REC Silicon said it is continuing to work towards a restart of operations at its Moses Lake polysilicon production facility in the US, with the company buoyed by recent policy initiatives unveiled by US President Joe Biden.

Discussing the Norway-headquartered firm’s Q2 2021 results, CEO Tore Torvund said the company is exploring opportunities created by the president’s renewables agenda which could add further weight to a restart of REC Silicon’s fluidised bed reactor (FBR) technology.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“A US solar value chain will support the transition to renewable energy, create high-paying manufacturing jobs in the US and result in the restart of the REC Silicon Moses Lake facility,” Torvund said.

And in a conference call with analysts following the results disclosure, Torvund said the company was still working to restart production at Moses Lake in 2023 – some four years after the facility was shuttered in 2019 – but stressed this was dependent on REC Silicon securing sales in the region, either for solar-grade polysilicon or silicon anodes.

During the investor presentation, REC Silicon stressed the benefits of its FBR method, and in particular the results of its FBR-B technology that has been used to produce solar-grade polysilicon within the company’s joint venture in Yulin, China, itself a 20,000 metric tonne facility. REC Silicon said the FBR-B method posed numerous benefits over the Siemens process, including reduced energy consumption, and the company estimates it could operate facilities with around one-third of the workforce required to operate a facility using the Siemens method.

REC Silicon would look to upgrade around half of the FBR-A reactors at Moses Lake to FBR-B at a cost of around US$40 million, Torvund said.

But this would be contingent on the creation of a market for polysilicon outside of China, and in particular the US, which has been all but curtailed due to trade sanctions relating to the material.

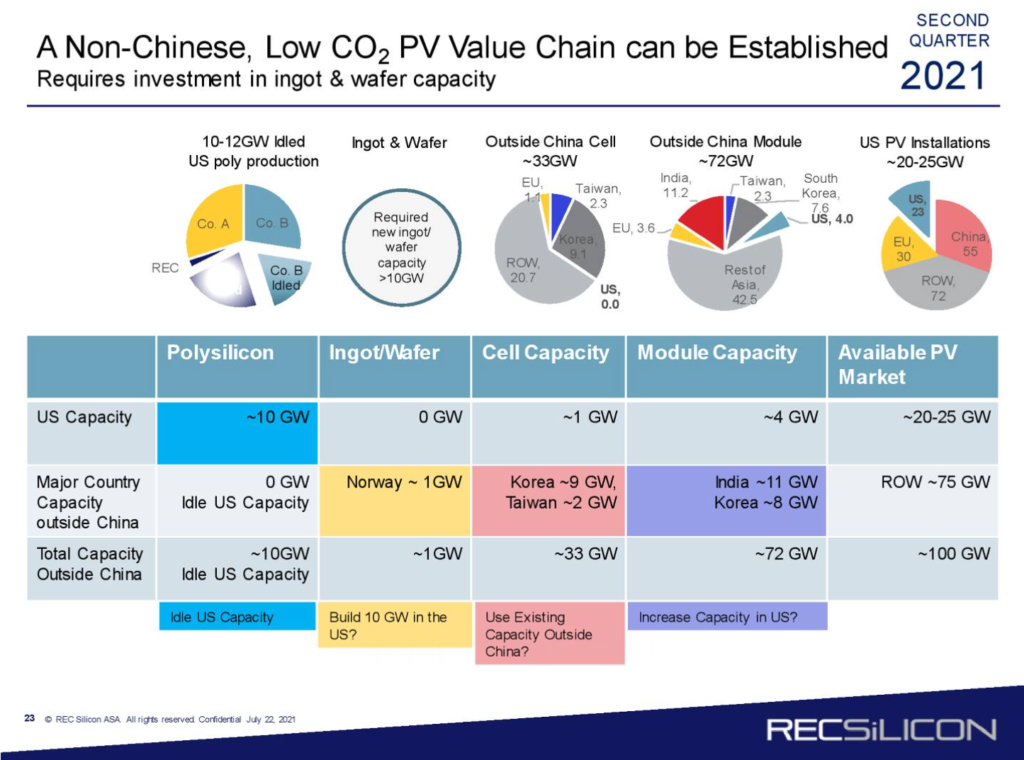

REC Silicon noted that despite facilities in the US having the capacity to produce polysilicon for around 10GW of solar modules, there is currently no polysilicon being produced because there is no access to ingot or wafering capacity in the country. Almost all ingot and wafering capacity exists in China, which has a further knock-on effect on US solar manufacturing chains, as represented in the below slide used in REC Silicon’s presentation.

Torvund continued to point towards recent policy initiatives in the US that have been announced and progressed under President Biden, including both an extension of the investment tax credit (ITC) to help stimulate solar installations, and a prospective manufacturing tax credit proposed by Democrat senator Jon Ossoff last month.

That tax credit, proposed to be enshrined within the Solar Energy Manufacturing for America Act, would provide tax credits for each unit of material or component produced at facilities in the US. Under Ossoff’s proposals solar-grade polysilicon would receive a tax credit of US$3 per kilogramme, with further credits available for wafers, cells and modules produced inside the US.

Those incentives would be available until the end of 2028 before being gradually phased out until 1 January 2031.

Torvund said the initiatives “make sense” given the US’ ambitions to decarbonise its economy, however it is expected that the Ossoff proposals will not proceed in their current guise, and are more likely to be watered down to become a more straightforward tax credit available on investments made in facilities, rather than reimbursements on a per-unit basis.