Having shipped more than 44GW of PV modules last year, Chinese manufacturer JinkoSolar is expecting that figure to increase by 50% in 2023.

PV Tech spoke to JinkoSolar vice president Dany Qian about module pricing, the prospects for TOPCon and the company’s key objectives for this year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Did the company achieve its target of shipping 43.5GW of modules last year? Which markets is the company targeting in terms of module shipments?

Dany Qian: Yes, we exceeded the target by shipping 44GW+. In terms of main target markets, these were China, Europe, Latin America and Asia.

Could you share any shipment data about the Tiger Neo modules since the series was launched in November 2021? How have the products been received by the industry?

We have shipped more than 10GW of Tiger Neo to over 80 countries as of the end of 2022. Tiger Neo has proven hugely popular with customers, particularly due to the power output, which is so important to them.

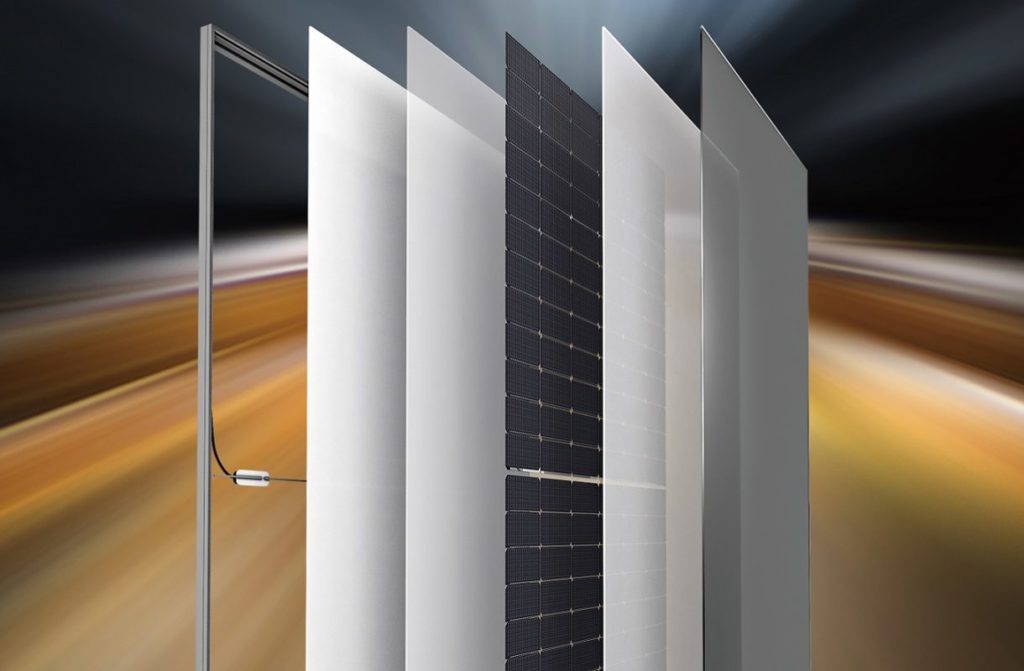

JinkoSolar recently announced the launch of the second generation of its Tiger Neo modules. How has the series been improved on compared with the first generation?

Tiger Neo is a quite-revolutionary n-type panel, bringing to market an efficiency of 23.23%. Compared to the first generation, the average efficiency is 1% higher and power output is up by 15-20Wp, based on the same size. The temperature coefficient is reduced from -0.30% to -0.29%, while the bifacial factor has increased to 80% ± 5%.

What are the benefits to the company of focusing on TOPCon modules?

We are seeing the mainstream solar PV business transition towards n-type. The main theme of solar PV shows this year will certainly be n-type, because the solar industry is very competitive and responds well to better and more affordable technologies. Module manufacturers know that if they don’t transition, their competitors surely will. That’s why we are moving and leading the industry in that direction.

Over the past four or five years, the PV industry hasn’t really introduced any new products, even when a company has claimed otherwise; it may be larger, but it isn’t new. N-type TOPCon is new, resulting in more power (Wp) and increased yield (kWh/kW).

Focusing on N-type secures our leadership position in technical innovation and manufacturing excellence. It increases our competitiveness and contributes more to the balance sheet. The solar industry is a capital-intensive industry and the capital efficiency of TOPCon is high. It has driven the innovation to occur across the entire supply chain, ranging from equipment to process material, resulting in a synergistic ecosystem.

How much module manufacturing capacity will the company aim to have by the end of 2023? What challenges will you have to overcome to reach that target?

A 50% growth over 2022 is a conservative outlook. Unstable polysilicon prices, new and unexpected bottlenecks emerging throughout the supply chain and the fluctuation of the US dollar versus the Chinese yuan may have an effect, but Tiger Neo is turning up the heat on the competition with n-TOPCon remaining the main theme of the industry.

What are the company’s other main objectives for 2023?

Energy storage systems, residential, C&I, large-scale utility and BIPV, both rooftop and facade.

Polysilicon prices have been declining. What’s the outlook for module pricing this year?

The recent drop in polysilicon prices is mainly because of the sudden and simultaneous release of new capacity which was built two years ago by several large polysilicon players, but there remain issues due to the high inventory of polysilicon stockpiled by wafer manufacturers in response to the shortages of the last two years.

However, once these inventory levels return to normal and no new capacity is added, the balance will recover and the price of polysilicon will stabilise again at around 100-130RMB/kg (US$14.80-19.20/kg), or else polysilicon players will bail on the capacity and production. Actually, existing wafer capacity still has far outsized polysilicon. Fresh challenges occurring in the wafer sector have driven the price cut in polysilicon, but this will be reflected retrospectively and will be experienced far less on the module side since new bottlenecks and shortages will occur across the supply chain – very similar to what happened some years ago, when polysilicon prices rose 400% while module prices increased by only 20%.