The majority of Taiwanese solar industry companies that are publically listed have recently reported December, 2017 sales figures, highlighting how elusive the recovery in sales has been in 2017.

The Taiwanese solar industry supply chain failed to recover lost revenue in 2017, compared to 2016, despite global demand growth.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Pressure on average selling prices (ASP’s) and increased competition from China-based merchant sell and module suppliers as well as the growing shift to monocrystalline wafers left many Taiwan companies coming to terms with weaker demand.

Confronted with a number of negative market dynamics, a group of suppliers announced plans to make a mega merger to cut operating costs, pool financial resources and increase downstream business opportunities in the Taiwan market, which could see significant growth in 2018, offsetting China’s greater dependence on its own supply chain as its domestic market exceeded 50GW of installations and potentially meet and beat that figure again in 2018.

Despite the challenging year, many companies closed the gap on lost sales from 2016, setting the stage for further recovery, not least should the domestic market take-off in 2018.

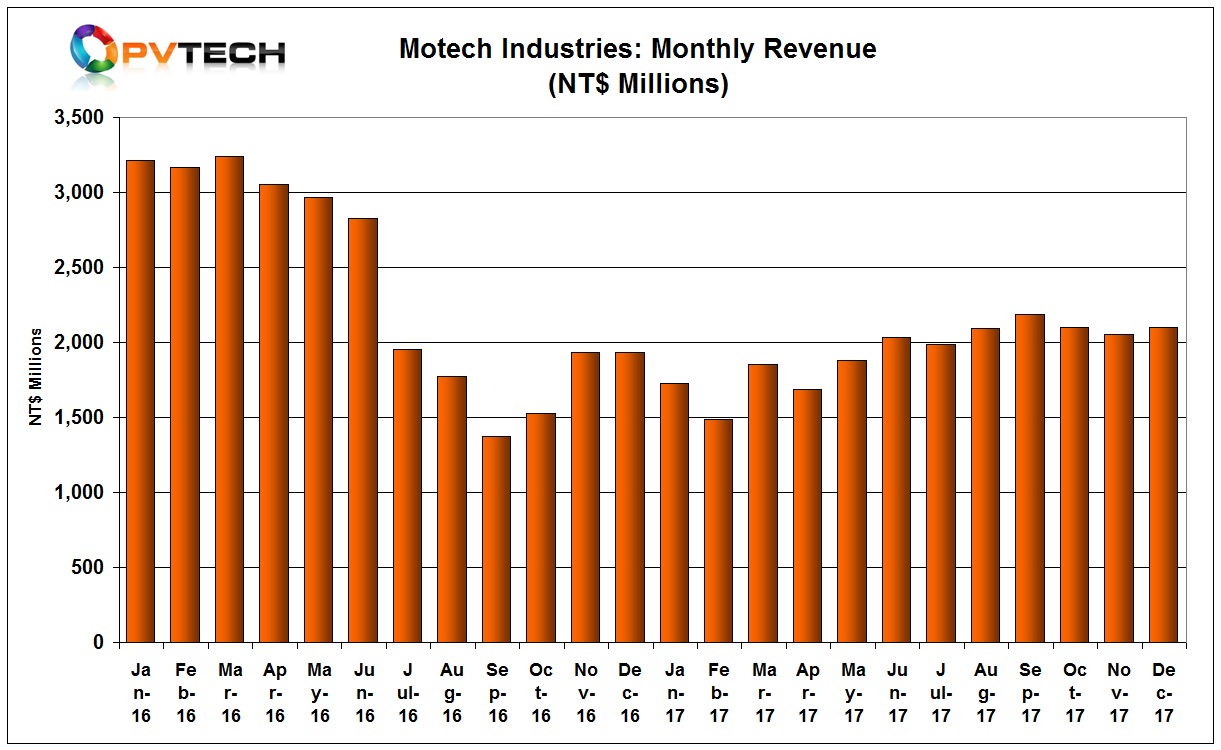

Motech Industries

Leading Taiwanese PV cell and module manufacturer Motech Industries monthly sales peaked in September and have flat-lined just above NT$ 2,000 million through to December.

