LONGi has increased its wafer prices for the first time in nearly two months with the industry braced for continued high prices throughout the rest of the year.

Yesterday LONGi confirmed price increases of about 4% for its wafers, the first time it has increased prices since 24 June 2021. The full details of the price increase are below.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

| Wafer size | 19/8/21 price | 24/6/21 price | % increase |

|---|---|---|---|

| 182mm | US$0.836 | US$0.803 | 4.1% |

| 166mm | US$0.697 | US$0.669 | 4.2% |

| 158mm | US$0.683 | US$0.655 | 4.3% |

LONGi’s price increase follows Tongwei hiking the price of its cells for the first time since July. Details of Tongwei’s pricing as of 12 August are below.

| Cell size | 12/8/21 price | 30/6/21 price | % increase |

|---|---|---|---|

| 210mm | RMB1.02/w | RMB1.00/w | 2% |

| 166mm | RMB1.03/w | RMB1.00/w | 3% |

| 158mm | RMB1.12/w | RMB1.08/w | 3.7% |

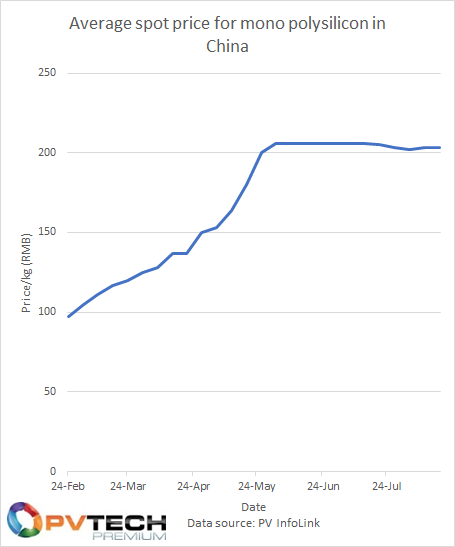

Polysilicon prices have plateaued since early June, when they reached an average spot price of RMB206/kg (US$31.7/kg), and did show early signs of falling in late July. But they have since risen and plateaued again, staying stagnant at around RMB203/kg.

Earlier this week Longgen Zhang, chief executive at polysilicon producer Daqo New Energy, noted how in the opening weeks of Q3 2021 average selling prices for polysilicon had risen to US$26 – 28/kg, up from the Q2 average of ~US$20/kg with demand for modules – and in turn cells and wafers – remaining strong despite higher prices.

Daqo also noted that recent policy initiatives in China have intended to stimulate deployment of distributed solar projects across the country, which is also increasing the demand forecasts for solar modules from September onwards.

As a result, polysilicon supply is expected to remain tight throughout the rest of the year.