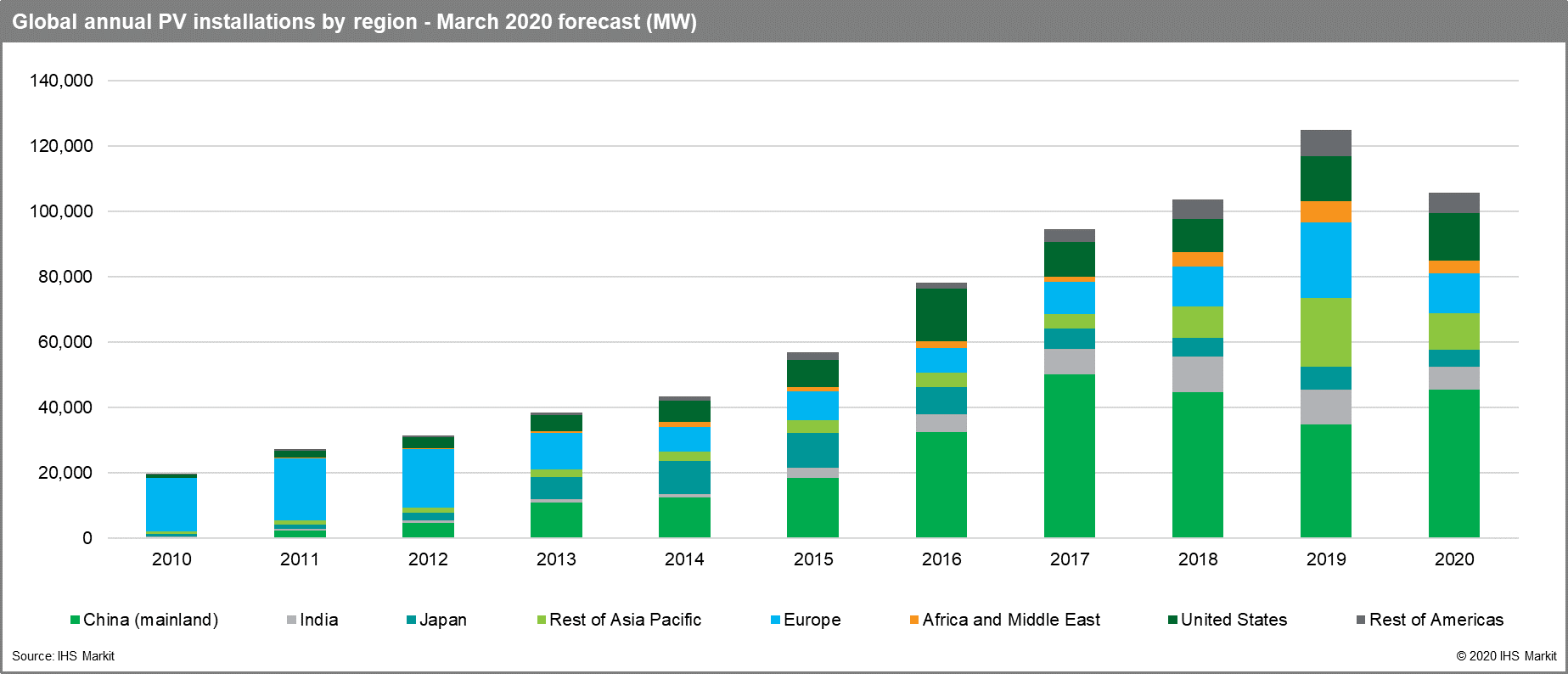

Taking a more pessimistic view of the impact of COVID-19 on the end-market demand for solar installations in 2020, IHS Markit expects global installs to decline 16% to 105GW in 2020, compared to around 125GW in 2019.

The major disruptive factors in the first quarter of 2020 had primarily been component shortages from China, due to the New Year holiday season and the subsequent extended leave after the festive season as a result of COVID-19-related government restrictions that limited or delayed overseas installations.

Although PV component production is ramping back to full capacity levels, almost all major PV markets around the world have been impacted to various degrees with lockdowns and travel restrictions, disrupting solar installs from across the residential, commercial and industrial and the key utility-scale market segments.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

IHS believes that COVID-19 will severely impact the planning and start of new PV projects through the second half of 2020 with the hardest hit regions being key growth markets such as Europe, India and the rest of Asia.

China installs to bounce back

In contrast to most other markets, IHS Markit said that it expects China to install around 45GW in 2020, after installations plummeted almost 32% in 2019, reaching just over 30GW. IHS Markit is making this assumption based on a rapid recovery of demand in the second-half 2020, due to Chinese government support mechanisms.