Motech’s sales in December were NT$2,099 million, up only 2% from the previous month. Sales were almost 22% down year-on-year. The underlying monthly trend was a narrowing of the sales gap with the previous year’s monthly sales.

Motech reported fourth quarter and third quarter sales that were better than in 2016. However, the company experienced a significant gap (almost 50%) in the first half of the year with sales in the prior year. Fourth quarter 2017 sales were around NT$ 6.25 billion, down 0.22% from the third quarter.

Full-year sales were around NT$ 23.189 billion, down 19.94% year-on-year

Motech has also reported in early January, 2018 that it had secured a syndicated bank loan valued at around NT$ 4.8 billion (US$161 million).

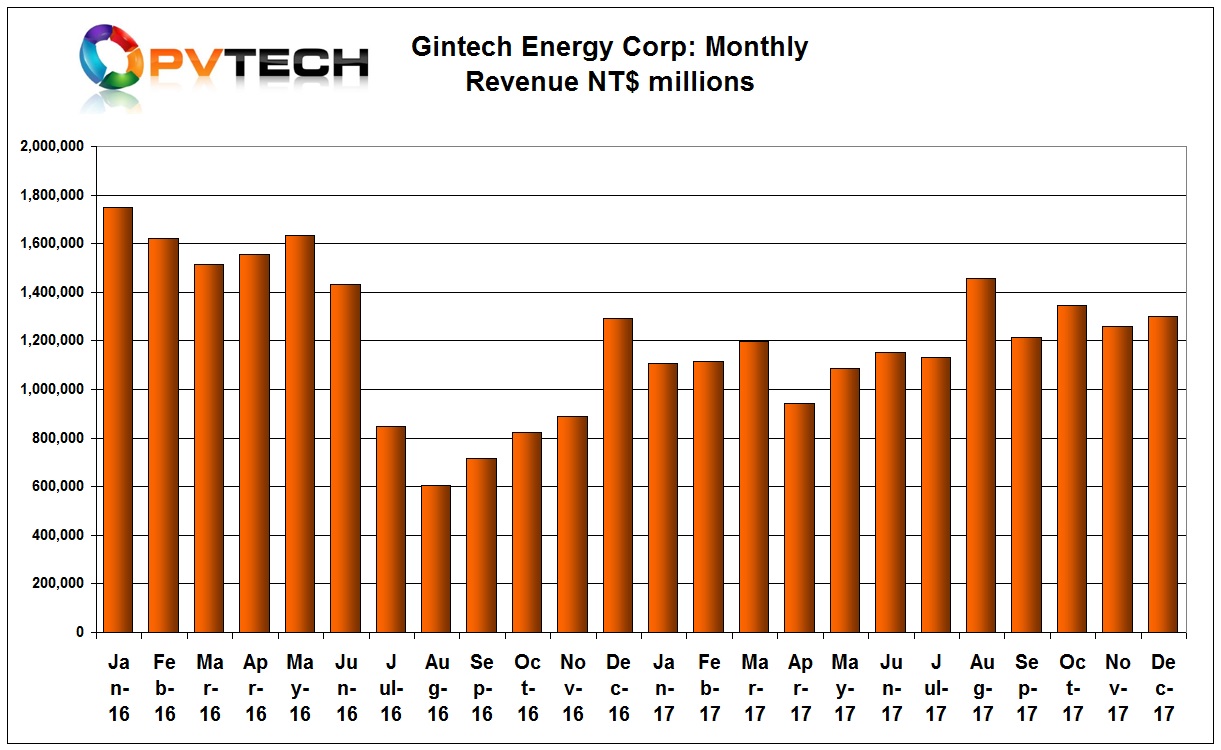

Gintech Energy

Merchant solar cell and module producer Gintech Energy was almost able to maintain sales above the NT$1.3 million level on a monthly basis in the fourth quarter of 2017.

Gintech reported December sales of NT$1,300 million, up 3.1% from the previous month and only 2.5% down from the prior year period. The sequential month sales gap decrease from over a 36% decline year-on-year in January.

