Leading monocrystalline wafer producer and ‘Solar Module Super League’ (SMSL) member, LONGi Green Energy has defied the downward pricing pressure on its core wafer business and weak global demand, driven by the impact of COVID-19 on the solar industry supply chain to report record revenue, profit, and module shipments in the first half of 2020.

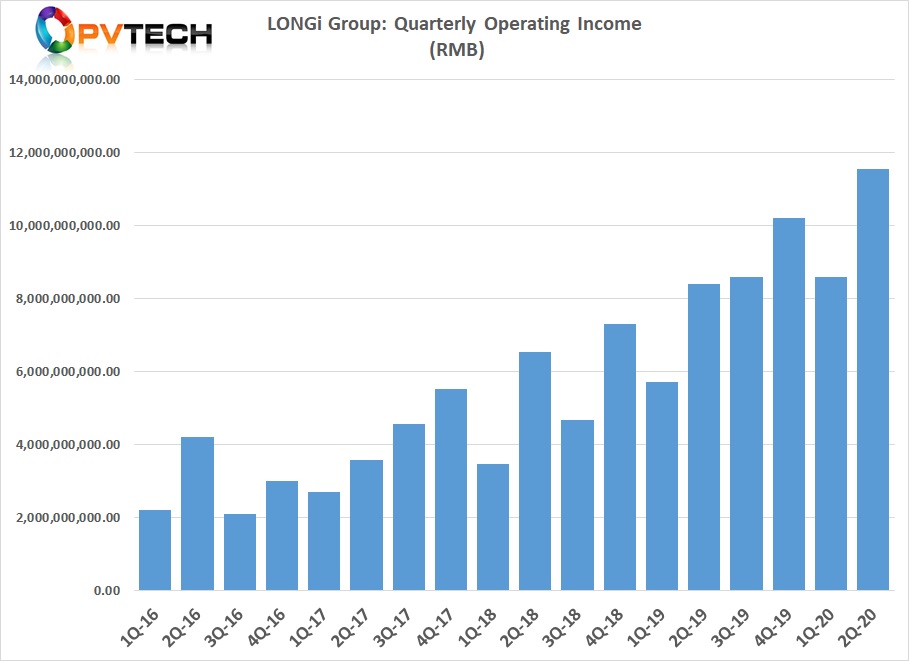

LONGi reported first-half 2020 operating income (revenue) of RMB 20.141 billion (US$2.933 billion) a new record for a six-month period and a new quarterly record in Q2 of RMB 11.54 billion (US$1.68 billion). The operating income was 42.73% higher than in the prior year period.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Revenue generated within China totalled RMB 12.487 billion (US$1.818 billion), accounting for 62% of total revenue. Overseas revenue was RMB 7.654 billion (US$1.114 billion), accounting for 38% of the total.

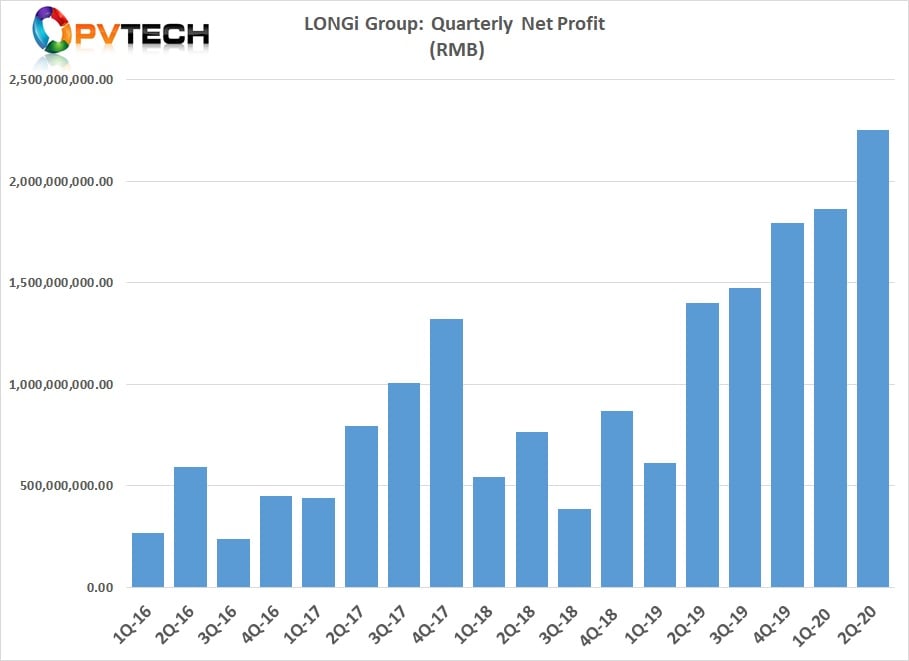

Ignoring multiple wafer pricing reductions throughout the reporting period, LONGi posted record net profits of RMB 4,116 billion (US$599.57 million), which were 104.83% higher than in the first half of 2019.

