Property insurance for a solar project, having been an easy “check the box” issue 10 years ago, is fast becoming a top credit item for securing financing from banks, according to the head of a data analytics and insurtech firm. There is also potential for a coverage gap developing because traditional insurance carriers are tightening their portfolio exposure as natural catastrophe (nat cat) events, such as hailstorms, floods, tornados and fires, drive insurance costs up.

“More risk is getting pushed on to the asset owner and it’s happening in the form of higher deductibles and lower submits and more expensive insurance,” Jason Kaminsky, CEO of San Francisco-based kWh Analytics, tells PV Tech Premium.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Developers take a glimpse at insurance and assume they’ll find a way out of the problem as they jump into modelling, says Kaminsky, but it’s a much more acute long-term issue than many industry members are aware of. Asset owners might be holding some risk that’s going to be very expensive and challenging to insure due to future nat cat issues.

With his history in banking, Kaminsky reflects that the landscape has changed in the past few years as asset owners have been unable to secure full insurance limits for their projects, with more than 50% of lenders receiving waiver requests on their insurance obligations within the loan agreements, as noted in kWh Analytics 2021 Solar Risk Assessment.

“You used to have an insurance procurement person buying insurance, but now, it’s a CFO-level issue for the developers, so the importance of it to the finance and development community is growing,” he says.

Moreover, solar insurance is a dynamic space with policies constantly evolving each year, unlike the auto or homeowners insurance industry where policy terms and conditions are relatively stable.

Avoiding a PV coverage gap

Last month, kWh Analytics introduced its new property insurance for renewable energy assets with capacity partner Aspen Insurance, providing coverage against physical damage for solar and other renewables. This introduced more capacity to a rapidly growing sector at a time when renewables’ insurance premiums are on the rise. The company wants to avoid the solar industry entering a coverage gap where there are assets that should get insurance but can’t access it.

After carriers lost money on extreme weather events, such as the 2022 hailstorms in Texas, the market is hardening, bringing higher and more conservative rates, Kaminsky says. As a result, raising the level of property insurance capacity is challenging in today’s market and creates a supply-demand mismatch.

Due to the hardening market and losses in the industry, insurance carriers have started to stop wearing the risk and are pushing large deductibles onto PV asset owners and adjusting terms and conditions. This causes tension within project finance structures as carriers try to figure out the risk allocation between the lender and the owner.

Kaminsky says: “For the most part, it all gets pushed onto the owner and onto the equity and it makes what’s already a challenging asset to develop and finance just that incrementally harder, because now they’re also wearing however many millions of dollars of nat cat risk.

“What is often overlooked is you can’t get your financing without insurance. It’s a critical piece of the puzzle. If you show up and ask the bank for a loan and you say, ‘I can’t get insurance on this asset’, you’re not going to get the loan. So, it’s 100% critical.”

It is also worth noting that insurers re-underwrite every single asset in the whole solar market every year, as it’s a one-year policy, says Kaminsky, adding: “So as the industry grows, you have to write everything that came before it plus new assets, and at a time when there have been losses and carriers are trying to manage their exposures, you have more demand than you have supply.”

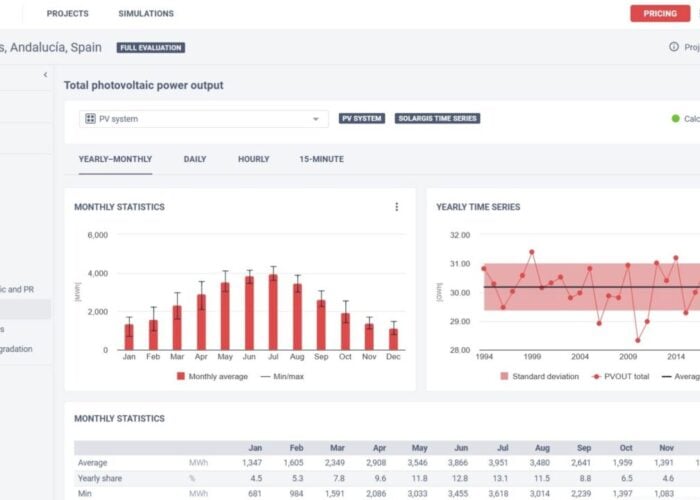

A key difference provided by kWh Analytics’ new offering is that it can draw from its proprietary database of 300,000 renewable energy assets. Evaluating historical operating data, the company can identify the most common failure modes among existing solar PV projects and incorporate that into its renewable energy property insurance underwriting.