Full-year sales were NT$ 14,306,211 million, down 2.55% from the prior year.

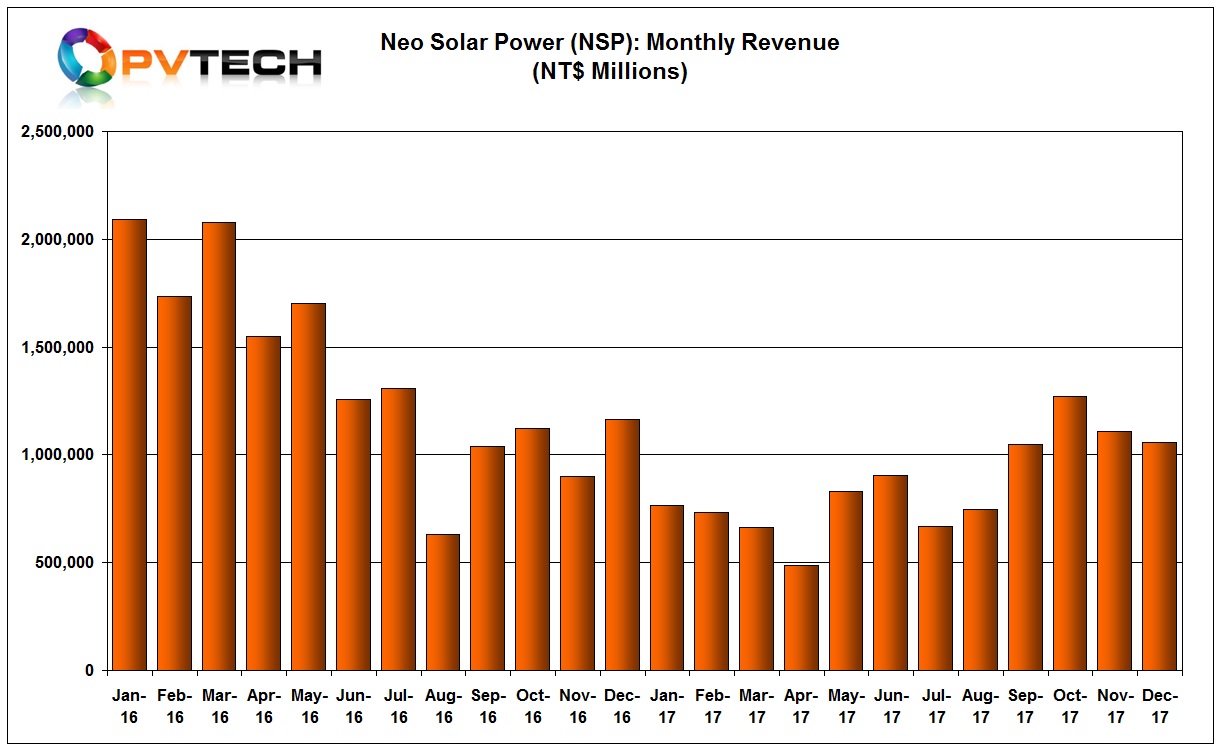

Neo Solar Power

Taiwan-based merchant solar cell and module producer Neo Solar Power (NSP) was able to hold sales above the NT$ 1,000 million mark in the fourth quarter of 2017, a significant improvement over sale in the previous quarters.

NSP reported December sale sales of NT 1,058 million, down 4.71% from the previous month.

NSP’s fourth quarter sales totalled around NT$ 3,441 million, up 39.46% from the prior quarter and up 9.22% from the prior year. However, sales totalled around NT$ 10.289 billion in 2017, down 37.78% year-on-year.

