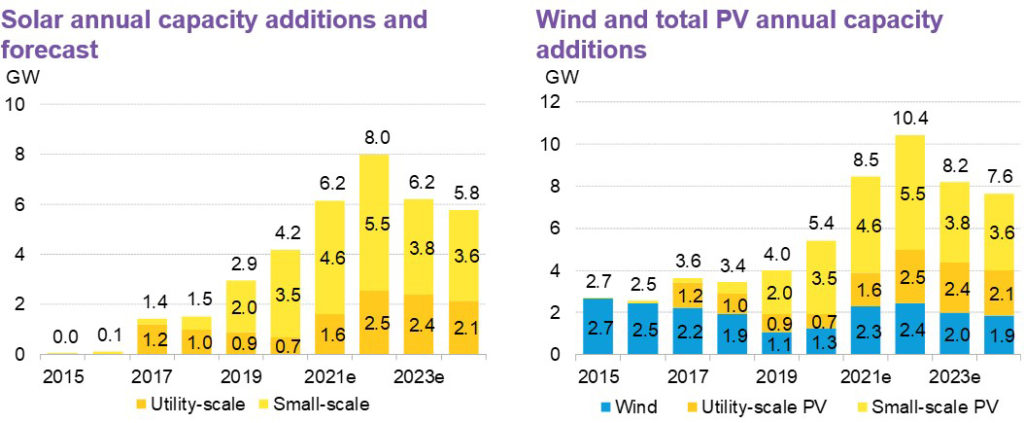

Historically, Brazil has been dominated with hydropower and wind, but now the solar market is booming fast. Since 2017, when solar started to be included in the country’s power auctions, the nation has climbed 12 places on the world rankings of installed solar PV and now sits at 14th, according to Latin American solar trade body ABSOLAR. And it shows no sign of slowing down. In fact, deployment in the country is expected to accelerate as Brazil is forecast to add 8GW of solar this year, far outstripping wind power at 2.5GW, according to BloombergNEF (BNEF).

The reasons for this are myriad and will be examined in detail below, but it is important to note that the main driver for solar PV is not via utility-scale projects, as is the case in most markets, but instead through small-scale distributed generation systems. That’s not to say it’s all plain sailing as barriers to greater deployment, such as access to project finance and grid constraints, do exist.

PV Tech spoke with analysts, companies, trade bodies and banks in the country to examine the key drivers for Brazil’s solar market moving forward, discuss its potential and assess what obstacles need to be addressed for the country to capitalise on its environmental advantage.

The future is small-scale

It is crucial to note that small-scale solar is, and will continue to be, the main driver of PV deployment in Brazil. This year, the country is expected to add 8GW of solar, of which 5.5GW will be from small-scale sites, according to BNEF. Last year, the split was 4.6GW of small-scale solar to just 1.6GW of utility-scale. The reason for this is Brazil’s very attractive net metering laws for systems up to 5MW that have been in place since 2015. The impact of the laws only started in earnest in 2017 – the first-year small-scale capacity additions exceeded 1GW (they were just 100MW in 2016) – and have caused a distributed solar boom in the country. The appetite for small-scale systems is growing further still, with research from ABSOLAR showing “90% of Brazilians want to produce [their] own renewable electricity at home”.

The net metering laws do not tax generators who put electricity back onto the national grid, allow for ‘remote generation’ whereby electricity generated need not be consumed on site and can be shipped across the utility region easily and are loosely regulated, with a streamlined application process.

At the start of the year, however, Brazil announced long-awaited changes to its net metering system, with profound consequences for the solar industry. While the new laws remain “highly favourable” to small-scale solar deployment, less generous payments in the future are turning what is already a “red-hot” market into one “going into overdrive” as generators scramble to access the existing, more lucrative scheme, according to James Ellis, head of Latin American research at BNEF.

Under the new rules, which come into effect in January 2023, any solar PV systems below 5MW will be eligible for net metering tariffs until 2045 but will have to start paying tariffs on the power generated for the first time. “According to the new tariff system, between 2023 and 2029, there will be a gradual increase of the amount to be paid with respect to the distribution tariff and, starting in 2029, the full amount of the distribution tariff will apply,” explains Camila Ramos, managing director of Clean Energy Latin America (CELA).

“The prospect of major revisions to Brazil’s net metering policy has already been a key ingredient driving a distributed solar boom that has seen small-scale capacity jump from zero in 2015 to 11GWdc [today] − double [the country’s] total utility-scale solar capacity,” Ellis says.

When it comes to the “bigger picture”, Ellis says “the new law provides much-needed legal certainty to the sector – consumers, developers, investors and distributors – and will put Brazilian behind-the-meter solar on a more sustainable growth path beyond the current frenzy.”