PV Tech Premium recently covered a kWh Analytics report drawing from that database that stated US solar assets are not meeting performance expectations across all segments, which Kaminsky says could risk damage to the industry’s reputation in the long term if equity investors in PV projects do not see their return profiles being realised a few years down the line.

“We’ve identified a gap in the market related to underperformance and we have insurance that actually supports the production of solar facilities,” he adds.

kWh Analytics started work on the property insurance product after conversations with bankers in 2021, when the banks began raising alarm bells over the lack of adequate capacity and sought a more specialised approach from carriers to underwrite the risk.

“Given our background in project finance, it was kind of like a lightbulb moment,” says Kaminsky. “This is going to be a bigger and bigger problem as the industry grows and as we looked at the market more, what we came to appreciate is that there are only a few big companies in the space in insurance.”

Insider knowledge for specialty asset classes

Brokers told kWh Analytics that these established insurance firms were bringing experience from oil and gas or commercial property to renewables, but as a result, were not asking the most relevant questions regarding loss profiles for this specific industry.

“My perspective as someone who worked in banking is that for a specialty asset class, you need specialty knowledge,” says Kaminsky. “There are unusual circumstances that can happen out of a renewable energy facility that you just don’t see in other segments.”

Some carriers use third-party software to model natural catastrophes, but the providers of the software lack data on renewable energy, so proxy asset classes are utilised to approximate the loss profile of a renewable energy facility. These proxies may not be accurate representations of the underlying facility.

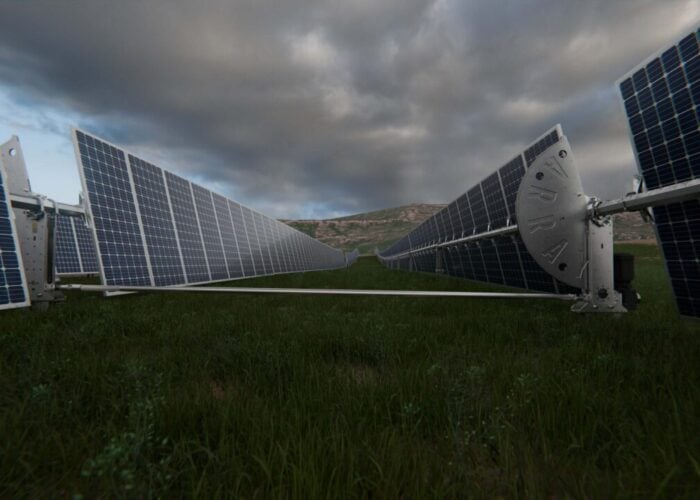

“There’s a lot of differences between what’s actually out in the field and how they’re reacting to natural events and there’s a lot of decisions on the site that could affect that,” says Kaminsky. “How are the modules attached? Are they on trackers? What decisions are they making? When hail is coming, do they try to move the panels out of the way? How often are they mowing the grass? All these can affect the loss profile.”

Likewise, insurers need to understand where risks are being allocated and developed, particularly with major changes like the Inflation Reduction Act and the relevant tax credit transfers.

With its data capabilities, kWh Analytics acts as a technology and underwriting company that partners with insurance carriers. Its latest announcement was the partnership with Aspen Insurance, but there are more collaborations that have yet to be made public, says Kaminsky.

Extreme weather rising

There are also fears that increased extreme weather risks and a lack of specific renewable expertise and data are scaring carriers away from the renewables property market. Recent damages and the anticipated size of the related insurance claims have been unprecedented.