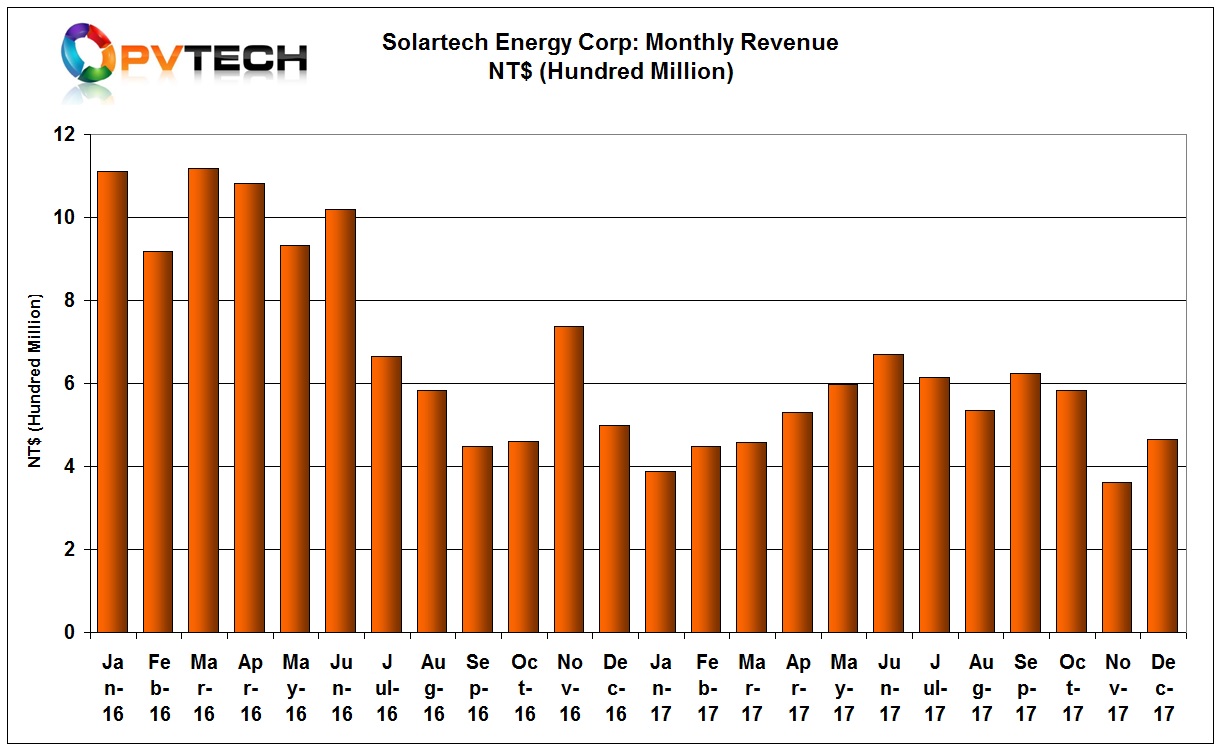

Solartech Energy

Merchant solar cell producer Solartech Energy Corp experienced a rollercoaster sales ride in the fourth quarter of 2017. Sales peaked in June and have fluctuated through the second half of the year.

Solartech reported December sales of NT$ 465 million, up 28.75% from the previous month and down 6.65% from the prior year period. The company cut the monthly sales gap by around 50% by the end of the year but sales were down almost 35% year-on-year.

Full-year sales were around NT$6,282 million.

