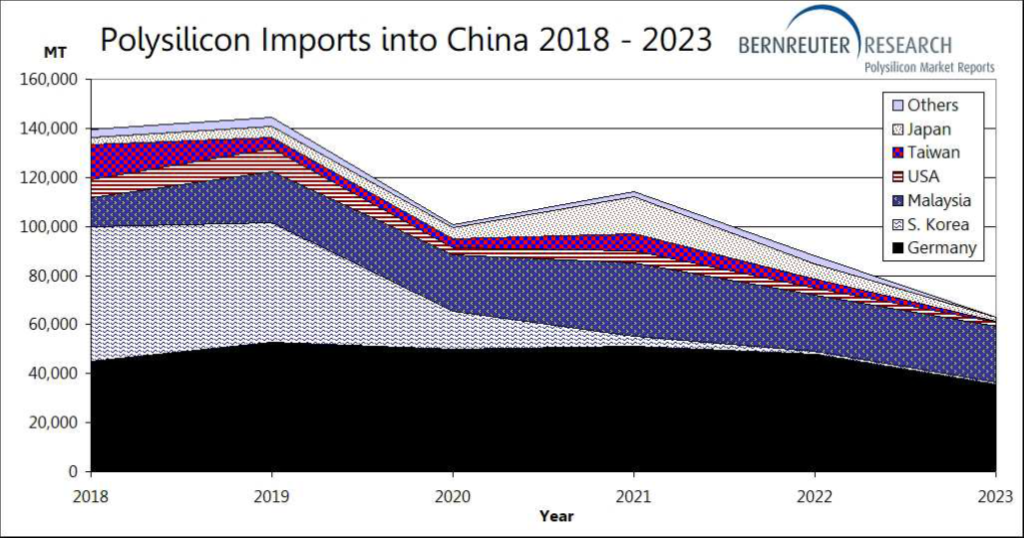

Polysilicon imports to China have fallen to their lowest levels since 2011 as non-Chinese polysilicon producers have shipped greater volumes to Southeast Asia, according to a recent report from Bernreuter Research.

The shift in shipment destination is driven by the solar industry’s response to US import legislation, namely the anti-dumping and countervailing duty (AD/CVD) tariffs and Uyghur Forced Labor Prevention Act (UFLPA) which have put pressure on manufacturers looking to supply the US market.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Johannes Bernreuter, head of polysilicon market analyst firm Bernreuter Research, said: “The non-Chinese polysilicon manufacturers Wacker, Hemlock Semiconductor and OCI Malaysia are increasingly shifting their shipments from China to Vietnam, where three of the four largest Chinese solar module suppliers have established wafer plants.”

These three module suppliers are JA Solar, JinkoSolar and Trina Solar, the report said. Trina Solar began production at a 6.5GW 210mm monocrystalline wafer facility in Thai Nguyen, Vietnam in August 2023, and another major Chinese manufacturer, Canadian Solar, is currently building a 5GW wafer facility in Thailand, due to begin production in March.

Bernreuter’s report used data from Chinese customs which showed that imports fell 28.5% between 2022 and 2023, from 88,093 metric tons (MT) to 62,965MT.

US import barriers

The main “push factor” driving these companies to develop capacity in Southeast Asia is the US’ twin AD/CVD and UFLPA policies.

The former applies stringent import tariffs on solar products coming from China to the US. In August 2023, the Department of Commerce (DOC) found five solar manufacturers guilty of circumventing the tariffs by relocating portions of their Chinese supply chains to Southeast Asia for ‘minor processing’. The tariffs are currently suspended by an executive waiver from the US President’s office and are due to come into force in the summer of 2024.

Wafers are the key point in the supply chain for AD/CVD, as the most upstream component which the tariffs cover. PV Tech’s full coverage of the tariffs can be found here.

The UFLPA is more straightforward and impactful – it bans any product from entering the US which is manufactured wholly or partly in the Xinjiang autonomous province in western China. Bernreuter’s report says that leading Chinese solar companies subsequently “began to create separate supply chains based on polysilicon from non-Chinese manufacturers for the export of solar modules to the US”.

This process, known as bifurcation, allows manufacturers to satisfy US import laws without needing to change their practices for markets that do not require supply transparency. Bifurcation was criticised by European solar representatives in a public discussion earlier this month.

However, concurrent with the imposition of the UFLPA, Bernreuter’s report shows that polysilicon exports from China to Vietnam rose from 639MT in 2022 to 4,970MT in 2023, according to Chinese customs statistics. This is more than a 700% increase.

“That raises doubts about the claims of a separate supply chain and should sound alarm bells at the Customs and Border Protection (CBP),” said Bernreuter.

Price pressure

Polysilicon prices fell almost 75% over the course of 2023, a drop that was reflected in German polysilicon producer Wacker Chemie’s quarterly results over the year.

Nonetheless, Bernreuter’s report said that Wacker and OCI Malaysia – another non-Chinese polysilicon company – now account for 98% of imports to China. Polysilicon capacity in China has grown massively in recent years, and a report from Bernreuter covered by PV Tech in November predicted that 2024 could see the market consolidate as even greater Chinese capacity expansions loom on the horizon.

Q4 2023 saw polysilicon imports to China almost halve compared with the first three quarters. Bernreuter said: “ If the fourth quarter is any indicator for 2024, then polysilicon imports into China will plunge by another 40% to no more than 38,000 MT this year.”