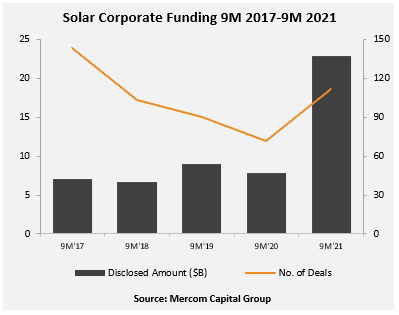

Total corporate funding in solar increased 190% in the first nine months of this year, with US$22.8 billion raised in 112 deals compared with US$7.9 billion in 72 deals in the same period last year, according to a Mercom Capital Group report.

The biggest increase was in venture capital (VC) funding, which rose to US$2.2 billion in 39 deals, an increase of 466% compared to last year (US$394 million in 29 deals). Of this, downstream solar companies accounted for 88% of VC funding, up from 78% last year, with US$1.9 billion raised.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The top five VC deals this year were: US$800 million raised by California residential group Loanpal; US$250 million raised by solar software company Aurora Solar; US$240 million raised by solar and energy storage developer Nexamp; US$127 million raised by utility-scale developer Intersect Power; and US$125 million raised by Indian distributed solar company Fourth Partner Energy.

Furthermore, public market financing was 209% higher with US$6.3 billion raised in 23 deals compared to US$2 billion raised in 10 deals in the first nine months of last year. There have been seven initial public offerings (IPOs) and SPACs announced in solar so far this year.

“Investment activity continues to be robust across the solar sector and not just compared to 2020 (because of COVID). This will end up as one of the best years for solar financing since 2010,” said Raj Prabhu, CEO of Mercom.

A Mercom report in July 2020 showed that corporate solar funding fell by 25% year-on-year to US$4.5 billion in the first half of 2020, although the decline could have been much starker.

Nonetheless, “solar project acquisitions in the first nine months of 2021 have already surpassed all of 2020,” explained Prabhu.

That said, the solar industry faces a tough year ahead with production problems in China causing polysilicon and module price rises, with some downstream installers stockpiling goods as a result. PV Tech Premium has analysed how production and procurement are adapting.

Mercom’s report also showed that large-scale project funding was down from US$13.1 billion across 121 deals in the first nine months of last year to US$11.6 billion over 138 deals this year. Even so, large-scale solar project acquisition activity was up 129%, with 55.5GW of projects acquired compared to 24.3GW in the first nine months of 2020.

Finally, there have been 83 M&A transactions recorded this year compared to 42 transactions during the same period last year.