Solar wafer and cell manufacturers in China have hiked their prices once again this month after a jump in spot prices for polysilicon in the country.

Solar manufacturing has also been further complicated in the country after earthquakes over the weekend disrupted production at facilities owned by LONGi and Zhonghuan Semiconductor (TZS), two of the industry’s largest wafer suppliers.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Earlier today LONGi announced a further price increase for its wafers, coming less than two weeks after the leading solar module and wafer producer last increased its prices. The company’s prices rose around 9% across the board, with full details below:

| Wafer size | 25 May 2021 price (USD) | 14 May 2021 price (USD) | % Increase |

|---|---|---|---|

| 158.75mm | 0.655 | 0.599 | 9.3 |

| 166mm (M6) | 0.669 | 0.612 | 9.3 |

| 182mm (M10) | 0.803 | 0.735 | 9.25 |

LONGi’s price hike follows a similar move from solar cell manufacturer Tongwei, which increased its prices by between 8 – 9% on Friday (21 May 2021). Full details regarding Tongwei’s price increase are below:

| Wafer size | 21 May 2021 price (RMB/W) | 14 May 2021 price (RMB/W) | % Increase |

|---|---|---|---|

| 158.75mm | 1.10 | 1.02 | 7.8% |

| 166mm | 1.08 | 0.99 | 9.1 |

| 210mm | 1.08 | 0.99 | 9.1 |

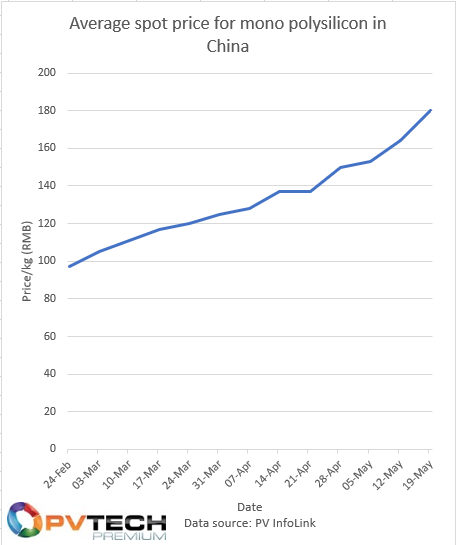

This week’s price increases follow a jump in the average spot market price for polysilicon in China. While the price has been steadily rising since the turn of the year, prices jumped by more than 9% last week, according to data compiled by PV InfoLink. The below chart illustrates the growth of the average polysilicon spot price since February this year.

Meanwhile, LONGi Green Energy has revealed the impact to its manufacturing output from earthquakes in China which occurred in Yunnan and Qinghai provinces late last week. LONGi has mono silicon rod and wafer production facilities in Yunnan, and the company confirmed in a statement to the Shanghai Stock Exchange that around 10% of its silicon wafer production output for this month has been disrupted, equivalent to around 120 million solar wafers.

LONGi added in its statement that related subsidiaries were working on restoring production, which is expected to resume next week.

In a filing issued to the Shenzhen Stock Exchange, TZS revealed that the earthquake in Qinghai caused some disruption to its production, resulting in the loss of around 130MW of its output for this month. Similarly, TZS said it was working to restore full production.