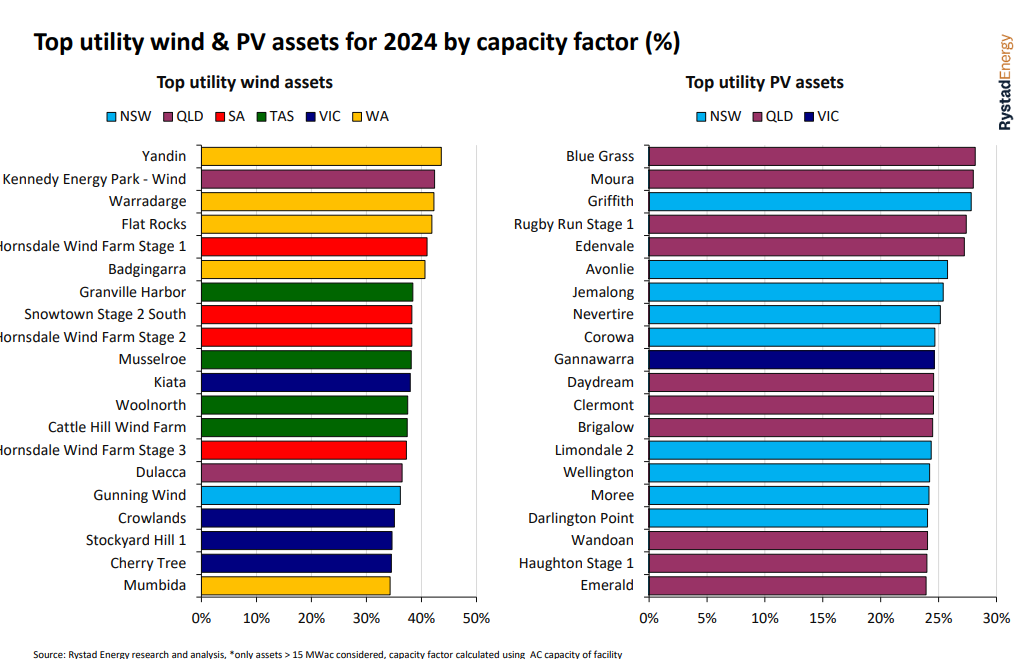

New data released by research firm Rystad Energy has shown that four of the top five best-performing Australian utility-scale solar PV plants in 2024 were located in Queensland.

The top three performing assets, in terms of AC capacity factor, included Spanish solar PV developer X-Elio’s 200MW Blue Grass plant, Greek industrial conglomerate Mytilineos’ 110MW Moura plant both in Queensland, and Neoen’s 36MW Griffith solar PV plant in New South Wales (NSW). PV Tech reported earlier this month that the Griffith site was the best-performing solar PV asset in December 2024, a month dominated by New South Wales.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The reasons behind the Blue Grass PV plant being the top-performing asset have not been disclosed. However, the regional council attributes its success to the “fantastic conditions” for renewable energy production in the Western Downs region of Queensland. Located in Hopeland, the solar PV plant is operated by X-Elio, which plans to enhance its strong generation potential by adding a 350MW solar-plus-storage project called Sixteen Mile near the existing facility.

According to David Dixon, a senior analyst at Rystad Energy, across 2024, Neoen emerged as the highest total volume by equity ownership with 1.4TWh. Chinese developer Beijing Energy International Holding (BJEI) follows this with 1.2TWh and Atmos Renewables with 1TWh. You can find a full breakdown of the top 20 performing assets in 2024 below.

Dixon previously said that, on an annual basis, renewable energy generation across the National Electricity Market (NEM) and Wholesale Electricity Market (WEM) reached 92TWh or 39% of total generation.

Casting an eye to the future, Dixon predicts that this 39% figure will increase to around 43-45% in 2025, with several gigawatts of solar PV, including rooftop and utility, as well as wind capacity, to be energised and commissioned across 2025. This will also be aided by utility-scale battery energy storage capacity doubling to over 6GW by year-end.

