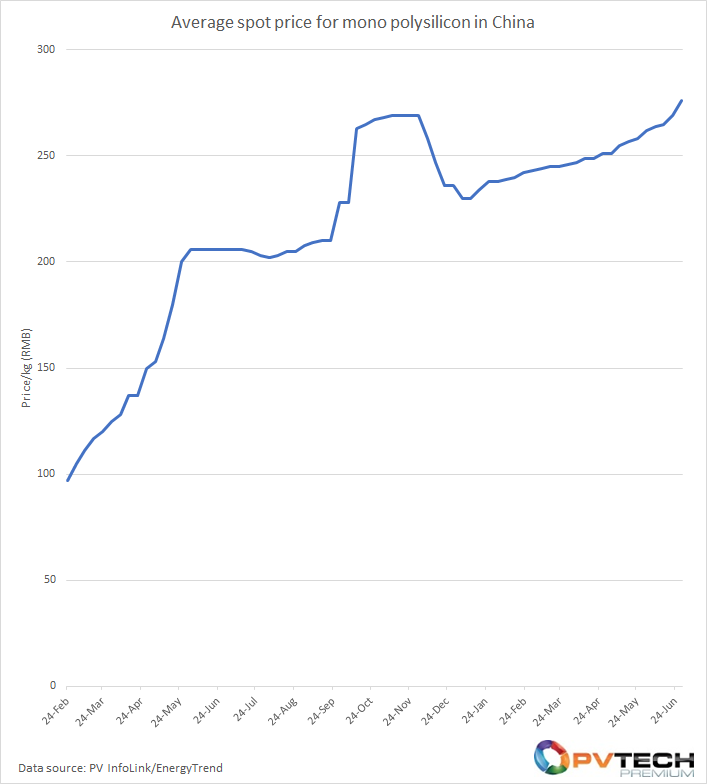

The solar industry supply chain’s jitters continued this week after polysilicon prices hit another high, driving silicon wafer prices further upward too.

This week’s polysilicon pricing update recorded prices of up to RMB280/kg (inclusive of China’s 13% sales tax, equivalent to around US$37/kg excluding that tax), with an average price of around RMB276/kg (US$36.49/kg excluding China’s sales tax).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Prices jumped by around 2.6% on last week’s price, which itself marked the first time prices rose above last year’s high of RMB269/kg and amounted to an 11-year high.

Polysilicon prices have risen throughout the year but have jumped sharply in recent weeks on the back of sustained demand and panic buying from wafer manufacturers. Supply shortages have been further exacerbated by a fire at an East Hope-owned facility in Xinjiang which is set to reduce its output for around one month.

The impact of the fire has been limited as the facility was due to begin maintenance works, with other polysilicon production facilities in the country also expected to begin maintenance works despite the high industry demand.

As PV Tech Premium’s PV Price Watch feature noted earlier this week, continually high polysilicon prices – coupled with a bottleneck at the ingoting stage – have ricocheted down solar’s value chain, driving up solar wafer and module prices in recent weeks.

Earlier today LONGi confirmed another increase in its wafer prices, prices rising by around 6% to the highest they’ve been in recent years.

Solar prices are expected to remain high until the end of this year when a slate of new polysilicon production capacity is expected to come online, bolstering supply.