Shorter purchasing contracts with private companies could be a “lucrative” short-term source of income for Poland’s solar market.

That’s according to a panel of industry leaders discussing the future of Poland’s renewables sector as part of the Solar Finance & Investment Europe conference this week, organised by PV Tech publisher Solar Media.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Poland’s National Plan for Energy and Climate has targeted deploying 7.8GW of solar by the end of the decade, and a report from Poland’s Institute of Renewable Energy (IEO) published last summer suggested that this could be reached by 2025.

Much of the country’s historical PV market growth was driven by residential installations and self-consumption, but as the cost of production has fallen worldwide, Poland is now setting sights on more grid-scale generation supported by capacity auctions. Poland’s energy regulator allocated 800MW of solar capacity in a renewables tender last November, dedicated to developers with more than 1MW installed capacity.

Joaquim Barbosa, country manager of developer EDP Renewables in Poland, said that the auctions have been “by far the favourite mechanism to secure and handle the production” of solar power in the country. The Polish parliament is currently expecting to continue using auction mechanisms until at least the end of 2027, Barbosa said, with annual volumes proposed beforehand. The country manager believed this will “give very good visibility of what it’s going to be like and for the developers to plan their investment.”

However, there is scope for power purchase agreements (PPAs) signed with corporations to become another “lucrative” revenue stream for Poland’s developers, said Anna Chmielewska, associate director of the European Bank for Reconstruction and Development. The points were made less than a month after renewables group BayWa r.e. secured what it claims is Poland’s first corporate PPA, a 10-year agreement with construction group HiedelbergCement on a 65MWp park close to the German border.

Chmielewska, said that corporate PPAs could provide short term revenues between auctions, but the sector “cannot hope for 15 years corporate PPAs”. “We need to look for 5-7 years to be a basis, following effectively merchant exposure,” Chmielewska added.

Nonetheless, she believes there is appetite for a more flexible corporate market in Poland, adding that she has seen “signals of foreign companies in Germany or other markets actively looking for opportunities to sign PPAs with investment in Poland.”

Maria Merdzhanova, head of sales in northern Europe for PV module supplier JinkoSolar, said that that PPAs could be as little as three to five years long in order to garner interest from a wider range of private companies. She argued that there are still projects in Poland that have connectivity, but did not win financing through auction.

“The private PPA markets will really take off,” she said, “because there is a lot of projects which were developed but never won the auctions. They have the connection. Some of them are still valid, but they couldn’t win the auctions.”

“Once the banks start becoming more flexible”, with, she said, “shorter PPAs like three years long, the private PPA market will really take off. The problem is the bank requires at least 10 years for a PPA. No private company will sign a realistic PPA for 10 years, but maybe with three to five years from what I’ve seen”.

Although Barbosa believed that the financial regulators helping to construct PPAs would have to set a minimum length they are willing to take, he does still “see interest in the market for those a bit longer, about 10 years”.

“Banks need to give a signal of what they are ok with. The banks will have to give an example of what they’re willing to take and most likely go after it.”

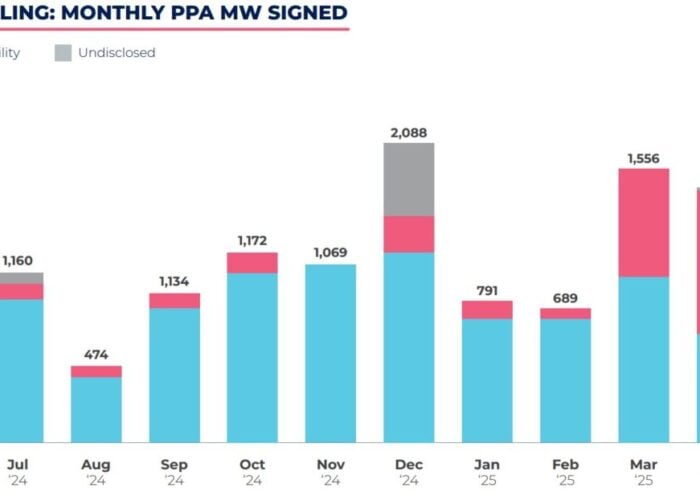

As other countries in Europe have stepped back from offering subsidies, PPAs have become an important revenue stream for developers and power producers. A recent report from software firm Pexapark claims that Europe could exceed 10GW of renewables PPA volumes this year, largely driven by deals in the comparatively mature Spanish market.