Mexico is set to hit between 30-40GW of solar PV installations by 2040 under various scenarios projected by the International Energy Agency (IEA).

A new IEA report ‘Mexico Energy Outlook’ described a country rich in solar and wind resources that will be exploited by its innovative power auction system. These auctions will lead to more than half of the country’s new power generation capacity installed between now and 2040 coming from renewables.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

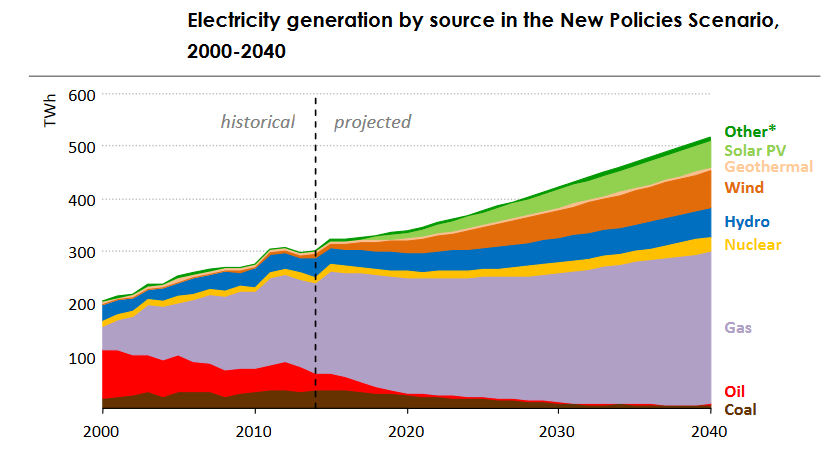

In terms of electricity generation, the report forecast that renewables will account for 37% by 2040, of which 24% will be from wind and solar power. In other scenarios renewables could account for as much as 60% by 2040. The nascent solar market is expected to account for a significant part of this new generation even though no specific solar target has been set.

IEA also projects a 30-50% reduction in cost for solar PV with generation expected to jump from 0.2TWh in 2014 to 52TWh in 2040. However, there are risks for the industry around indigenous land rights.

The Agency cited the country’s energy reform known as Reforma Energética as a major factor in the significant projected increase in renewables capacity. The reform sought to end the monopolies held on oil and gas by Petróleos Mexicanos (PEMEX) and on the electricity sector by the Comisión Federal de Electricidad (CFE). In doing so, it would open up Mexico’s energy sector to new players, investment and new technology.

Reform was hampered by a period of lower oil prices round the globe since oil revenue still accounted for a third of Mexico’s revenue in 2014. Government finances were therefore negatively impacted by the low prices.

However, the first two auctions of 2016 for new power supply did demonstrate that there is an appetite for investment in new solar PV and wind generation.

“This is not a reform, it’s a revolution on an unprecedented scale,” said Dr Fatih Birol, executive director of the IEA. “This transformation touches every sector of the Mexican energy industry and goes well beyond. However, let’s not underestimate the task ahead. It is a huge undertaking and there will be challenges but the reform has made remarkable progress.”

A rapid rise in electricity demand combined with the higher penetration of renewables and relatively high network losses, makes a strong case for modernisation of the country’s grid, said the IEA. Mexico already plans to increase the length of the country’s transmission lines to around 132,000km up from 104,000km in 2014.

Meanwhile, 46,000km of new transmission lines are forecast to be added by 2040 and around 70,000km of ageing lines replaced.

The new report comes off the back of IEA’s medium term renewable energy report 2016, which cited policy in Mexico as one of the factors that caused the Agency to dramatically increase its forecasts for renewables deployment. Once again this report was seen as rather conservative in its PV figures of 49GW global deployments in 2015. BNEF for example had the figure significantly higher at 56GW.

Mexico targets 35% of electricity from clean sources by 2024.