Size, scale and vertical integration are imperative for success in the richly competitive US solar market as a result of its maturation and evolving customer base, the CEO of Arevon Energy, the US renewables platform spun out of Capital Dynamics, has said.

Yesterday Capital Dynamics revealed it had spun out its US clean energy infrastructure arm and merged it with asset management firm Arevon to create Arevon Energy, a new US clean energy platform that will develop, build, own and operate solar and energy storage projects throughout the US.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The platform will start with 4.5GW portfolio of operational, under construction and late-stage development solar and battery storage sites, as well as a 3GW pipeline it is looking to progress.

Speaking to PV Tech, Arevon Energy CEO John Breckenridge said it was this scale – the business has total assets valued at US$12 billion – that stands to give Arevon sufficient strength in order to succeed in what is rapidly becoming a richly competitive US solar market.

“That gives us the scale, in terms of procurement, in terms of how we operate, in terms of how we construct even in some of our development activities, relationships with off takers… all of those things that are beyond the cost of capital that are only really available if you have size, scale and vertical integration,” Breckenridge said.

That vertical integration has been a key motivation in assembling Arevon, Breckenridge added, noting that the business’s aim is to integrate the capabilities of Capital Dynamics into Arevon and “drive further in that direction”.

“I think that’s really the only way to succeed in this sector at the moment,” he said.

Component procurement is a particular subject of interest given supply chain constraints and pricing volatility that is impacting purchasing practices, driven by both raw material costs and policy. Arevon is backing its scale to be effective here as well.

“If you want access to batteries today, and you’re a small buyer, you’re going to be waiting a long time and paying high price. We’re buying billions of dollars worth of batteries, so that gives us a lot more opportunity to access that market. It’s the same thing with things like panels, and in all the other aspects of the business,” Breckenridge said.

“It’s very hard to be a lot better than everybody else at one thing, so the goal for us is to be a little better at a lot of things.“

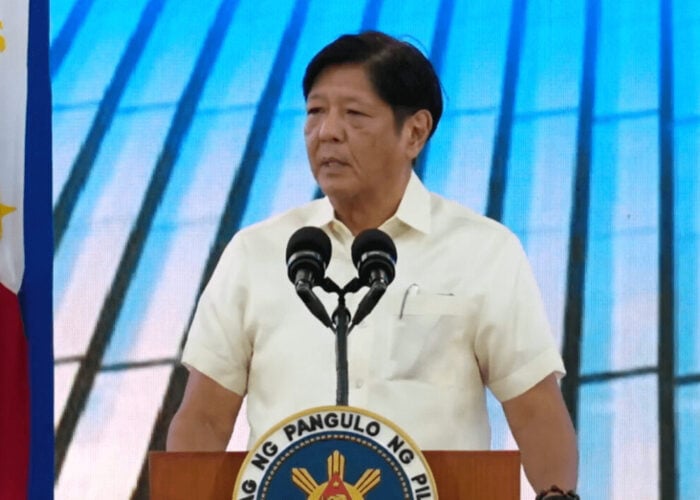

John Breckenridge

With the market increasingly competitive and made all the more difficult to navigate by supply chain constraints and pricing volatility, Breckenridge said it was Arevon’s intent to utilise its scale to deliver savings and efficiencies that can then be passed onto the customer.

The notion of “operational excellence”, as Breckenridge describes it, takes inspiration from his 18 years of experience in managing manufacturing businesses where individual processes were stripped back in order to identify potential improvements.

“Whether it’s the way you evaluate transactions, the way you do financing, the way you develop, construct, procure… You’ve got to bring this operational excellence, high efficiency thinking to every one of those aspects of the business. We are seeing huge opportunities for savings and for efficiencies by consolidating and looking at everything we do on a holistic basis,” the CEO said.

And these savings and efficiencies can then be utilised to deliver better offerings for customers, with utilities and corporate offtakers firmly in Arevon’s crosshairs going forward. But this is also being reshaped by customers looking for more complex and bespoke solutions that better fit their individual needs, with Arevon’s perspective being that the solar industry must adapt to the emerging power needs of businesses if they are to capture that business.

For Breckenridge, this is where the combination of solar and storage comes into its own.

“We’re going to provide customers with power the way they use it, and that involves complex combinations of solar-storage, power trading, all the things that you can put together to offer a total renewable solution that meets the customer’s needs,” he said.

Arevon intends to be active in all of the US’ key markets such as California, but also in markets such as PJM where Breckenridge describes the market as smaller and more spread out. The south east of the country is also seeing considerable activity, with the company intent on establishing geographical diversity to mitigate any prospective risk in the market.