Polysilicon prices in China have continued to stabilise, with no significant fluctuations over the past month.

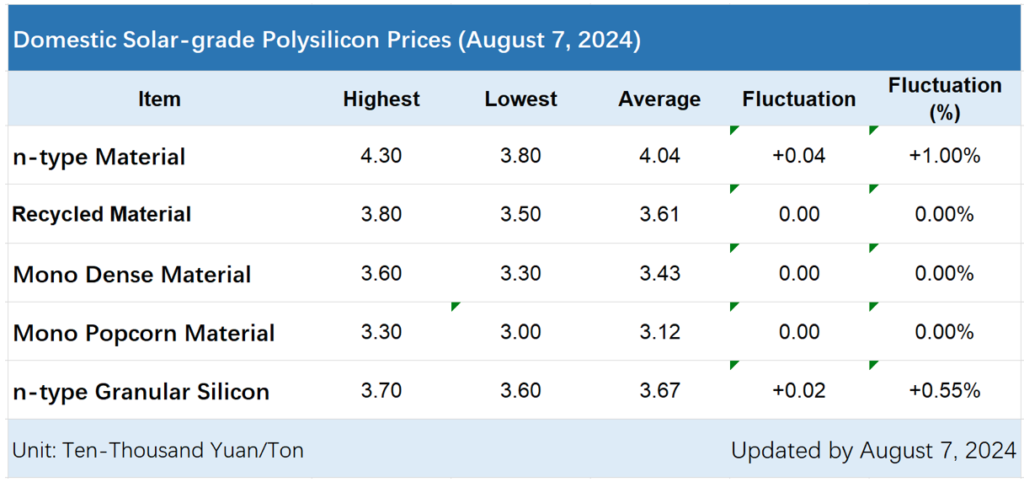

On 7 August 2024, the Silicon Industry Branch of the China Nonferrous Metals Industry Association announced the latest polysilicon prices, which remained stable this week. Some new orders rebounded from the bottom. Among them, the transaction price of n-type rod silicon ranged from RMB38,000-43,000/ton (US$5,291-5,570) and averaged at RMB40,400/ton, a month-on-month increase of 1%.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The transaction price of mono dense material ranged from RMB33,000-36,000/ton and averaged at RMB34,300/ton. The transaction price of n-type granular silicon ranged from RMB36,000-37,000/ton and averaged at RMB36,700/ton, a month-on-month increase of 0.55%.

The Silicon Industry Branch said that this week, five companies secured deals for n-type rod silicon and two for p-type rod silicon. Top companies had less difficulties in securing contracts, and prices had already rebounded from the bottom. Through trading with the futures and spot dealers, a small number of the companies realised a slight increase in prices. The price of granular silicon also rose to a certain extent.

The Silicon Industry Branch said that there are two reasons for the price rebound. On the one hand, impacted by upstream production suspension and maintenance for several months in a row, silicon output in July dropped to 138,000 tons, a month-on-month decrease of 14.53%. August and July are expected to be the same in output.

On the other hand, silicon prices had been stable for many weeks before the adjustment. Some downstream companies consider that the bottom price of this cycle has appeared, which stimulates companies to purchase and stock up at ultra-low prices. The combined effects of production reduction and stockpiling have led to an increase in silicon quotations. Small orders and urgent orders have seen a higher increase in prices, while the actual transaction prices for large orders and long-term orders were mostly stable, with no significant price increase on a large scale observed for now.

However, as the industry inventory is still maintained at a high level of around 300,000 tons, supply and demand have not undergone a fundamental change. As a result, the price rise this time is not expected to be sustained.

Wafer, cell, module production and price

In terms of wafers, according to the statistics of the Silicon Industry Branch, the wafer output in the past July was expected to remain at 50.6GW, down 1.8% month-on-month.

The Silicon Industry Branch said that according to the scheduling plans of various enterprises, the August wafer production is expected to grow to 51-52GW. The reduced inventory pressure is leading to a potential recovery.

It is worth noting that the production of silicon wafers is still huge: according to statistical data, the domestic wafer output totalled 416.15GW from January to July, up 37.2% year-on-year.

Domestic cell output in July was 49GW, down 5.8% month-on-month. Domestic module output in July was 49GW, down 4% month-on-month. Among them, the price of M10 mono TOPCon cells fell to RMB0.285/W, down 5%. Affected by the price drop, the cell segments were facing more operating pressure. Some third-tier cell factories were forced to shut down.

Silicon Industry Branch also pointed out that, in terms of module prices, the current price of 182mm TOPCon bi-facial glass-glass modules has dropped to RMB0.76/W, which has fallen below the cash cost. As the upstream price is bottomed out at present, with the coming of the peak season in H2 of the year, market demand is expected to pick up month-on-month. The PV module price is to remain stable. However, low-price bidding and inefficient products are expected to still disrupt the market.