As solar projects become ever larger, sites with slopes and uneven terrain are becoming the norm for project development, leading tracker manufacturers to adapt their offerings accordingly. Molly Lempriere details the latest launches that aim to address this issue.

Around the world, solar developments are getting bigger and bigger, making site selection more challenging. As such, perfect postage stamp sites with grid connections in many areas are seemingly a thing of the past.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, technology is stepping up to open up sites that wouldn’t have previously been possible, or would have been prohibitively expensive. Core to this has been the launch of terrain-following trackers, allowing solar developments on uneven terrain and steeper gradients.

“As we mature as an industry and get larger and larger projects, the land available is actually a lot worse than it was even four or five years ago,” says Nick Price, director, global sales engineering at Nextracker, but by changing from a fixed-tilt tracker to a terrain-following alternative, it can make sites that weren’t feasible or economical “pencil out”.

New products on the market

Nextracker launched its NX Horizon-XTR terrain-following single-axis tracker last March. Like many of these new tracker technologies, it came about through collaboration with engineering, procurement and construction companies (EPCs), with the view of making new sites economically viable for development.

For Nextracker, one of the early EPC adopters of the XTR was SOLV Energy, which is responsible for a number of the operational sites using the technology so far.

“NX Horizon-XTR’s ability to follow terrain can significantly reduce earthwork, allowing these otherwise-infeasible sites to become economically and environmentally viable solar projects. Less earthwork means lower upfront costs and improved scheduling,” said VP of engineering, Donny Gallagher of SOLV Energy.

Amongst the companies to have now launched terrain-following trackers is Array Technologies. The company launched its OmniTrack product at the RE+ conference in Anaheim, California, in September, which is forecast to reduce the amount of site grading work required by up to 98%.

“I can tell you from our developer customers in particular, who are constantly looking at opportunities for permitting new land, they are incredibly excited about what this does open up for them, particularly in places where maybe land is either at a premium or it just isn’t as readily available anymore,” says Erica Brinker, CCO, Array.

“The market reception has been huge. Just because you’re going to have to do very little to choose a piece of land that otherwise ten years ago, you wouldn’t have even looked at. So definitely, definitely a big opportunity, not just for Array, but really for the solar industry in general.”

Also on display in California, was new kid on the block Sunfolding’s TopoTrack product. Using AirLink technology, it can reduce earthwork by 97%, according to the company.

“The TopoTracker is actually a very special configuration of our innovative core technology, which is the T 29 Tracker,” says Rahul Chandra, Sunfolding’s VP product.

“So we use compressed air to point the modules towards the sun … [our actuator] has two bladders on either side of it. In whichever side we want the module to point towards, we compress that side, we blow it up full of air, or we use the other side. That’s how we do the controls algorithm.”

Terrain-following trackers are gaining a lot of attention currently, but what are the main benefits of the technology?

Easing the permitting process

The biggest benefit to terrain-following trackers is the dramatic reduction in grading needed to make site development feasible. Levelling out the ground to create a flat enough surface for conventional solar farms comes with a range of challenges, and can add a considerable cost.

“There are some things you cannot out-engineer, and in my experience well-established topsoil is one of them,” says Nick de Vries, SVP technology and asset management at US independent power producer Silicon Ranch, which uses Nextracker’s XTR.

“Deploying traditional trackers on sites with varied terrain has required extra earthwork and longer foundation piles, which increases project costs and adds risk. Earthwork is especially painful as it affects a solar project three times: first performing grading, next reseeding the exposed dirt and later fixing the inevitable erosion and hydrology issues that come from the lack of well-vegetated topsoil.”

Even before work begins, being able to prove there will be a limited amount of grading can ease the permitting process for projects. In the US, the siting and permitting process can take more than three to five years to complete, according to trade body the Solar Energy Industries Association. Using terrain-following technologies to reduce the need for grading can help avoid potential challenges within this process by removing some of the environmental risk.

The goal of a tracker should be to allow a solar farm to be developed as organically on a site as possible, explains Chandra. This includes disturbing the land underneath as little as possible.

“When you think about project risk, that’s one of the biggest risk milestones early on in a project because it’s an open-ended timeline, right? How long it’ll take for you to get permitting. And if you don’t rearrange the underlying land, then your permitting requirements become that much easier.

“In Minnesota, for example, if you disturb an acre of land or more for your project, you automatically need to file a bunch of extra stormwater permits. And so you think about all of these additional requirements that come into place, just because you’re doing a ton of this grading.”

As well as minimising the time required to gain a permit, it can also make securing a permit on a site with additional challenges more likely. For example, Nextracker’s XTR has been used at Melbourne Water’s 9.54MWdc Winneke Solar Farm in Australia.

“The specific challenge of that site was that because of the cultural heritage of that site, there was no grading allowed, so you couldn’t do any earthwork,” explains Price.