Expect 2022 to be a boom year for distributed generation in Brazil. After this, deployment levels should start to fall but will remain strong as the policy environment continues to be favourable. Small-scale solar will continue to drive PV deployment in the country (see figure 1), although utility-scale projects will have their part to play.

A role to play for utility-scale

Although utility-scale capacity additions are set to remain below small-scale generation as distributed generation takes centre stage, the contributions large projects make will still be important to Brazil’s energy mix. Crucial to this is the growth of the free market in Brazil as developers increasingly trade power from solar PV directly on the free market via bilateral agreements.

Once solar became included in national auctions in 2017, about 1GW of utility-scale solar was added every year from 2017 to 2020, although this was far surpassed by utility-scale wind. In 2021, however, more utility-scale solar was commissioned than wind, with the trend set to continue over the next few years. BNEF expects roughly 2.5GW to be commissioned this year, compared with 2.4GW for wind, with this remaining above 2GW for the next few years. Utility-scale solar has been the most competitive power source in the Brazil’s latest reverse auctions, says Ramos.

When it comes to utility-scale projects in Brazil, developers enjoy certain financial benefits too, including an exemption from import tax and ICMS, which is the equivalent to state VAT in Brazil. ICMS Agreement No 101/1997 exempts certain equipment of solar and wind project from state VAT and runs until 2028.

In addition, a Federal Government programme called Special Regime of Tax Exemption for Infrastructure Development suspends federal taxes on the import and sale of equipment, machines and services for infrastructure projects, including solar.

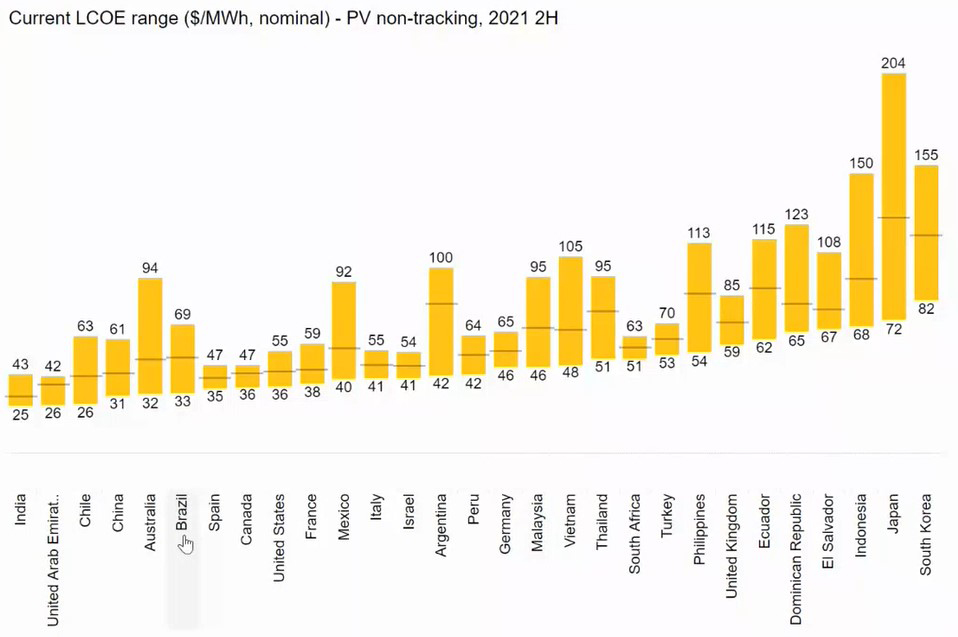

These financial factors in combination have led to levelised cost of energy (LCOE) for solar in Brazil being on par with wind, where it is a world leader, and among the likes of China and the US, at a low of US$33/MWh, according to BNEF (see figure 3).

“Brazil has fantastic solar resource and natural conditions to reach one of the lowest LCOE in the world,” says Luis Barros, head of operations and maintenance for EDP Renewables.

Importantly, the Brazilian power sector is comprised of two different markets – the regulated market and the free market. Brazilian agency ANEEL oversees the regulated market and determines the commercial relationship between consumers and providers through auctions, while in the free market generators can strike bilateral agreements with parties able to negotiate on price and volume. This free market is growing significantly, says Ramos.

“Corporate PPAs are becoming a very important source of solar PV,” says Ramos. And the free market is also becoming an option for smaller consumers as the threshold for accessing it drops, with smaller consumers increasingly able to trade on it. There is even a schedule in place to allow residential consumers to access the free market, she explains, “so this is a very important development for utility scale projects.”

Financing constraints and currency considerations

Companies looking to invest in the Brazilian market should be aware of two financial issues – access to project finance and currency risk if trading in Brazilian real. Heavy competition for project finance from either state development banks or private lenders can be an issue, while much financing in the country still takes place in local currency, rather than US dollars, which is more volatile, causing risks to bankability.

