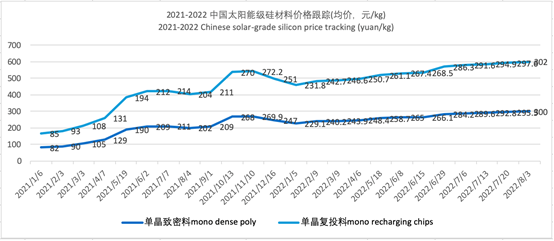

The price of polysilicon in China rose across the board last week, despite signals that it may have stabilised, constituting the 25th round of price increases this year alone, according to data from the Silicon Industry Branch of China Non-Ferrous Metal Industry Association.

The average transaction price of mono recharging chips and mono dense poly chips exceeded RMB300,000/MT (US$44,360/MT), a jump of about 1.5%.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

PV Tech understands that the inventory of many silicon material companies is still negative, leaving many long-term order demands unmet. Multiple silicon material companies mainly executed their previous long-term orders this week, which were mostly priced at RMB300,000-305,000/MT (US$44,360-45,100/MT).

At the same time, transactions occurring at lower prices disappeared. The lowest transaction price of various types of silicon material rose by RMB12,000/MT (US$1,774/MT) – an important reason for the rise of average price this week.

In terms of supply and demand, due to the restarting of some major production lines by large manufacturers, Chinese polysilicon production will slightly exceed previous expectations, according to the information published earlier by Silicon Industry Branch.

The newly added production is mainly from Xinjiang GCL and East Hope, as well as Leshan GCL, Baotou Xinte, Inner Mongolia Tongwei Phase II, Qinghai Lihao, and Inner Mongolia Dongli, amounting to 11,000MT. But one or two companies are expected to undergo production line changes in August, causing out to drop by 2,600MT compared with July.

As a result, an increase of production output by around 13% in August, compared with July, would ease the current supply crunch to a certain degree but, in general, silicon prices are still in the upward range.

Moving forward, the Silicon Industry Branch estimates that the production of polysilicon in September will hit a new high. This is based on the historical high production output in August and the overhaul procedure of polysilicon companies will being close to completion as well as the release of a large number of newly added capacity.

By then, the operating rate of silicon wafers manufacturers will be improved to a certain extent with the increase in raw material supply and considerable profit margins. This is until the downstream demand turns weak, which will lead to the decline in the operating rate of silicon wafers. Subsequently, market supply and demand patterns will gradually reverse once again.

The rise in silicon prices also causes upward price pressure on the costs of components and solar power plants. Wafers and cells have increased in prices as a response and components also climbed to the alarming level of RMB2/W (US$0.30c/W). As the price of silicon material rose again, people are concerned whether wafers and cells will rise with it.

PV Tech Price Watch will continue to keep you updated with information on the Chinese raw materials and component market