For every ton of silicon produced, Chinese manufacturers incur losses – this has become the grim reality of today’s polysilicon sector.

At a polysilicon production base in Xinjiang, trucks no longer queue up to load cargo. Piles of silver-colored silicon material are stacked high in warehouses.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Current prices have fallen below the cost line for 90% of the manufacturers,” said an anonymous production manager, gesturing at the inventory reports. “Production costs hover around RMB60,000 per ton, but selling prices can’t even reach RMB50,000 (US$6,861). The more we produce, the more we lose.”

Such scenes are playing out across China’s major polysilicon production zones. According to data from the Silicon Industry Branch, from 2023 to April this year, polysilicon prices have plummeted 72%, while the average inventory turnover days across the industry have surged from 15 to 47 days.

A brief respite occurred earlier this year when China’s distributed PV policy (Document No. 136, previously reported by PV Tech) triggered a minor production rebound. During this period, while the prices of solar cells and modules rose, polysilicon—burdened by substantial inventories—failed to follow suit, though the pressure eased slightly. However, as the PV installation rush entered its “final countdown,” demand growth began to falter, sending industry chain prices downward again.

Since April, prices throughout the PV supply chain have softened, with downstream products such as wafers and solar cells experiencing a price drop of 2%-12%. During the week starting from April 16, China’s polysilicon prices broke a 13-week stabilization with a slight decline.

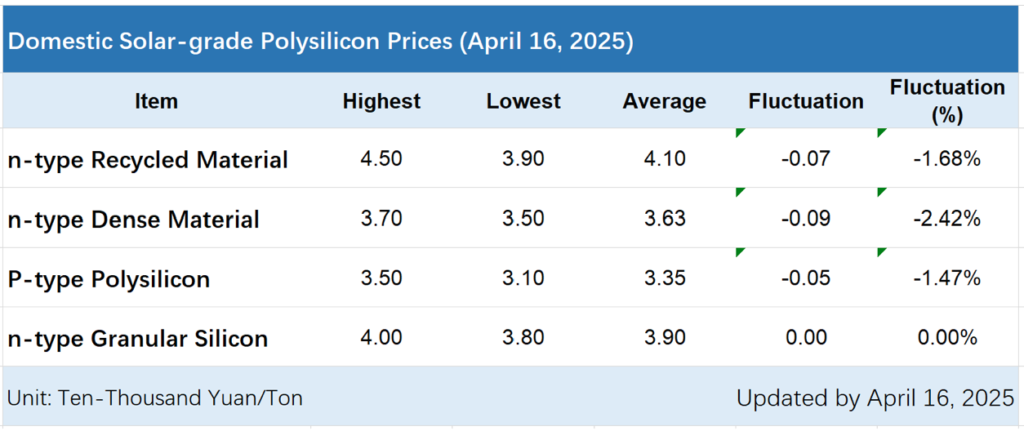

The latest polysilicon pricing report from the Silicon Industry Branch reveals a lukewarm spot market with modest price drops. Among silicon products, except for granular polysilicon, all the others saw price reductions—with n-type monocrystalline dense chunk silicon (used for ingots) posting the steepest decline at 2.42%. Only a few leading polysilicon manufacturers maintained stable pricing.

The specific price performance is as follows:

– N-type recycled material: the transaction price range is RMB39,000-45,000/ton, and the average transaction price is RMB41,000/ton, down 1.68% month-on-month

– N-type granular silicon: the transaction price range is RMB38,000-40,000/ton, and the average transaction price is RMB39,000/ton, remaining flat month-on-month

– P-type polysilicon: the transaction price range is RMB31,000-35,000/ton, and the average transaction price is RMB33,500/ton, down 1.47% month-on-month

Meanwhile, China’s polysilicon futures reached a record low since their listing, closing at RMB37,626/ton on April 18, reflecting the market’s uncertainty regarding demand and investors’ growing concerns over the financial pressures borne by related enterprises.

Polysilicon manufacturers are truly under profit pressure. On April 21, Xinte Energy announced that for Q1 2025, the company achieved operating revenue of RMB3.199 billion but reported a net loss attributable to shareholders of RMB263 million.

On April 22, TBEA, the parent company of Xinte Energy, released its 2024 annual report and Q1 2025 report. According to the annual report, in 2024, TBEA recorded operating revenue of RMB97.782 billion, down 0.35% year-on-year, and the net profit attributable to shareholders was RMB4.135 billion, plunging 61.37% year-on-year.

For Q1 2025, the company reported total operating revenue of RMB23.383 billion, a 0.77% year-on-year decrease, and net profit attributable to shareholders of 1.6 billion yuan, down 19.74% year-on-year.

In its 2024 annual performance forecast announcement, TBEA explained the reasons for the poor performance. One important reason was the impact of the imbalance in the supply-demand relationship of the PV industry chain. Since April 2024, the market price of polysilicon had fallen below the cost of polysilicon producers and had continued to operate at a low level. As a result, the company’s polysilicon business had suffered significant losses in 2024.

According to the data from Baiinfo, currently, the inventory of polysilicon factories stands at about 263,000 tons, which is at a high level for the same period in recent years. On the demand side, the market’s expectation of weakening demand has strengthened. Some wafer companies have plans to reduce production in May, and PowerChina previously announced the termination of a 51GW module centralised procurement. Recently, module prices have begun to fall, and the high-price sales of wafers and cells have been obstructed, with the market clearly cooling down.

Wang Yanqing, an analyst at CITIC Futures, stated that the price decline is attributable to the fact that the terminal installation rush has come to an end, and demand will continue to decrease. Currently, the downstream monocrystalline pulling sector is exerting significant pressure on polysilicon pricing, and silicon material manufacturers’ bargaining power has weakened. Market expectations suggest that the spot transaction price of polysilicon may further decline.

Looking ahead, without policy interventions or supply-side catalysts, the current capacity of leading companies alone could already meet downstream demand in the second half of the year based on supply-demand dynamics. Overall, the outlook for polysilicon futures remains pessimistic.