More than 20GW of non-hydro capacity is expected to come online in Taiwan by 2030, according to a new report, driven by solar installations and offshore wind.

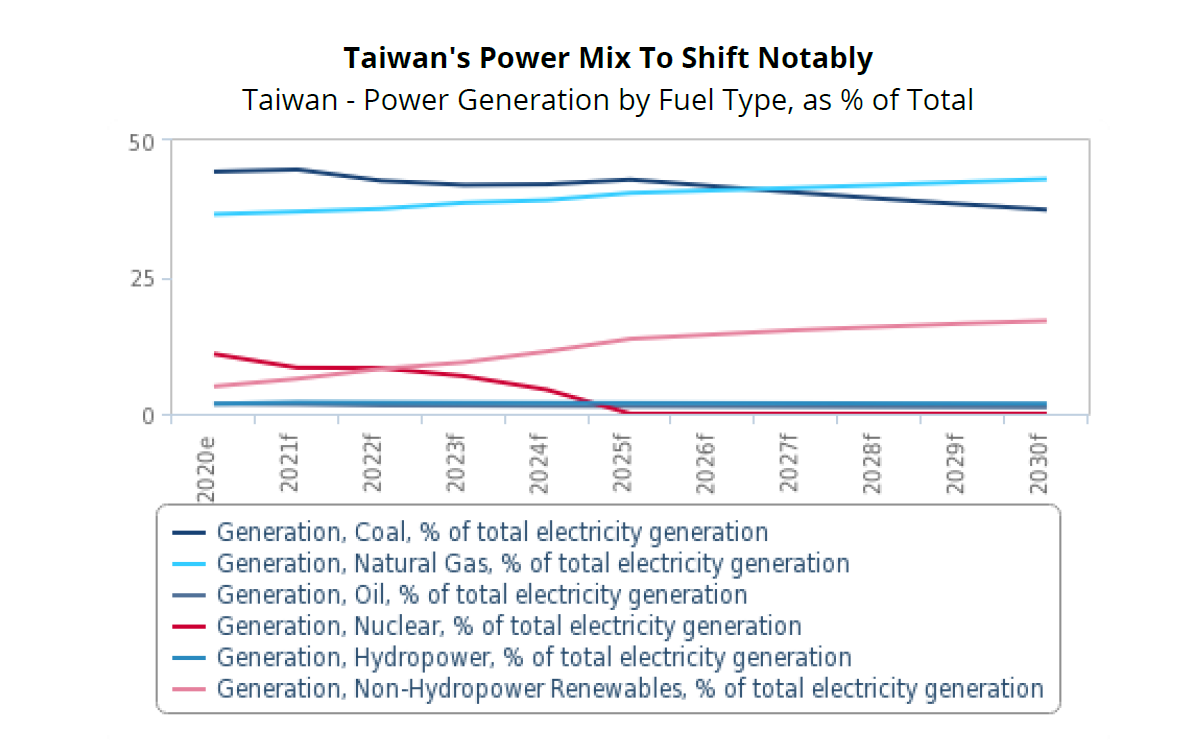

Although it received a sharp shock at the start of last year, the speed of Taiwan’s transition to solar and wind power could still go a long way to mitigating the loss of coal plants, claims a new report from market analyst Fitch Solutions. It predicts that coal power generation in the energy mix will fall from an estimated 44% in 2020 to 37.3% by 2030, but remain a key generation source. At the same time, the country could also host close to 60GW of installed non-hydro renewables capacity by the end of 2030.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Solar developers in the country were forced to extend PV power project completion dates last February as a result of the COVID-19 outbreak in China and subsequent disruption across the continent. Before that, the Taiwanese government had set out installation targets in which solar played a central role. In October 2019, Economic Affairs minister Shen Jong-Chin said the government would aim for 6.5GW of solar by 2020, and 20GW by 2025, although some project managers in Taiwan had already cast doubts on this target before the pandemic hit, citing scarcity of land on the densely-populated island and low power prices as key obstacles.

The report from predicts that Taiwan will see an additional 20.4GW of combined non-hydro renewables capacity installed within the next decade. This, analysts said, would be “driven primarily by solar and offshore wind.”

Fitch claims that the supply-chain disruption of last year will “abate in the longer term” due to continued investor interest in the renewables sector across most markets. A report published by BloombergNEF earlier this month revealed that clean energy initiatives attracted just over US$500 billion last year, with the majority (US$303.5 billion) earmarked for renewable energy capacity, despite COVID-19’s global impact. Although a nascent market in within Asia, Taiwanese clean energy initiatives received US$6 billion of investment into energy transition initiatives, a spokesperson told PV Tech. Roughly US$2.3 billion of this was in solar capacity.

The government has targeted a 25% renewables energy supply by 2025, with 27% coal by 2025. Fitch’s report predicts that ministers will seek to “accelerate” the clean energy goals over the next few years.

In addition, Fitch’s analysts expect the country’s nuclear phase-out to continue despite some calls for plant projects to be restarted. A referendum is to be held in August this year over the dormant Lungmen Nuclear Power Plant project, but the report claims it would not come online until at least 2030 even if restarting its construction was given the go-ahead. A further four nuclear plants are expected to be shut down by 2024, totalling 2,921MW of nuclear capacity taken from the grid. However, the report suggests that non-hydro renewables installations could substantially offset the loss of nuclear and coal.

“President Tsai Ing-wen has announced a new aim to develop Taiwan into a regional renewable energy hub, and to become a global player in the renewable space,” the report notes, adding that stronger legal frameworks are being developed alongside simpler investment procedures and mechanisms for renewable energy.

“Strong government support has already translated into robust investor interests and the project pipeline has strengthened accordingly, particularly for offshore wind, which support our bullish capacity growth forecasts over the coming decade.”