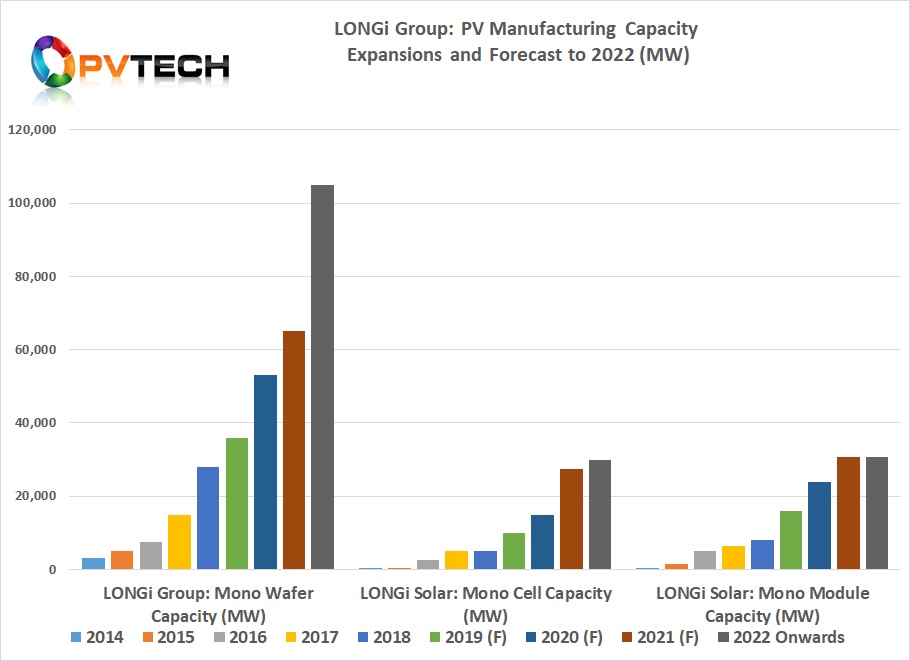

LONGi said that continued wafer capacity expansions, coupled to a rapid shift in demand towards large-area wafer sizes (166mm x 166mm) partially offset ASP trends and the demand impacts.

The company reported external monocrystalline wafer sales of RMB 2.469 billion (US$359.62 million), a year-on-year increase of 14.98%, and self-use wafers totalling RMB 1.489 billion (US$216.88 million).

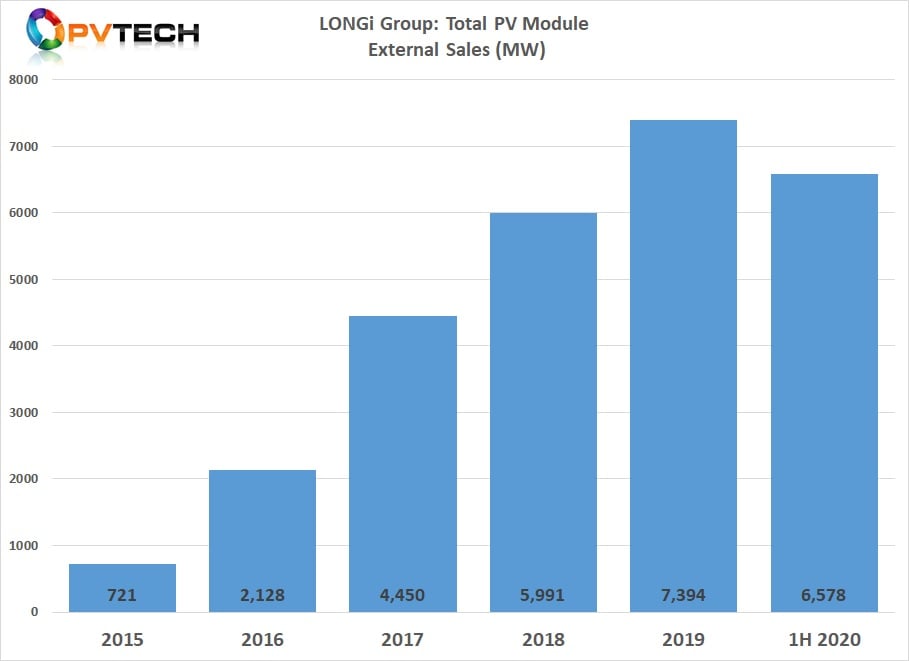

With the shift to larger wafers, demand for high-efficiency monocrystalline PV modules using larger wafers led to an external sales volume of 6,578MW in the first half of 2020, an increase of 106.04% from the prior year period, setting a new shipment record.

PV modules used in its PV project business were 222MW in the reporting period and the company sold monocrystalline cells totalling 338MW to external customers.

Manufacturing update

LONGi said that its annual production capacity for monocrystalline silicon wafers reached approximately 55GW by the end of the first half of 2020. Monocrystalline silicon wafer output reached approximately 4.400 billion pieces, a year-on-year increase of 54.14%.

Monocrystalline PV module production capacity reached about 25GW at the end of the reporting period, while production output reached 8,002MW, a year-on-year increase of 124.59%.