Australia’s Clean Energy Regulator (CER) has disclosed that 1.5GW of new renewable energy capacity in the National Electricity Market (NEM) has received authorisation for a Large-scale Generation Certificate (LGC) throughout the second quarter of 2025.

This performance has prompted the regulator to revise its 2025 projections upward to 3-3.5GW from the previous estimate of 2.7-3.1GW.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to the CER’s latest Quarterly Carbon Market Report, four major renewable energy power plants secured approval during Q2. These include the 520MW Stubbo Solar Farm and 346MW Wollar Solar Farm in New South Wales, the 450MW Clarke Creek Wind Farm in Queensland, and the 58MW Mokoan Solar Farm in Victoria.

The CER has said the Mokoan solar PV power plant is particularly significant as it has become the first project from Tender 1 of the Capacity Investment Scheme (CIS) to receive approval under the Large-scale Renewable Energy Target (LRET).

As reported by PV Tech last year, the first tender round of the CIS saw 2.75GW of solar PV and 3.55GW of wind successful. In total, 19 projects completed the tender process, with the majority located in New South Wales and Victoria, with seven projects each. Queensland saw three successful projects, while South Australia secured two projects.

Meanwhile, the LRET incentivises investment in utility-scale renewable energy through a market-based certificate system. The programme requires electricity retailers to purchase LGCs from renewable energy generators to meet a legislated target of 33,000GWh annually until 2030.

The strong second-quarter performance builds upon additional approvals in July and August, bringing the total approved capacity for 2025 to 2.6GW as of 22 August.

The CER reports that an additional 820MW of capacity was approved between 1 July and 22 August, including the 440MW Culcairn Solar Farm and 46MW from two biomass projects, with the Kwinana Waste to Energy Facility (42MW) in Western Australia among them.

As of late August, 691MW of large-scale renewable energy capacity was still under assessment by the CER.

Record generation from renewables

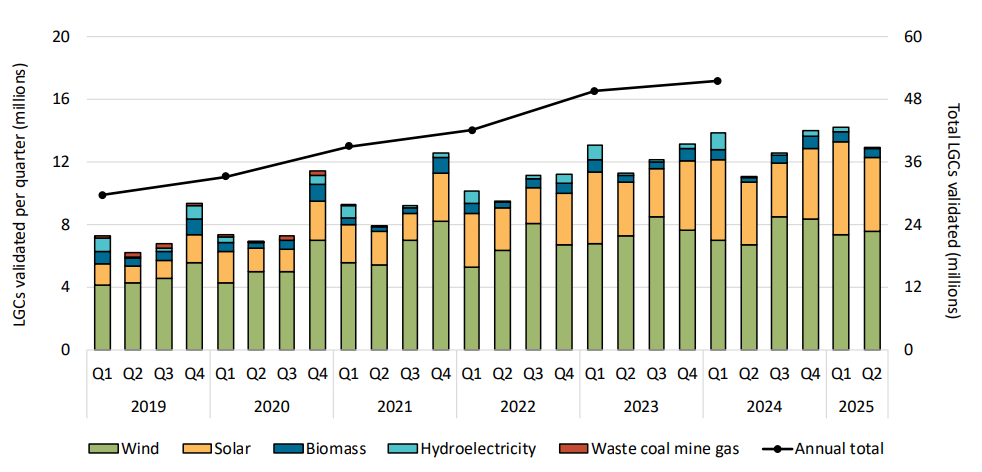

The report highlights that generation from large-scale renewables continues to set records across Australia. In the second quarter of 2025, a Q2 record of 13 million LGCs was created, representing a 17% increase from Q2 2024.

The year-to-date total reached 27.2 million, tracking toward the upper end of the CER’s projection of 54-57 million for the full year.

Total large and small-scale renewables accounted for an average of 37.2% of the generation across the NEM during the quarter, up from 31.9% in Q2 2024 and setting a new Q2 record.

According to the CER, this increase has been driven by new renewable power stations and improved generation conditions for wind power, which saw a 31% year-on-year increase compared to Q2 2024, from 5.8TWh to 7.6TWh.

Both hydroelectricity and utility-scale solar experienced year-on-year increases compared to the second quarter of 2024.

Hydroelectric output rose by 4%, increasing from 3.5TWh to 3.7TWh, while utility-scale solar output increased by 17%, rising from 3.1TWh to 3.6TWh. Overall, the penetration of renewable energy sources in the NEM reached 40% in the first half of 2025, up from 35% in the same period of 2024.

Solar PV continues to play an integral role in shattering renewable energy records in the NEM. Last week, the NEM set a new instantaneous renewable energy share record of 78.6% at 11:50 on 22 September, surpassing the previous day’s record of 77.9%.

Rooftop solar’s contribution peaked at 45.9% of total demand, representing nearly half of all electricity consumed across the five NEM states and territories. This solar penetration forced coal generation down to a historic minimum of 21.9%, while combined coal and gas generation fell to just 22.5% of the mix.

The record renewable energy penetration follows a dramatic month-on-month increase in solar generation.

According to our latest NEM data spotlight, available for PV Tech Premium subscribers, in August 2025, utility-scale and rooftop solar PV generation in the NEM saw a 22.5% increase to 3,338GWh compared to July, reflecting the seasonal shift from winter to spring.

Policy developments boost renewable energy targets

Readers of PV Tech will likely be aware that the Australian government announced in July a 25% expansion of the CIS to support 40GW of new renewable energy by 2030, up from the previous target of 32GW.

This increase raises the targets for renewable energy generation capacity from 23GW to 26GW and clean dispatchable capacity from 9GW to 14GW.

According to the CER, this expansion has been facilitated by the competitiveness of tenders to date and reduced costs of installing new solar and battery systems.

The government has also streamlined the CIS tender process, cutting the timeline from nine to around six months by implementing a single-stage bid process where project and financial details are submitted together.

This is now being tested in the latest CIS tenders in Western Australia (Tenders 5 and 6), which seek 2.4GWh of energy storage and 1.6GW of renewable energy generation.

The CER said the streamlined process is expected to reduce administrative burdens for project developers and potentially accelerate the pace of new renewable energy deployments across the country.

Investment decisions show measured progress

While approvals remain strong, the pace of final investment decisions (FIDs) has been more measured. In Q2 2025, six projects reached FID, totalling 672MW of capacity.

Notable projects include the 240MW Wandoan South Solar Farm in Queensland, the 190MW Cloudbreak Solar Farm in Western Australia, and the 106MW Lancaster Solar Farm in Victoria.

This brings the cumulative FID capacity to 952MW by the end of Q2 2025, which the CER notes is approximately 75% of the average seen over the first two quarters since 2019.

The regulator said that it acknowledges that FID is inherently variable over time, with some years showing significantly higher activity than others.