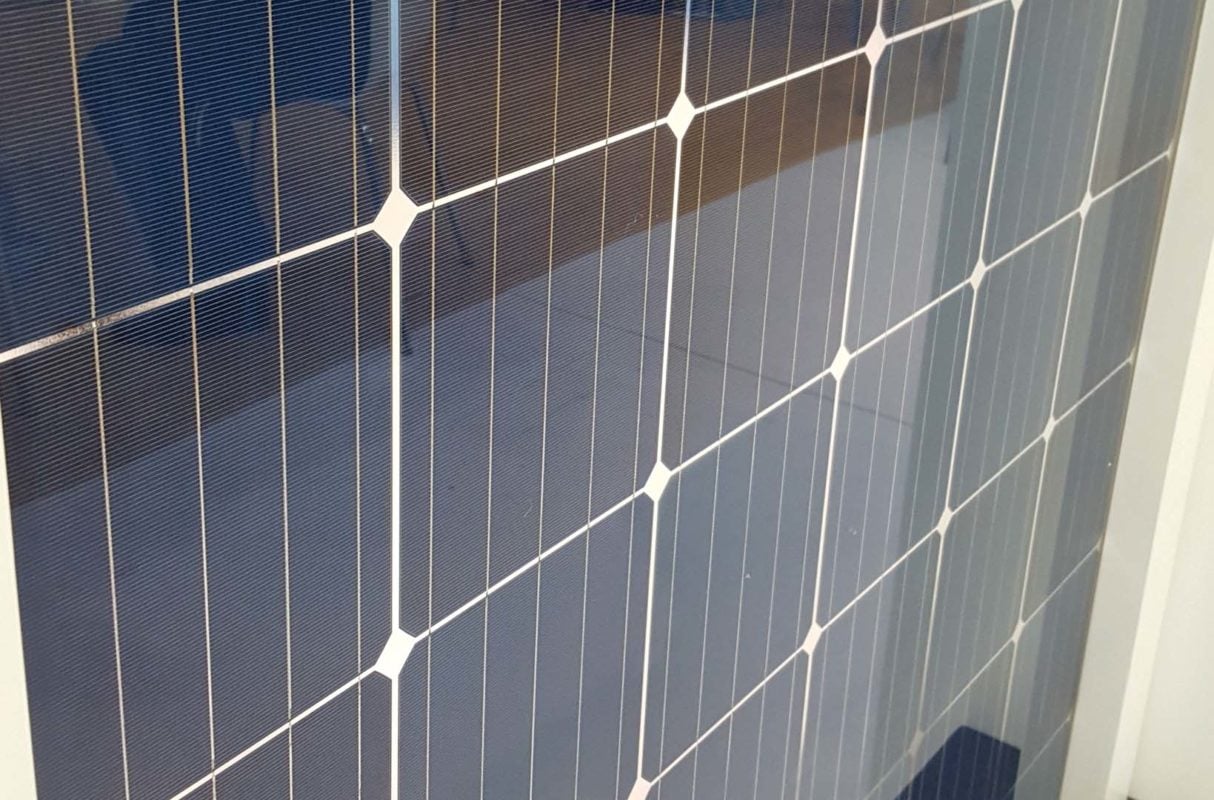

China-based integrated monocrystalline PV manufacturer Solargiga Energy Holdings said it would expand module assembly capacity by 1GW at its existing manufacturing facilities at a cost of RMB160 million (US$25.2 million).

Solargiga said that the expansion would be completed and commence volume production late in the second quarter of 2018.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In May, 2017 Solargiga acquired a 63% stake in struggling multicrystalline wafer manufacturer Chuanghui New Energy, formerly known as Jinzhou Aoke New Energy Co and converted the facilities to produce PV modules instead.

Solargiga has been expanding monocrystalline silicon ingot and wafer capacity to 1.8GW, which is expected to be ramped in the second half of 2018. The company is expected to have 2.2GW of nameplate module capacity after the 1GW expansion. In-house mono cell capacity stands at 400MW and is expected to be expanded modestly in 2018.