Chinese power restrictions are likely to change in Q1 next year and will consider the power necessity and industrial demand of certain regions. Nonetheless, polysilicon prices will remain high well into next year and could rise even further. And, distributed solar is the future of solar PV generation in China.

This was the verdict of a panel of experts at ROTH Capital’s webinar this week who came together to discuss upstream manufacturing, technology and the industry’s outlook in China.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Energy restrictions likely to change in Q1 2022

China will likely drop its energy restrictions in Q1 of next year as it will broadly be in a position to match supply with demand, said Sakura Yamasaki, director of Singapore Solar Exchange. This was also a view held by Frank Haugwitz, director of Europe Asia Clean Energy Advisory Company, who said that although power restrictions were open ended, he expected gradual relief to the power constraints in Q1 2022.

China sets targets for each of its 30 provinces’ energy consumption, with 20 of them failing to meet these in the first half of the year, leading to the restrictions. Moreover, “pressure will increase for failing provinces who don’t meet annual targets,” said Haugwitz. “And any missed targets will get added on to next year’s, so there is no escape.”

Nonetheless, the pair were sanguine about the ability of major solar producing provinces to get back to normal production routines. While Yamasaki said she had heard that some solar companies may be exempt from future power restrictions, Haugwitz said Chinese authorities were assessing the necessity and need for power across regions, considering which industries to be most resilient and important when aligned with national policy.

There have also been some reports this week suggesting Chinese government intervention is being considered and could even be close, with Reuters this morning reporting that thermal futures in the country fell by 11% today – the maximum the country’s financial regulations permit – on news that the country’s government is requesting coal mining output and imports to increase to rebuild stockpiles ahead of the winter months. Earlier this week China’s National Development and Reform Commission said it was exploring ways to lower coal prices, stating that all options remained on the table.

The root cause of the Chinese energy crisis remains, however, with future crises a distinct possibility, said Haugwitz. “There has been no lasting structural change in terms of power consumption and that is what is missing so far,” he said.

Lifting of energy restrictions no panacea

The price for polysilicon is likely to stay way above US$25/kg for the entirety of 2022, despite any changes to energy restrictions due to sky high demand, said Yamasaki. While things may stabilise in Q2 2022, predicting any more than three months in advance is an impossible task, she said, adding that polysilicon prices could easily go up further – “The ride up is still not finished”.

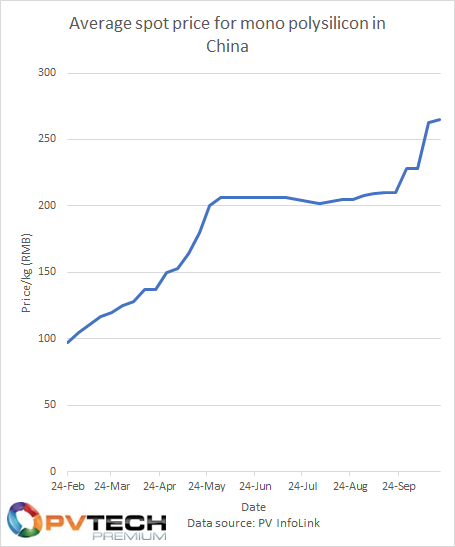

Data from PVInfoLink already puts the price of at around US$41/kg, while Yamasaki said the price of polysilicon in China was close to RMB300/kg (US$47/kg). Last week (14 October), PV Tech Premium reported that pricing for polysilicon chips has soared 13.2% to highs of RMB273/kg (US$42.42/kg), casting doubt and uncertainty across the industry.

Data from China Nonferrous Metals Industry Association (CNMIA) showed that Chinese polysilicon production this month is likely to decline by around 5-7% on September, meaning 2,000-3,000MT less polysilicon in circulation.

This is bad news for the entire solar supply chain, with the volatility causing both LONGi Solar and Tongwei to increase wafer and cell prices by between 5.6 – 7.7%. Furter downstream, developers and EPC’s are having to delay projects and dampen investor expectations as the cost of projects continue to rise and margins shrink.

Polysilicon price increases this week have been more modest, as illustrated below, but once again rose, albeit with ‘peak’ polysilicon pricing now considered close, PVInfoLink said.