Performance of utility-scale solar PV on the WEM stutters

As seen in the graph above, all of the top 20 performing utility-scale solar PV assets are based on the NEM, with there being a distinct lack of high-performing assets on the WEM, which operates exclusively in Western Australia.

Although several large-scale solar PV projects are being explored in the state, including a 70GW renewable energy hub larger than Wales, much of the state is still powered by coal and gas with smaller contributions from solar PV and wind generation.

Despite this, the Western Australian government has still emphasised the importance of renewable energy generation in the state’s energy transition. In July 2024, the state government inked a Renewable Energy Transformation Agreement with the Federal government to support renewable energy generation technologies, such as solar.

Under the terms of the deal, the Federal government will underwrite developers to build a minimum of 6.5TWh of new wind and solar projects in Western Australia and 1.1GW of new storage to help keep the electricity grid stable.

With Western Australia set to retire its state-owned coal-fired power stations by 2030 and replace them with utility-scale renewable energy generation projects, the agreement will support the state in ensuring grid stability is maintained throughout the transitional period.

Indeed, energy storage will be a key aspect of the energy system, as evidenced by the number of large-scale projects being developed, such as Synergy’s 500MW/2,000MWh Collie battery energy storage project. You can learn more about energy storage in Western Australia on our sister site, Energy-Storage.news.

Western Australia heads towards March election

Western Australia’s energy transition trajectory could change with the upcoming election scheduled for 8 March 2025. The centre-right Western Australian Nationals Party and its leader, Shane Love MLA, announced earlier this month that they intend to implement a comprehensive State Planning Policy for renewable energy projects if they win the upcoming state election.

Shane Love said the policy would establish a consistent framework for large-scale renewable energy projects and address significant gaps in the current planning system.

Western Australia’s election could be significant as some of the largest renewable energy proposals are set to be located within the state. Whether it be a newcomer or the currently elected Labor, the government’s ambition must match the industry, which has questioned the government’s support throughout 2024.

For example, Australian mineral exploration company Province Resources shelved its multi-gigawatt solar and wind-powered green hydrogen project in the state due to a lack of government support.

Australia’s NEM to add 150GW of solar PV, wind and energy storage

The shortcomings in the performance of the WEM’s utility-scale solar PV assets are contrasted by the NEM, which continues to go from strength to strength in its energy transition. All twenty of the top-performing solar PV assets were on the NEM, almost evenly split between New South Wales and Queensland, with Victoria securing tenth place via its 60MW Gannawarra solar PV plant.

The Australian Electricity Market Operator (AEMO) said in August 2024 that 1.2GW of new large-scale solar projects had been brought online and connected to the NEM in the past year. Despite this strong rollout, this was trumped by the 3.9GW/13.5GWh of battery energy storage systems (BESS) that were brought online.

Casting an eye to the future, UK-based research group Cornwall Insight said last year that it is likely that the NEM will add 150GW of solar PV, wind and energy storage capacity by 2043. A report outlines that the installed capacity for these technologies is expected to rise from 52GW in 2025 to 208GW by 2043, representing a 300% increase.

Australia’s NEM covers South Australia, Tasmania, Victoria, New South Wales, ACT, and Queensland and is predominantly oriented towards a baseload power grid comprising mainly coal generators.

A key driver of renewables energy generation growth is the withdrawal of coal-fired power stations, which are likely to close by 2038, as indicated in an AEMO report released earlier this year and further backed up by the Clean Energy Council (CEC) CEO Kane Thornton, who told PV Tech that AEMO’s prediction was “same timeframe that we [the CEC] are working towards”.

This is contradicted by Cornwall Insight’s Thomas Fitzsimons, who exclusively told PV Tech that coal-fired power will still play a role in the electricity mix for the next few decades, with the last to shut in the 2050s.

The rise in renewable energy generation and the NEM’s shift away from coal-fired power have led the Australian government to commence a review of the NEM to identify how it will operate in the coming decades and facilitate the uptake of solar PV.

The review will examine keeping household bills low while better-managing rooftop solar and utility-scale renewable energy generation uptake.