There are a couple of hurdles to project financing in Brazil, says Axel Holmberg, senior vice president of business development in Latin America for Scatec, which sees Brazil as a key market given its size, solar resources and industrial activity.

First, there is access to financing from government funded development banks. These banks have the most competitive rate but limited budgets, says Holmberg. Second, utility-scale solar in Brazil is a crowded market and private finance sources are also in high demand, meaning stiff competition between developers.

When it comes to development banks, there are a few different options. Some cover specific regions – such as BDMG that provides finance solely for the state of Minas Gerais or B&B in the Northeast of Brazil – while others like BNDES cover the whole country. “But their budget is coming from the government on annual basis, and it cannot finance all the demand in the market,” says Holmberg.

There are also long lead times for development bank financing and the disbursement never happens before construction starts, says Ramos, meaning developers will need a bridge loan or existing capital to break ground.

Moreover, development banks cannot finance imported equipment, so only local components of a project will get support. This mean that developers will often opt for dual financing – development banks for local components and commercial banks for any imported aspects of the project.

A BNDES spokesperson told PV Tech Power it funded roughly 700MW of solar projects last year, up from 663MW in 2020. “BNDES can leverage up to 80% of a project that applies for financing” and assesses “environmental permits, regulator authorisation, equipment and construction contracts, and energy commercialisation strategy” when making decisions, it says.

“It’s getting easier and easier to finance a distributed generation PV system”

The average size of PV projects in its portfolio is around 190MW, although BNDES also finances smaller and distributed generation projects through partner financial institutions.

Meanwhile, commercial banks are a source of finance for both small and utility-scale solar. Recognising Brazil’s distributed generation boom, more commercial banks are offering financing for small-scale solar systems. “It’s getting easier and easier to finance a distributed generation PV system,” says Ramos.

For utility-scale financing from commercial banks, competition is fierce, and the market is dominated by large-scale power producers, meaning it can be hard to access capital, says Martin Vogt, CEO of MPC Energy Solutions, an independent power production (IPP) with projects across Latin America. MPC is not active in Brazil in part because of “massive competition”, preferring to focus on other Latin American markets.

Another financial factor to be aware of when it comes to project financing in Brazil is whether agreements are made in US dollars or Brazilian real. Signing agreements in real can open companies up to risk through fluctuations and regulatory uncertainly, with the dollar being a much more stable bet, say Vogt and Holmberg.

PPAs in the regulated market are always in real, but while a portion of PPAs are brokered on the free market in dollars, a recent piece of legislation has formalised the practice, with Ramos expecting increasing numbers of private PPAs to be signed in dollars moving forward.

Grid constraints an issue, but not a huge one

While challenges certainly exist and improvements need to be made, the transmission and distribution network in Brazil is much better than most other countries in Latin America. That said, transmission queues are growing, and a lack of capacity can lead to curtailment in some regions.

Brazil has an almost completely connected national grid system that covers all the major demand and supply centres unlike other major Latin American markets, says Ellis. For example, Argentina has been unable to hold any renewable auctions since 2016-17 because of a lack of grid capacity, stymieing its transition to renewables.

“The overall transmission picture is less worrying than we see in some other markets. But that’s not to say that this isn’t an area of concern where you see huge amounts of renewable capacity being commissioned,” says Ellis.

What’s more, Brazil is to pare back discounts on the rate for using the electricity transmission system (TUST) or the electricity distribution system (TUSD) from March this year, which renewable projects in the country have enjoyed for some time. While this is more detrimental to wind, it will also impact solar power producers.

“Congestion on the transmission lines and rising costs associated with that is an area of concern for both wind and solar, but particularly for wind,” Ellis notes.

“The generation potential in Brazil is greater than its transmission capacity,” says EDPR’s Barros. “This has led to a ‘race’ among companies seeking to build new renewable energy plants to qualify for the 50% discount on the rate of use of the transmission system.”

Another issue is the length of connection queues. “There is a huge competition for connection,” says Ramos, with this varying by region. The state of Minas Gerais just north of Rio de Janeiro – a solar hotspot in the country – has much longer queues than other, less solar heavy regions, she explains.

One way to resolve this is to build out the transmission capacity and Brazil’s Energy Research Corporation (EPE) is “trying to work with associations and companies in the sector to reduce the levels of uncertainty regarding the planning process of these new transmission lines,” says Barros.

The Brazilian solar market has a lot of things going for it. A solar rich environment with lucrative distributed generation opportunities and a growing utility-scale scene have converged to spur deployment in the country, which has historically been slow on solar. While financing and grid constraint issues do exist, these are likely to be addressed through a combination of public and private activity alongside infrastructure upgrades. After years of languishing down the bottom of the solar league tables, Brazil is on the up-and-up and is on the way to realising its true solar potential.