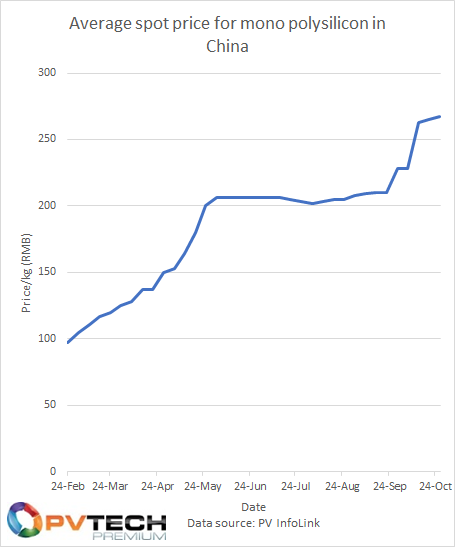

When the average market price for polysilicon began to spike in February this year, a rise which continued long into May, many in the industry wondered just how high it would climb before stabilising. A number of factors contributed towards the sharp incline, and there was some uncertainty over when it might stabilise.

But stabilise it did, and increases in the price tailed off into early June. At that point, many industry analysts concluded that the worst of the crisis was over and that pricing would normalise into Q3 and Q4, with much of the bulk purchasing orders already in place as manufacturers rushed to accommodate for Q4 demand.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

It’s perhaps fair to say that price increases since late September, sparked by a shortage and subsequent price increase of silicon powder alongside an energy crisis in China was entirely unforeseen. Indeed, most industry observers have labelled the combination of headwinds felt by the industry in recent months as unprecedented. But events have put further strain on polysilicon supply and any expectation of a normalisation in the final quarter of 2021 would now appear fanciful, with prices spiking to levels not seen in years.

Which prompts the question, just how high can polysilicon prices go?

Thankfully, this most recent price hike would appear to be tailing off. After a price spike of 13% several weeks ago, price increase have been far more modest of late, rising 0.3% last week and ~0.6% in the most recent round of updates, issued earlier this week by PV InfoLink, to RMB267/kg (US$41.74/kg, or US$36.93/kg excluding China’s 13% VAT added). By means of comparison, PVinsights’ average spot price figure stands at US$35.81/kg for this week (excl. VAT).

Industry sources have suggested the polysilicon price is certainly nearing its absolute ceiling. Speaking to PV Tech Premium, Johannes Bernreuter of Bernreuter Research said that during the summer, an average price of around US$30/kg would be a prospective ceiling price. However an increase in the cost of silicon metal has given polysilicon providers an excuse to go even higher.

Indeed, major polysilicon provider Daqo New Energy pointed to a surging silicon powder price as a principal reason for its elevated average selling prices seen in late Q3 and early Q4, with powder prices having risen from an average of US$2.5 – 3/kg in Q3 to US$8 – 10/kg in Q4 thus far. Prices are normalising and have begun to decrease in the past three weeks, but are yet to steer towards indicative prices seen in Q3.

Given how elevated prices are across the board, coupled with the average margin polysilicon providers have enjoyed so far this year – Daqo’s Q3 margin stood at an extraordinarily healthy 74.3% – there would possibly be room for polysilicon providers to absorb much of that cost increase. “The fact that they nevertheless [chose not to absorb] shows that there is still enormous demand despite a module price level that was thought to be unsustainable a few weeks ago,” Bernreuter said.

Bernreuter Research’s calculation for this week’s price, based on EnergyTrend data, comes in at US$36.37/kg (excl. VAT), with price increases tailing off. Figures from Silicon Branch of China’s Non-ferrous Metals Industry Association would also support this tailing off.

With Q4 demand tailing off, a short-term ceiling of around US$37/kg would appear to be the industry consensus. Daqo chief executive Longgen Zhang said yesterday the company was witnessing prices of US$35 – 36/kg today, and expected similar highs to continue throughout H1 2022, before softening towards the US$30/kg mark in H2 2022 as more capacity comes onstream and other issues, including China’s energy crisis, abates. It’s worth noting here that those forecasts are considerably higher than those provided by Daqo at the company’s Q2 results disclosure in August, when it estimated average prices of ~US$23/kg in H1 2022 and ~US$20/kg in H2 2022.

There is reason to be cautious, however, with demand likely to spike once again in the build up to Chinese New Year in January 2022 as polysilicon producers begin restocking practices. While the most recent storm would appear to be dissipating, headwinds could well gather speed once more early next year.