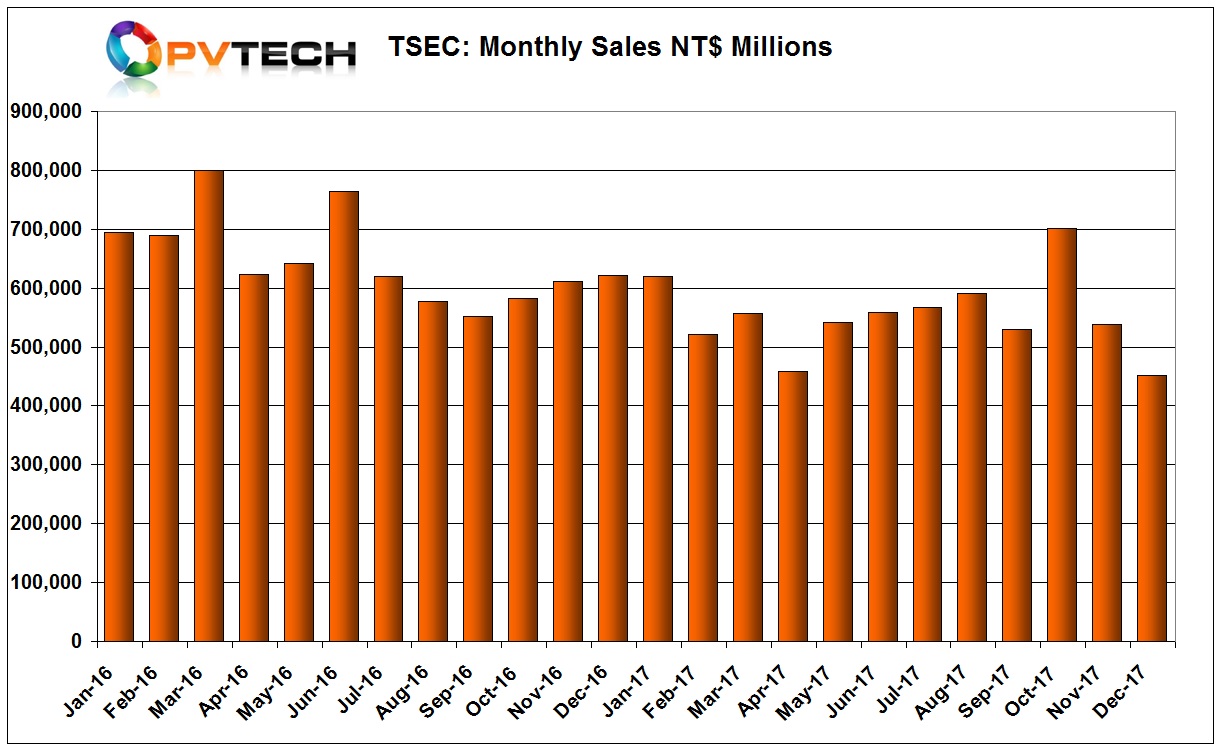

TSEC Corporation

PV cell and module manufacturer TSEC Corporation sales rapidly declined in the fourth quarter of 2017, reaching a year low in December, after peaking in October.

TSEC reported sales of NT$451.1 million in December, down 16% from the previous month. Full year sales were around NT$6,636 million, compared to NT$ 7,747 million in 2016.

