Solar balance of systems (BOS) provider Shoals Technologies has benefited from “robust demand” for its products in the US, as it completed its first quarter as a public company.

The Tennessee-based firm saw its backlog and awarded orders reach US$181 million at the end of March 2021, an increase of 42% year-on-year, as it posted record Q1 revenues and took on more customers.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

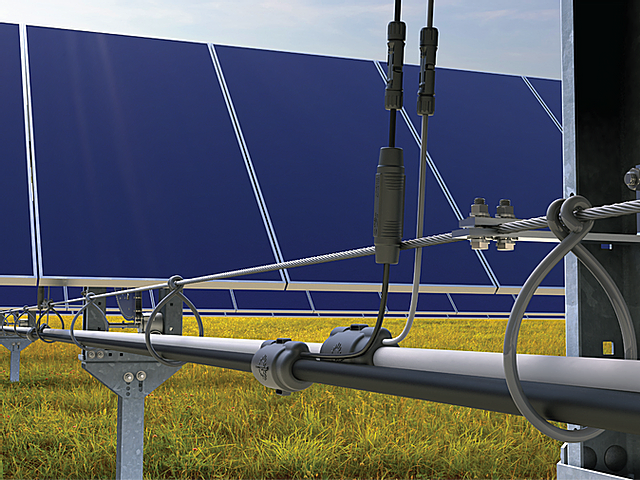

According to CEO Jason Whitaker, Shoals increased the amount of EPCs and developers using its Big Lead Assembly (BLA) solution – which combines cable assemblies, combiner boxes and fusing into a single product for utility-scale solar projects – from four to eight during the quarter.

“We are making steady progress on our growth initiatives of converting more customers to our BLA solution, broadening our product offering into complementary categories of EBOS (electrical balance of system), expanding internationally,” he said. This global expansion plan has seen the company install a sales team in Europe, where it expects to receive orders from this year.

First-quarter revenues reached a new high of US$45.6 million, with a 12% year-on-year rise driven by a 46% increase in system solutions revenues.

The results announcement comes after Shoals grew revenues 21% last year and carried out an upsized initial public offering that raised US$2.2 billion, with a share of proceeds allocated to converting customers to its BLA solution.

The company has reaffirmed its 2021 outlook, which call for revenues to increase by between 31 – 36.7%, reaching between US$230 – 240 million. Earnings are expected to be in the range of US$75 – 80 million, up 23 – 31% on last year.

Whitaker added: “Our performance reflects continued strong customer demand for our products, and we expect growth to accelerate as we progress through the remainder of the year.”