A subsidiary of Indian conglomerate Reliance Industries has acquired solar module manufacturer REC Group and a 40% stake in EPC and O&M solutions provider Sterling and Wilson.

Reliance New Energy Solar is purchasing REC Group from China National Bluestar for US$771 million as it looks to support the Norway-headquartered company grow its solar manufacturing capacity to more than 5GW within the next two to three years.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

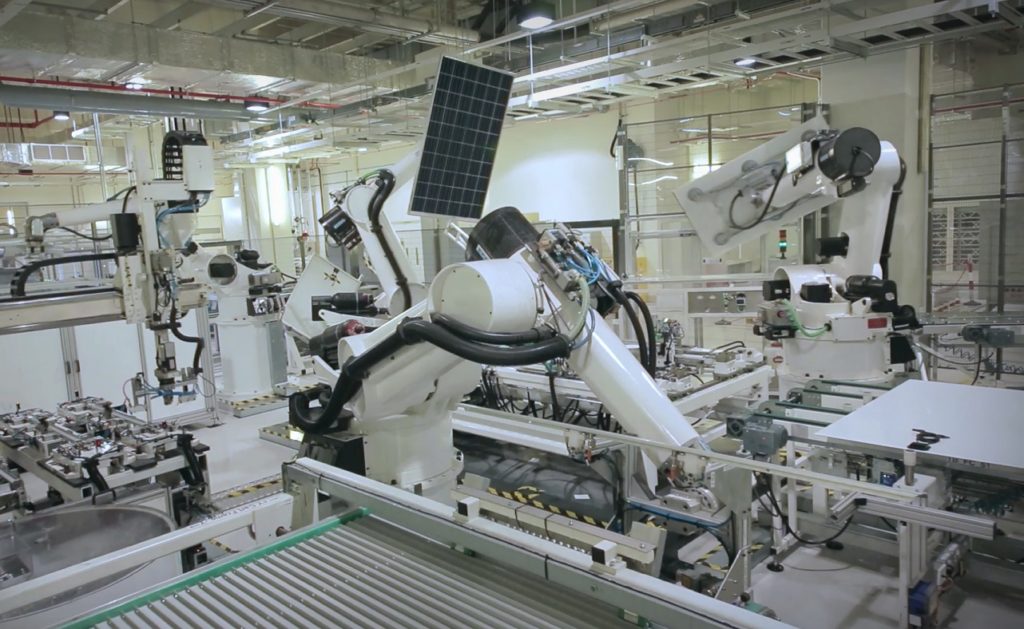

REC has two manufacturing facilities in Norway that produce solar-grade polysilicon as well as a Singapore plant making PV cells and modules that started mass production in 2019 and is expected to increase its output by 2-3GW. Reliance will also support the company in setting up a new 2GW cell and module facility in France and a 1GW module plant in the US.

The new ownership will allow REC to “rapidly boost its scale and better serve its increasing customer base”, the company said.

REC makes a range of p-type, n-type and heterojunction (HJT) modules. Reliance plans to use the company’s technology in an integrated solar manufacturing facility that it will set up in the Indian city of Jamnagar with an initial capacity of 4GW that could eventually rise to 10GW – a complex that may also be replicated at other locations around the world.

With activities spanning areas such as hydrocarbon production, petroleum refining and petrochemicals, Reliance is India’s largest private sector company, with an annual turnover last year of US$73.8 billion.

As part of an effort to become net zero by 2035, Reliance earlier this year unveiled a US$10.1 billion clean energy plan that will see it aim to support 100GW of solar 2030 as well as set up production plants for PV, battery storage and green hydrogen.

“Together with our other recent investments, Reliance is now ready to set up a global scale integrated photovoltaic giga factory and make India a manufacturing hub,” said Reliance Industries chairman Mukesh Ambani.

Reliance is among the 18 companies that have bid to receive solar manufacturing support under India’s production-linked incentive scheme, according to consultancy JMK Research & Analytics, which said “it is highly likely” that Reliance and Adani “will be the main PLI beneficiaries” given their renewables investment plans.

Coinciding with the REC acquisition, Reliance said its purchase of a 40% stake in Mumbai-headquartered Sterling and Wilson will support the conglomerate in its goal of establishing and enabling up to 100GW of solar in India by the end of the decade.

Providing EPC services mainly for utility-scale solar projects, Sterling and Wilson has more than 11.4GWp of plants commissioned and under construction. It also provides solar O&M services, including for projects constructed by third parties, and currently manages a portfolio of 8.8GWp globally.

Sterling and Wilson’s chairman, Khurshed Daruvala, will remain in his role and lead the company’s next phase of growth.

Ambani said that with its global presence, engineering knowledge and experience of carrying out complex projects, Sterling and Wilson will become an important part of his company’s solar value chain. “This will enable us to deliver our comprehensive, end-to-end ecosystem leading to cost-efficient green energy for Indian consumers.”