Array Technologies’ Q1 2021 results, published last week, were illustrative not just for the company, but for the solar tracker market in general.

Posting an earnings miss is not usually conducive to appeasing shareholders or analysts, but withdrawing full-year guidance on the back of spiralling costs and volatile, unpredictable market conditions is enough to trigger serious disappointment and questioning.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

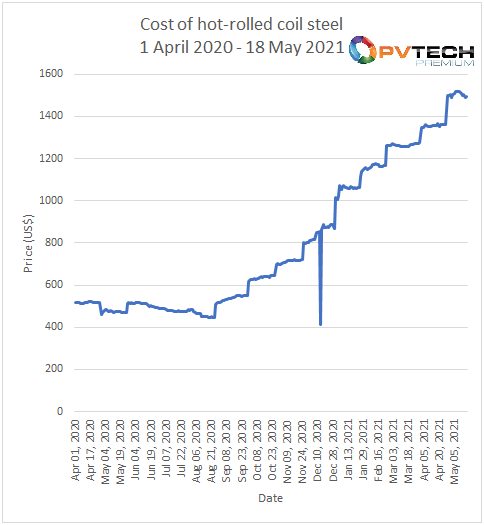

The problem, as Array chief executive Jim Fusaro revealed, is the cost of hot-rolled coil steel used in Array’s products, which has spiralled to “unprecedented” levels over the course of the last year and continued to rise even further in the post-reporting period.

Indeed, looking at the historical data for US Midwest domestic hot-rolled coil steel futures illustrates the issue at hand. On 1 April 2020, market data shows the price per short ton was around US$515. By 31 March 2021, it had reached US$1,348 per short ton, equating to an increase of some 156%. The bad news for tracker manufacturers and other users of hot-rolled coil steel is that in the seven weeks since 1 April 2021, the price has – as Fusaro told analysts last week – jumped by a further 11%, standing yesterday a US$1,496 per short ton. The chart below illustrates the sheer scale of price increases in the material since last April.

Module manufacturers will more than likely have some sympathy with tracker providers given the price of polysilicon has been on a similar rise over the course of the last year. Meanwhile, Fusaro also noted that the cost of logistics has also soared in recent months, a lament shared by solar module manufacturers as well.

Simply put, not only are utility-scale solar components significantly more costly to produce than they were a year ago, but it is also more expensive to get them where they are supposed to be. Manufacturers have already expressed a need to pass on at least some of these cost increases to customers, resulting in inevitable project pushbacks and delays.

But the manufacturers too will have a cost to bear, perhaps most notably in their market valuation.

Array Technologies’ share price tumbled heavily in the wake of its results disclosure last week. Having closed on Tuesday 11 May at US$24.95, it closed the following day at US$13.46 per share, a fall of 46%. The most recent collapse has added to what’s proven to be a tumultuous year for Array shareholders. On 22 January 2021 shares in the company were worth more than US$51 – now they’re valued at around 70% less, the first drop triggered by a secondary share offering earlier this year which priced shares at US$28, diluting the share count in the process.

Other tracker manufacturers were similarly hard hit – not by Array’s Q1 miss or its decision to withdraw 2021 guidance of course, but by the spread of fears around materials costs. FTC Solar, which was only admitted to the market in late April after an underwhelming IPO, fell 25% to US$8.76 immediately after Array’s results. Flex, which owns Nextracker, fell around 8%, but has since climbed back somewhat. Whether Flex continues with its plan to list Nextracker given these jitters, coupled with early signs of a cooling in investor appetite for some green stocks, remains to be seen.

Soltec, the Spanish tracker manufacturer which also has a project development arm, fell 10% to €6.84, however the company’s own results, which demonstrated a 53% fall in first quarter revenues year-on-year, reflected a wider malaise across the business.

If Fusaro’s sentiments, expressed to analysts in the wake of last week’s results call, ring true, there will be little respite for tracker manufacturers throughout the rest of the year. Fusaro expects steel and logistics prices to remain high at least throughout the current quarter and may not normalise until far later in the year. While actions to mitigate the increases – passing on costs, negotiating longer-term contracts – may help, they evidently won’t have such an affect as to allow the company to reinstate or offer guidance.

Array Technologies’ expectation is that while the pressures will be bad for the company, they’ll be even worse for its competitors. “Importantly, we believe our competitors are being impacted by the same cost increases that we are experiencing and, in certain cases, much more significantly because their smaller size gives them less buying power with suppliers.

“We believe the near-term pressure that is being created by the current environment may enable us to accelerate our market share gains because some of our competitors may not be able to deliver on customer commitments given their inability to procure raw materials at a competitive price or at all,” he said.

All eyes will therefore fall on tracker companies’ next set of results. If materials and logistics costs continue to rise, or even just stabilise at their existing levels, then the tracker market could be set for a significant shake-up.