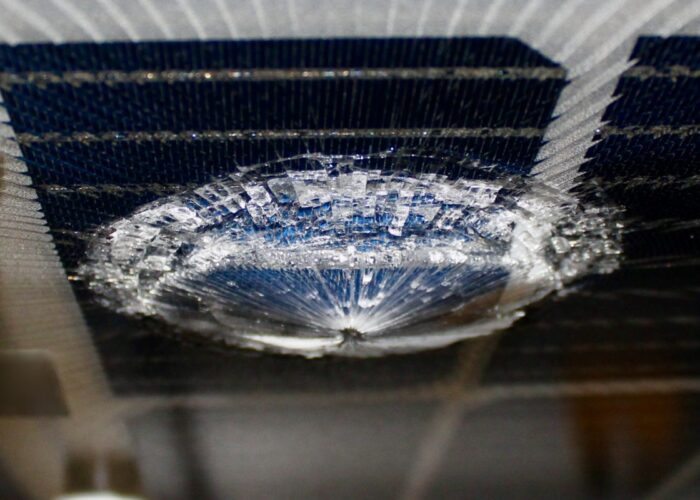

In 2022, the US renewables market experienced its worst summer on record for natural catastrophe claims with hail experienced in Texas in early summer resulting in solar losses estimated in excess of US$300 million, according to GCube Insurance’s North American Nat Cat Update report. Other major losses specific to solar included wildfires on the West Coast in 2021 (US$67 million), a tornado in Louisiana in 2020 (US$30 million) and Hurricane Hanna in 2020 (US$10 million). The report also said current testing for solar modules is inadequate to account for the rising severity of extreme weather events in North America.

Endemic underestimation

GCube noted that despite awareness of these trends, large-scale losses are still taking the industry by surprise, with widespread damages and vastly exceeded sub-limits a common feature of emerging nat cat and extreme weather claims.

Fire suppression system provider Firetrace International recently claimed that the increased hardening of the renewable energy insurance market could theoretically prompt a shift towards insurers covering asset damage but not lost revenue as a result of business interruption due to asset downtime.

Ross Paznokas, global business development manager, clean energy, at Firetrace International, says that there is a resounding story among all global insurance providers that there is a lack of actuarial data for solar, wind and battery storage systems.

“Every single insurer is saying we never estimated properly the natural disasters that would happen – hail, tornado and wind. We’ve never estimated that there’d be fires in the inverter, that then – not able to be isolated – would burn the entire perimeter, because high voltage, direct current comes into that inverter from every string connected to it until the sun goes down. If you have a fire at noon, it burns and cannot even have any firefighter come to be close to it until nightfall, so the damage just gets bigger and bigger.

“With battery energy storage systems, there have also been a tonne of stories about how fire has propagated or how there’s been a false release of a water-based extinguishing system and then that water-based system goes in and fries every single one of the electrical components as it was falsely discharged.”

Despite rising premiums, insurers have still been under-pricing renewable products and will have to raise premiums or reduce coverage as a result, subjecting owner-operators to more risk, says Firetrace, echoing Kaminsky’s comments. This is at a time when owner-operators are already facing large deductibles, particularly in solar, chiefly as a result of unprecedented nat cat claims.

Renewable energy platforms are finding that for the same amount of money they’re getting much less coverage and insurers are now asking far more than ever before to understand how a renewable energy system works and how the risk of fire is being mitigated, says Paznokas, adding: “For business interruption insurance, the risk profiles are just adding up to where the premiums are significantly higher than what they’ve had in the past.”

Paznokas makes the point that while it is hard to have control over nat cat events, one can have some control over internal fire risks within equipment, hence the company supplies fire suppression systems that detect fires at their origin and electrically isolate the equipment without depleting oxygen for technicians working near the fire outbreak. This is, at least, one controllable way to prevent the catastrophic loss of an asset.

Finally, one of the GCube report conclusions was that due to supply chain challenges, appropriate cover is important to ensure financial protection in the event of extended downtime and soaring component costs. Hence, it is not only climate change, but also geopolitical events and inflation that are impacting the insurance landscape.