SolarEdge Technologies scored a revenue record in Q1 2020 thanks to growth worldwide and is now keeping a close watch on customers’ financial health, to make sure every order will be paid for.

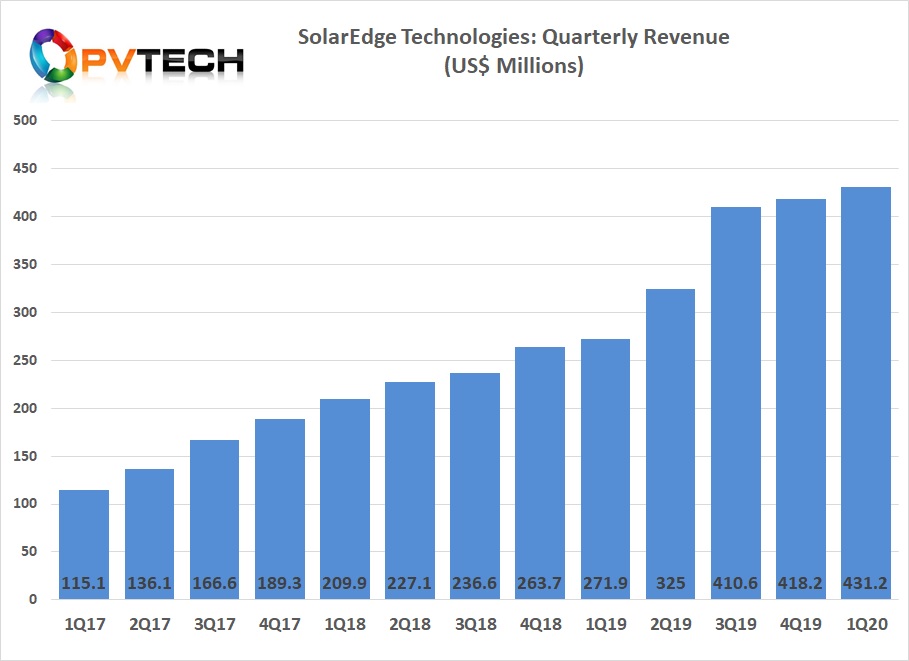

The company reported revenue of US$431.2 million in the first quarter of 2020, up 58.6% year-on-year and up 3.1%, quarter-on-quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The inverter maker shared results showing profitability held in a quarter when COVID-19 expanded all across its key markets, with US$42.2 million posted in GAAP net income compared to US$19 million in Q1 2019 and US$52.8 million in Q4 2019.

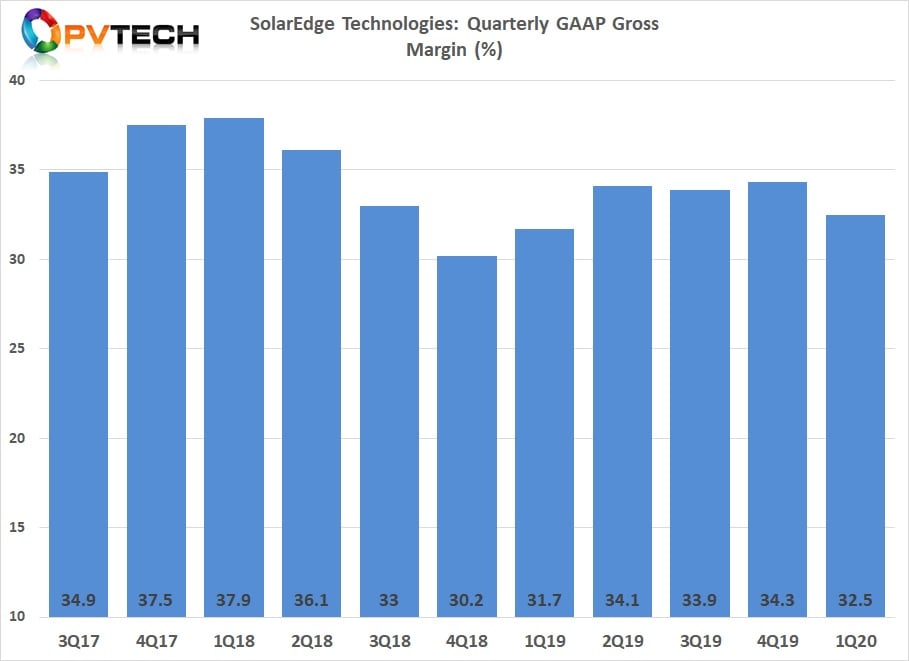

However, gross profit margin declined to 32.5% in the reporting quarter, down from 34.3% in the fourth quarter of 2020.