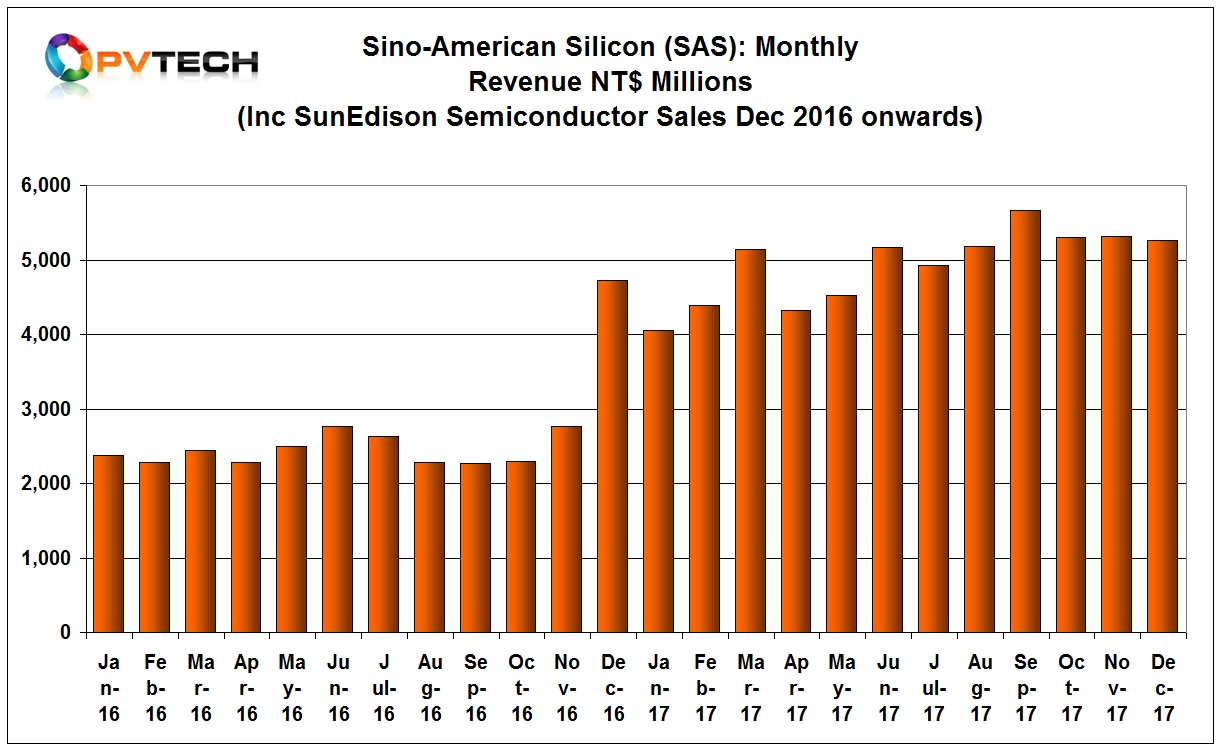

Sino-American Silicon

Integrated PV and wafer manufacturer Sino-American Silicon (SAS) sales remained relatively static above the NT$ 5,000 million mark on a monthly basis in the fourth quarter of 2017, having peaked in September.

SAS sales in December increased just 1% to NT$ 5.268 billion (US$176 million), while fourth quarter sales were around NT $15.892 billion, up over 87% year-on-year, due mainly to acquisitions in 2016, reaching a total of NT$ 59.256 billion.