“But actually, originally that site was pegged to go fixed tilt. And so that’s one of the things we’re seeing more and more is on these really challenging sites, people are looking at fixed tilt, but then you’re losing 20-30% production by going to a fixed-tilt system. So by having the XTR system, we really changed the game on that particular site.”

Reducing weight to reduce labour

Once a planning permit has been secured for a site, terrain-following trackers can also reduce the work required for installation. For example, Sunfolding’s technology, thanks to its air drive system, is significantly lighter than traditional fixed-tilt trackers.

“Every penny that you could save, on installation costs, upfront capex, operating costs, permitting costs, all of that matters,” says Chandra.

“So the other benefits of this technology is the simplicity of this design. Our actuator is so light, it’s actually designed to be easily installed, it weighs somewhere in the neighbourhood of 40 to 50 pounds, which means two individuals can easily pick it up and put it on top of a post, not something you can do with these traditional trackers. And then that means how posts are so much lighter.”

This is particularly advantageous given the risks of driving piles into the ground, reducing the health and safety considerations within this. They also do not need to be driven as deep because they are lighter, needing to be driven around four feet into the ground as opposed to six or seven for traditional, heavier trackers.

By reducing the weight and therefore the depth of the piles, the trackers can be fitted faster than alternatives. This reduces the number of manhours needed to develop a site, helping to tackle challenges around labour shortages as well as reduce costs.

The final core benefit of using terrain tracking technology is the reduction in the environmental impact through reducing grading. This makes reseeding easier, but also decreases the likelihood of flooding at the site, as disturbances to the soil can affect soil moisture and nutrient distributions.

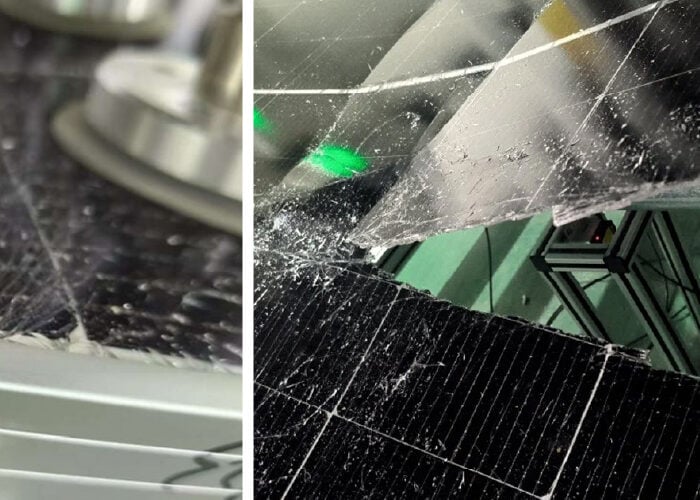

“So a lot of times during the construction phase, when they’re moving all this topsoil around you have the worst flooding on a site, worse than the 100-year flood because once you move that topsoil, you have nothing to absorb that rain. So when you have rains come through, it’s a mess out there. So just having a cleaner site like this is another side benefit as well,” says Price.

How much land does this open up?

The development of terrain-following trackers could potentially open up a huge number of sites that were previously unsuitable for solar due to being too undulating or steep. Part of this is making those that were previously too cost prohibitive to develop due to the large amount of grading required, possible.

“Really, it depends on the economics and PPA rates and things like that to do a full-scale analysis of whether this can make sense or not,” says Price.

“But when you’re going out and saying, ‘Oh, I’m gonna spend 10 cents a watt on grading’, that could change whether the project is viable or not. You cut that in half with XTR, five cents on a utility-scale project – that’s massive numbers.”

Already the company has seen projects that wouldn’t have been built otherwise, or would have taken years in design to ensure that the land available can be efficiently used. Using terrain-following technology can therefore speed up the development process, easing the financial considerations.

How much land this can open up in many ways remains to be seen, and will vary dramatically from region to region depending on the terrain and the maturity of the sector.

“We’re still in the learning phase. I know our pipeline shows that the US is very, very much headed towards challenging terrain, we’re seeing close to 85% of that pipeline look like it’s challenging terrain. And that’s a pretty hefty number,” says Chandra.

“What we’re more concerned with is how many projects are being discarded early on without having conversations with trackers and module suppliers to even just say, is this feasible or not. They’re just being discounted because the internal estimation models sort of show that it’s too cost prohibitive.

“What we’re trying to do now is have conversations with developers without any project in mind, let’s go to as early in the project lifecycle as possible to say, ‘Let’s have a conversation about this particular project, or what we can offer in terms of value and think about projects that you haven’t been able to take forward.’ So we’re very interested, while it’s harder to point to a specific number.”

Ultimately, it seems clear that terrain-following trackers will become a bigger segment of the market in the coming years, as solar developers look to more innovative solutions as the land available continues to become increasingly constrained. Companies will need to balance the additional cost of such trackers with the cost-savings they offer, to ensure the most efficient development with the smallest impact on the ground.