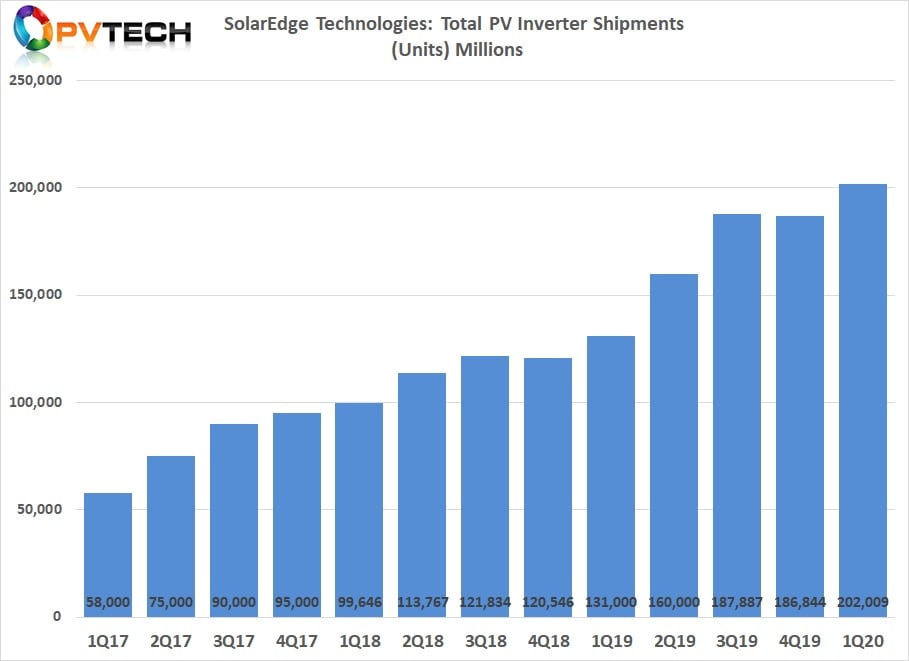

In addition, the shipment of five million power optimisers and 202,000 inverters over Q1 2020 helped SolarEdge push revenues to an all-time quarterly high.

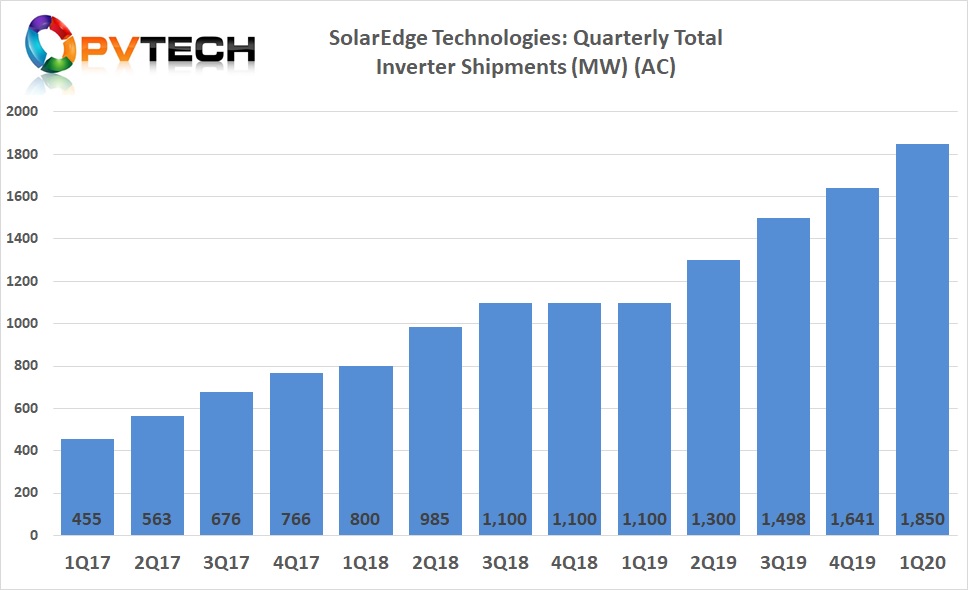

Total PV inverter shipments in Q1 2020 topped 1,840MW, another record for the company.

Speaking to analysts, CEO Zvi Lando remarked that the mood is currently less positive in the US than in Europe, where SolarEdge clinched Q1 2020 orders of 641MW and revenues of US$122.3 million. Led by Australia, the rest of the world (283MW, US$39.7 million) too was a highlight.

