The Australian government and the renewables sector in the country have been ramping up its energy transition efforts. Although a lot of new policies and projects were announced in recent years, experts said more has to be done to address labour shortages, skills gaps and reliance on fossil fuels.

The Federal Budget 2023-2024

In May, the Australian government issued the Federal Budget 2023-2024, which included AU$4 billion (US$2.71 billion) of new investment in the energy transition, and confirmation of tenders for renewables and energy storage. Of the new investment, AU$2 billion was directed to industries within or supporting the renewables sector, including augmenting existing Australian Labor Party-led frameworks such as Powering Australia, Rewiring the Nation, and the National Reconstruction Fund.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“We believe that this will bolster the market’s already strong growth of non-hydropower renewables in the power sector,” said Fitch solutions’ BMI Industry Research, adding that the strong domestic support for renewables will create increasingly attractive opportunities for investors in Australia’s non-hydropower renewables sector, which is expected to lead to greater development activity.

In the budget, the Australian government also announced that AU$1.3 billion had been assigned for household energy upgrades to improve energy efficiency, of which AU$1 billion will help provide low‑cost loans for double‑glazing, solar modules and other improvements to make homes easier and cheaper to keep cool in summer and warm in winter.

Australia’s renewable energy association Clean Energy Council (CEC) said in its pre-budget submission that the Australian government should proportionally respond to the US’ Inflation Reduction Act (IRA) specific to large-scale wind and solar projects, including the extension of production tax credits for solar farms that begin construction by 1 January 2025.

Australia’s solar PV market

In 2022, the renewable energy industry accounted for 35.9% of Australia’s total electricity generation, up from 32.5% in 2021, according to CEC’s Clean Energy Australia Report 2023.

Rooftop solar’s contribution in total electricity generation was as high as 9.3%. By combining larger-scale (5%) and medium-scale (0.4%) solar projects, solar PV accounted for 14.7% of electricity generation in Australia last year.

This proportion meant that rooftop solar played an important role in Australia’s energy transition as 2.7GW of capacity was added last year. Although the figure was down from 3.3GW in 2021, rooftop solar still represented the highest contribution (25.8%) in Australia’s renewables sector last year.

Medium-scale solar systems between 100kW and 5MW and large-scale solar projects with a capacity of more than 5MW accounted for 1.2% and 14% of renewable electricity generation respectively. Therefore, solar PV projects, regardless of their scale, accounted for 41% of renewable generation in 2022, followed by wind (35.6%), hydro (19.7), and bioenergy (3.8%).

Last year, the total capacity of medium-scale solar projects was 674MW, up from 646MW in 2021.

There were 12 large-scale solar projects commissioned in 2022 with a cumulative capacity of about 840MW, including the Suntop Solar Farm (150MW) in New South Wales and the Blue Grass Solar Farm in Queensland (148MW) owned by X-Elio, down from 19 projects and 1249MW in 2021 respectively.

As of December 2022, 48 large-scale solar plants were under construction, including the Western Downs Green Power Hub in Queensland which had received approval to export up to 300MW to the state’s grid. After completion, the facility’s final capacity could reach 400MW.

Another notable project under construction is the first stage of the New England Solar Farm in New South Wales. Boasting a capacity of 400MW, this phase is only part of the 720MW project.

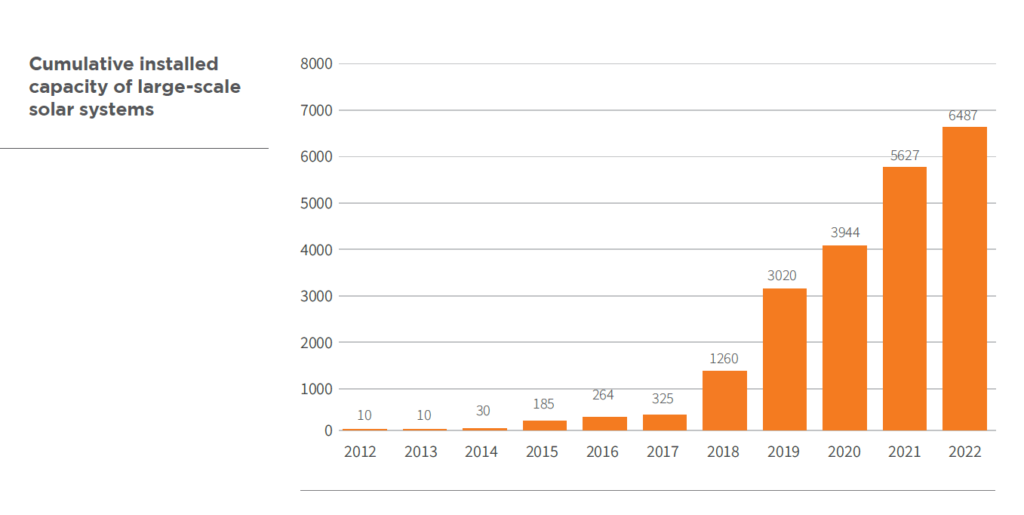

As of 2022, Australia’s cumulative large-scale installed capacity stood at 6,487MW, increasing from 5,627MW in 2021.