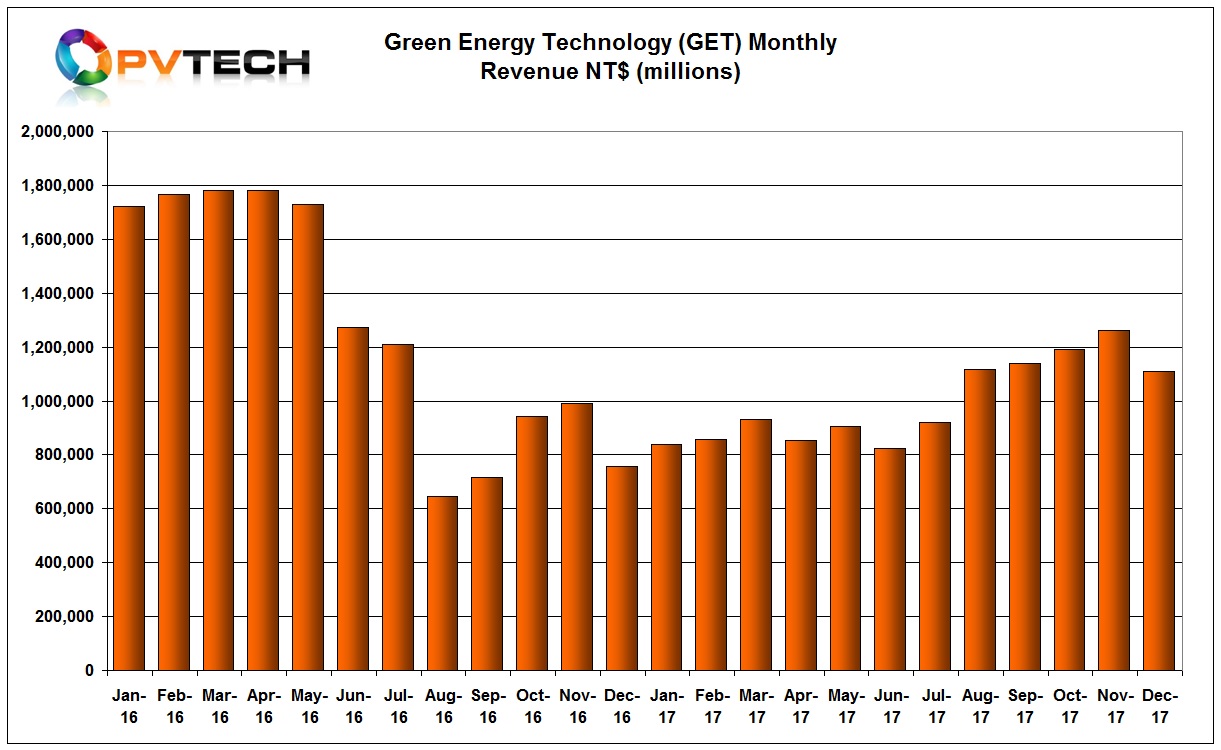

Green Energy Technology

Taiwan-based multicrystalline wafer producer Green Energy Technology (GET) sales peaked in November but reported a stronger second half year than in the prior year period.

GET has sales of NT$ 1,108 million in December, down 12% from the previous month but up 46% year-on-year.

Total sales for 2017 were around NT$ 11,947 million, down 22% from 2016.

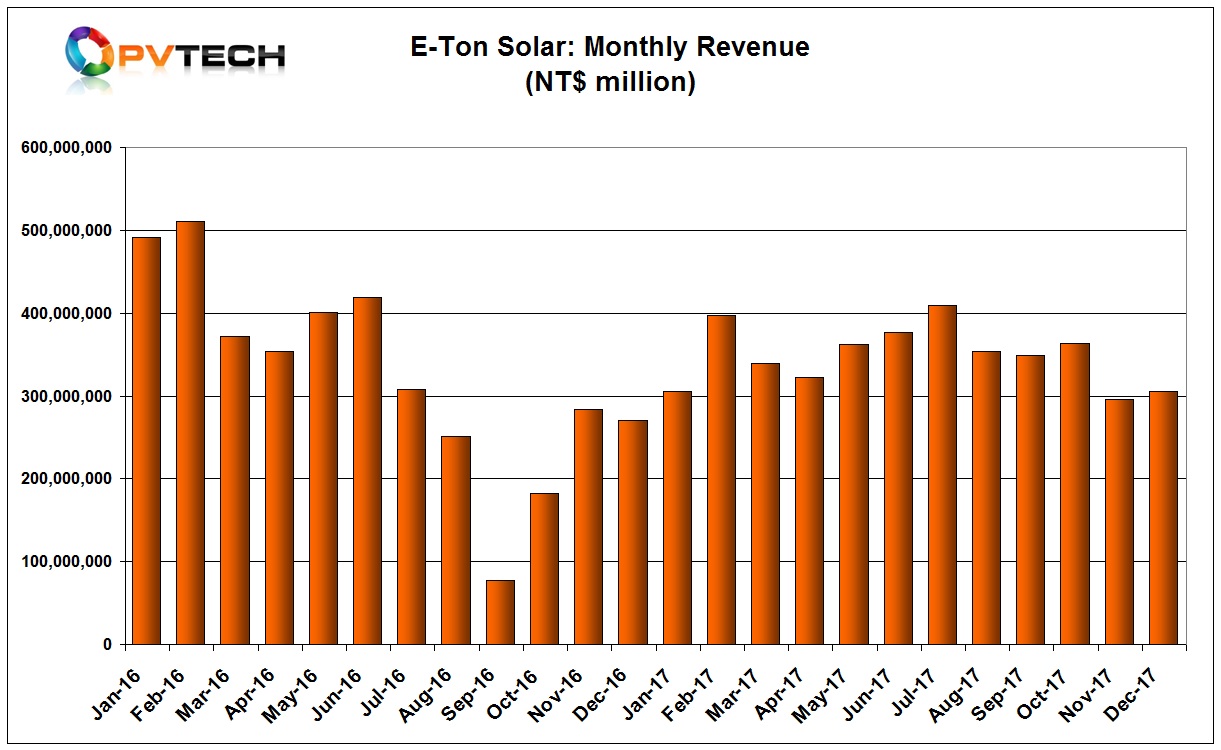

E-Ton Solar Tech

Mono and multicrystalline solar cell producer E-Ton Solar Tech experienced its lowest sales for the year in November and December, 2017. Monthly sales peaked in July and hit a low in November.