In Europe, the performance ranged from a buoyant Germany – where SolarEdge's March-April product installs rose 42% year-on-year – to a more muted Italy, a “historically strong” market where product additions plummeted by 47% but are beginning to recover.

As for non-solar revenues, SolarEdge recorded a Q1 2020 figure of US$23.6 million, helped along by strong-performing lithium-ion batteries. Despite COVID-19, the expansion of the 2GW factory SolarEdge controls in South Korea since its late 2018 takeover of Kokam is “underway as planned”, the firm said.

Long-term R&D focus as firm probes order backlog

As it posted its Q1 2020 results, SolarEdge also used the update to share its Q2 2020 guidance. The firm said it is expecting US$305-335 million revenues between April and June 2020, coupled with gross margins in the 30-32% region.

Quizzed by analysts over the dynamics that would push Q2 2020 revenues towards the upper or lower end of the bracket, CFO Ronen Faier said the firm is looking at “every order” to ensure it does not “provide credit to customers that we are a little bit afraid that we will not be able to collect.”

SolarEdge, Faier said, is sitting on enough backlog to cover the revenue range it is guiding. He added, however: “However, during the last few weeks, we have seen requests for either rescheduling [or] cancellations. And at the same time, we're also seeing from time to time customers that are either struggling or we are afraid that they will struggle with payment terms.”

“We will continue to examine the credit worthiness and strength of our customers … And we will carefully consider to adjust credit allocations as needed,” the CFO went on to say, adding that the inventory the firm built in the earlier stages of the COVID-19 crisis will help deliver orders in the coming quarters.

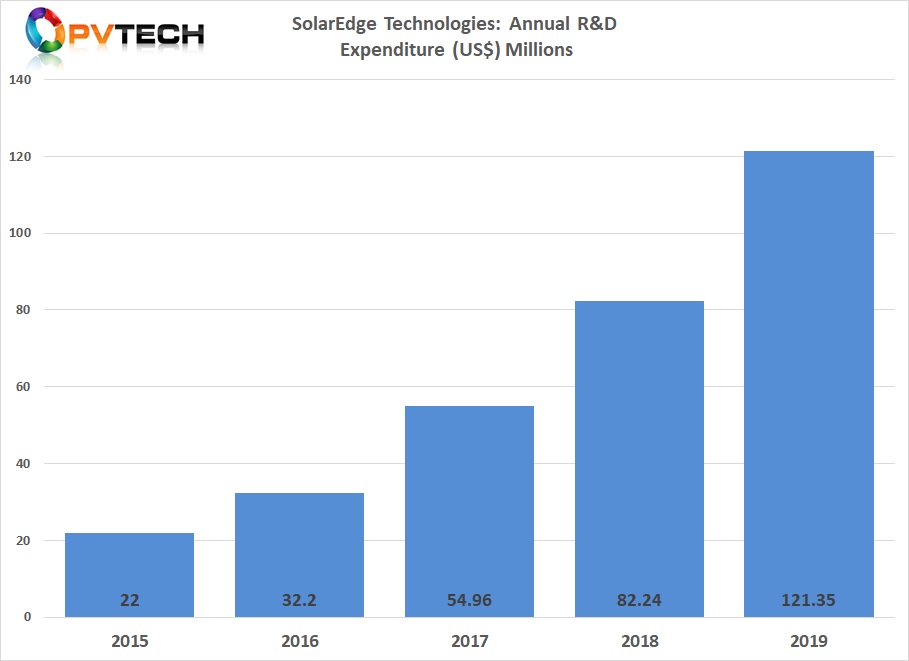

For his part, CEO Zvi Lando said SolarEdge – whose senior executives have taken voluntary pay cuts of 20% – will retain the R&D pipeline it had planned pre-pandemic. Later this year, the firm will start shipping its HD-Wave energy hub inverter, followed by a new commercial inverter line and an enhanced ground-mount power optimiser.

Pressed by analysts to share the firm’s outlook for Q3 2020, CFO Faier said the visibility is currently “limited”. He noted that the level of transparency has been good but added: “I think that neither us nor do the customers know how much of their inventory will be consumed.”

PV Tech has set up a dedicated tracker to map out how the COVID-19 pandemic is disrupting solar supply chains worldwide. You can read the latest updates here.

If you have a COVID-19 statement to share or a story on how the pandemic is disrupting a solar business anywhere in the world, do get in touch at [email protected] or [email protected].