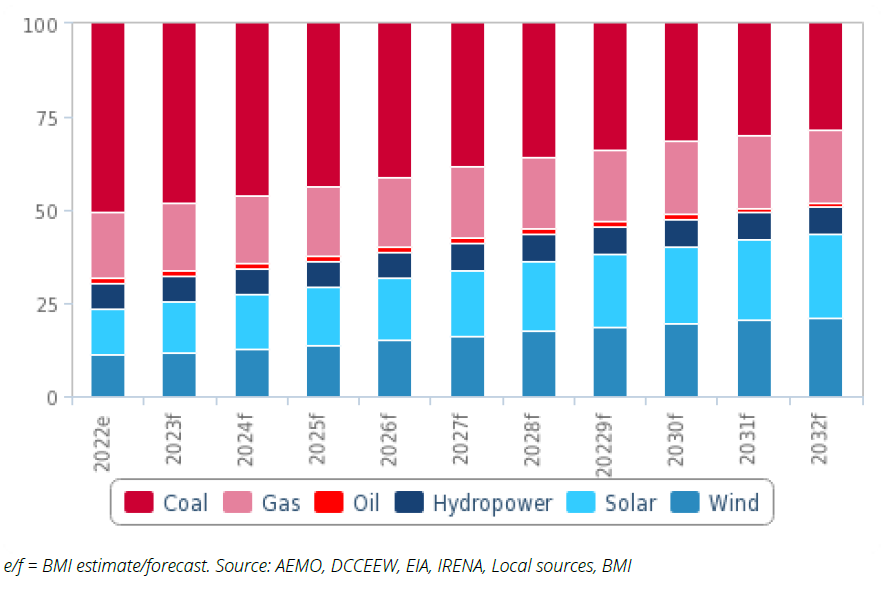

Despite Australia’s effort to increase its renewables capacity, Australia’s dependence on coal-fired power generation will remain over the next 10 years. In 2022, coal-fired power generation accounted for about a 50% share of the power mix. BMI Industry Research said as power companies announced plans to phase out coal power plants, coal-fired power generation’s share of the generation mix will drop to slightly under 30% by 2032.

In 2023, renewables including solar, wind and hydropower accounted for about 30% of Australia’s electricity generation. As the importance of coal will drop significantly and the rising importance of renewables, the combination of hydropower, solar and wind will contribute to half of Australia’s electricity generation.

Queensland’s renewable energy targets

Apart from the Australian government’s budget, Queensland also set multiple renewable energy targets, including bringing 22GW of new solar and wind projects by 2035. More precisely, it will legislate renewable energy targets: 50% by 2030, 70% by 2032, and 80% by 2035. More than AU$62 billion of investment will be injected, at least 95% in regional Queensland.

However, data from CEC showed that the proportion of renewable energy (22.6%) in total power generation in Queensland last year was far behind the other five Australian states. Tasmania topped the list as 99.1% of power was generated by renewables, followed by South Australia (71.5%), Victoria (36.8%), Western Australia (35.2%), and New South Wales (30.7%).

Arron Wood, chief policy and impact officer of CEC, commented: “This plan will give certainty to workers, communities, and investors, which will unlock an enormous amount of investment and job creation in renewable energy and energy storage, particularly into regional Queensland, which will benefit from 95% of investment dollars.”

Looking ahead, as Australia will continue its plan of energy transition, Wood said there were some issues that may hamper the growth in renewables.

“While the growth in renewables projects remained solid in Q1 2023, it is concerning that this has been overshadowed by a fall in new financial commitments and investment in the same period, owing to the need for greater certainty in the policy landscape.”

Grid congestion could also affect investors’ confidence in renewables projects due to the risks of curtailment and diminished returns on investment. In response to this problem, CEC suggested that a congestion relief market could be established, as well as the accelerated development of transmission upgrades across Australia.

Wood also called for enhanced collaborations among the government, the clean energy industry and other sectors to address labour shortages and skills gaps, adding that the skilled workforce will need to double over the next five to seven years.