Powering green hydrogen production could become a valuable revenue stream for solar asset managers in Europe as subsidy-free systems become mainstream, according to industry leaders.

João Cunha, chief operating officer and deputy CEO of Smartenergy Renewables AG, told panellists during today’s Solar Finance and Investment Europe event, organised by PV Tech publisher Solar Media, that green hydrogen will play an important role in the advancement of the renewables sector as a whole, and extracting more value from solar parks with low energy costs.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“The market will come to a point where all players in renewables cannot walk away from this new opportunity”, he told attendees of the Solar Finance and Investment Europe conference this week, adding that falling energy prices in the solar market will increase demand for alternative revenue streams, which could include using solar to create more expensive green hydrogen.

“We are all quite happy and excited by solar becoming the low cost energy generation, but this will pose another challenge to industrial and financial investors where to extract value, and also this comes with you expanding your presence.”

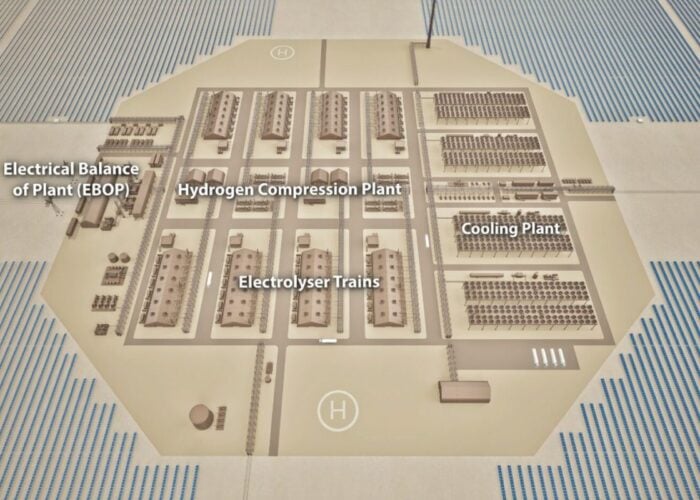

Since the cost of green hydrogen production has fallen substantially over the past five years, solar developers and utilities have started to take interest in attaching electrolyser technologies to their own PV systems to tap into the emerging market. Due to its relative maturity in the solar sector, as well as the Spanish government’s target of installing 4GW of electrolysis capacity by 2030, Spain has become something of a leading figure in the race for dominance in the emerging market. This week, Spanish utility Endesa announced plans to develop 23 green hydrogen projects in Spain powered by close to 2GW of combined solar and wind. Iberdrola also revealed plans last September to form a new business unit focused on 100% green hydrogen, while Naturgy and Enagás have joined forces to develop green hydrogen plant alongside a 400MW PV project in Spain’s Castilla y León region.

David Diaz, the chief financial officer of renewables developer X-Elio, told panellists that governments have given “a clear signal they want to boost production of green energy”, and hydrogen will be a part of that, noting that the latter half of last year had been a “boom” period for the energy source, but warned that it could be “too early in some countries” for electrolysers to play a significant role in the hybridisation of the clean energy landscape.

“There are question marks of what percentage subsidy might be needed today in some countries” he said, but later remarked that “many countries believe it’s a good use of taxes to be devoted to subsidising hydrogen.”

However Federico Gianndrea, head of Foresight Europe, said it would take another five to seven years before green hydrogen plays a significant role in the renewable energy mix.

“Everybody is looking at [hydrogen] at the moment,” he said, but added that he sees this as a sector that would be largely occupied by “industrial players” with technical expertise rather than financial investment vehicles in the initial stages.

“I would rather see financial players and renewables partner up with some industrial players to play that kind of role,” he said. I don’t see a purely financial player running a hydrogen plant because it requires that technology and skill to run those technologies, but in time big renewable energy players will put a service in their own plants and find agreements with industrial players to do so.” Gianndrea pointed to solar asset manger Octopus in Italy, which he noted trades on the possibility of using those plants…for the production of hydrogen.”

However, due to the lengthy construction process, Gianndrea said it would likely take another five to seven years to become “a mainstream type of asset class. Financial managers will be equipped by that point in time, but I think we’re still on the starting phase.”

The Solar Finance and Investment Europe conference continues tomorrow, with further content and individual country workshops planned for throughout February. For more information, including on how to participate, click here.

Note: The article has been amended to reflect that João Cunha works for Smartenergy Renewables AG, not Smart Energy Group as originally stated.