E-Ton had sales of NT$ 305 million in December, compared to NT$295 million in the previous month.

Fourth quarter 2017 sales were around NT$ 662.3 million, compared to NT$1,110 million in the previous quarter. Full-year sales were NT$ 4,178 million, up from NT$ 3,920 million in the prior year.

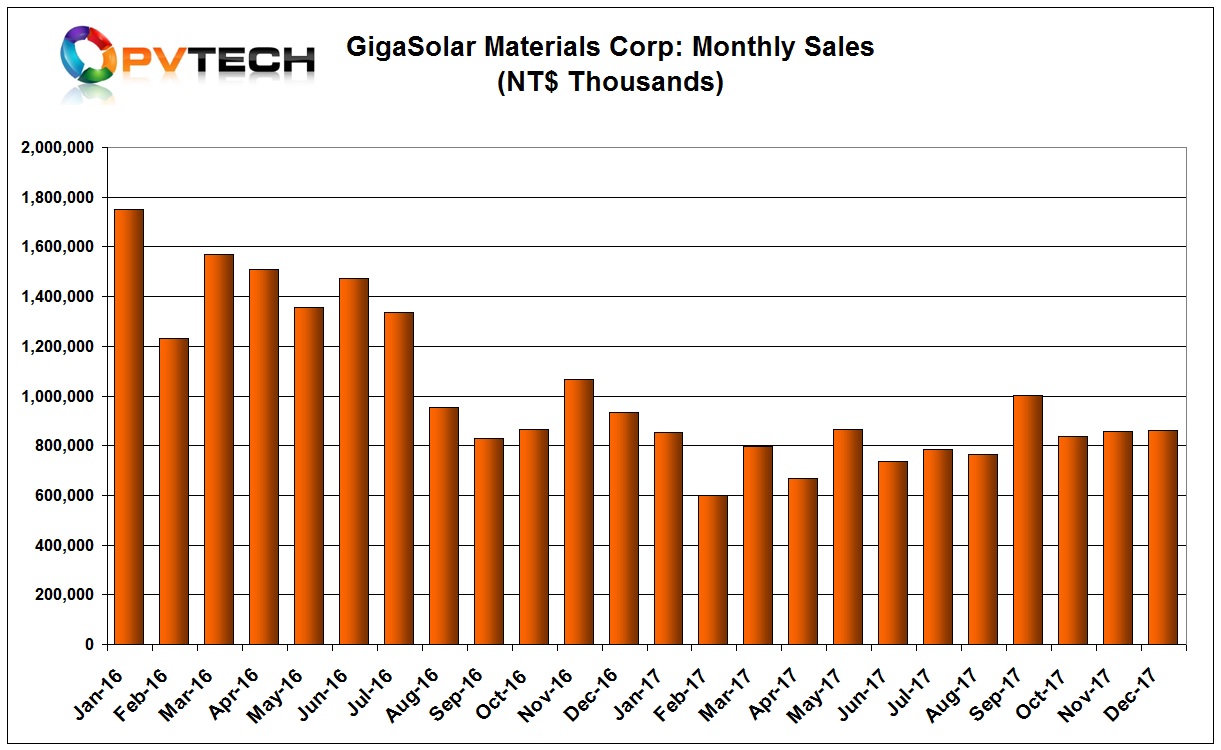

GigaSolar Materials Corporation

Solar cell conductive paste manufacturer GigaSolar Materials Corporation had monthly flat sales in the fourth quarter of 2017, after sales peaked in September.

GigaSolar’s sales in December were NT$ 862 million, compared to NT$ 855 million in the previous month. Fourth quarter sales were the highest for the year and topped NT$ 2,554 million, compared to around NT$ 2,552 million in the previous quarter.

Full year sales were around NT$ 9,624 million, down from NT$14,878 million in 2016, a 35% decline.