As 2023 comes to an end, PV Tech is reviewing the year in solar, reflecting on some of the biggest stories and trends of the last 12 months. In the third quarter of 2023, the European solar manufacturing industry demanded actions to address the influx of Chinese modules, although the EU increased its solar capacity targets. Meanwhile in the US, many solar companies and manufacturers announced manufacturing capacity expansion.

European solar manufacturing companies demand safeguarding the industry

One of the major issues in this year’s European solar manufacturing industry, particularly in Q3, was the threat posed by “unsustainably low-priced PV modules” from Chinese module manufacturers.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In response to this issue, multiple European cell and module manufacturers, start-ups and solar PV component suppliers published an open letter to the EU via the European Solar Manufacturing Council (ESMC). The signatories of the open letter said the prices of PV modules had dropped by over 35% to €0.15 (US$0.16) per watt, but these companies had a “limited chance for selling the production in such circumstances”.

The open letter also claimed that Chinese solar companies had adopted a “dumping stance” in the European market, offering European customers a series of two-year contracts with the price of €0.15 per watt. However, Chinese companies’ estimated production costs were about €0.2 per watt based on declared numbers.

As a result, European PV module production plummeted from 9GW in 2022 to about 1GW in 2023.

Moreover, the ESMC published another open letter in September, urging European legislators to adopt legislation that prohibits the sale of products made with forced labour particularly in Xinjiang, China, in addition to recommendations for its members to address forced labour in the supply chain.

Weeks later, a draft regulation banning products with forced labour in their supply chains from entering the EU was adopted by the EU Internal Market and International Trade Committees.

The proposed regulation would introduce a framework for investigating companies’ supply chains for the use of forced labour and would ban the import and export of any goods found to have been produced by such practices. Any goods already within the European market would also have to be withdrawn, to be donated, recycled or destroyed.

In July, research firm Rystad Energy announced that over 40GW of Chinese-made solar modules were in storage across Europe with a cumulative value of around €7 billion.

Rystad’s data also showed that roughly 87GW of modules were imported from China last year, a 112% increase on 2021, leaving over 40GW unaccounted for as Europe installed 41.4GW of solar PV in 2022, representing a 47% increase on the previous year, according to SolarPower Europe.

EU’s revised solar capacity target

As Europe is adding more solar capacity, the European Union (EU) announced that it is targeting an extra 90GW of installed solar capacity by 2030, reaching 425GW.

Lithuania significantly increased its target by more than 500% in its revised NECP to 5.1GW by 2030. Finland (133.3%), Portugal (126.7%), Slovenia (105.9%), and Sweden (117.9) also increased their targets by more than 100%.

In September, the European Parliament voted to accelerate the adoption of renewable power generation on the continent, aiming for renewables to meet 42.5% of the region’s energy needs by 2030, and calling on EU member states to meet 45% of their energy demand with clean power.

As part of the new legislation, the process by which countries can grant permits for new renewable power plants will be sped up, with national authorities encouraged to approve new clean power projects within one year.

One year anniversary of IRA and expansion plans in the US

The Inflation Reduction Act (IRA) passed into law in August 2022. 2024 has been earmarked to be the year when its effects begin to be fully felt in the solar PV industry. Project deployments and, in particular, manufacturing announcements have already significantly increased.

PV Tech Premium ran a piece about the anniversary of the IRA in August, bringing together some opinions and thoughts from industry experts.

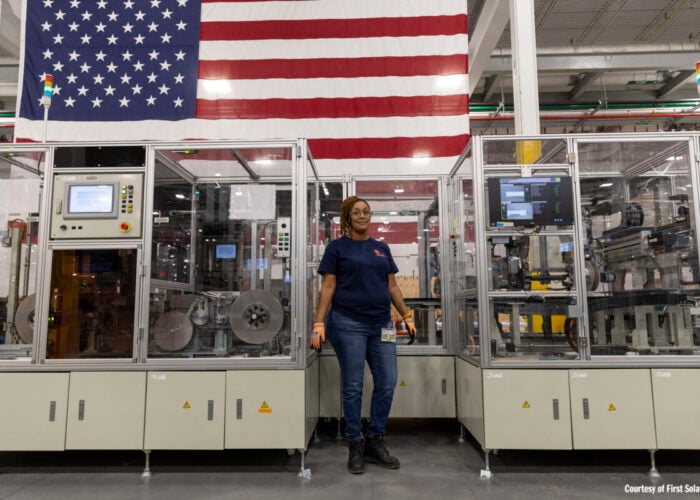

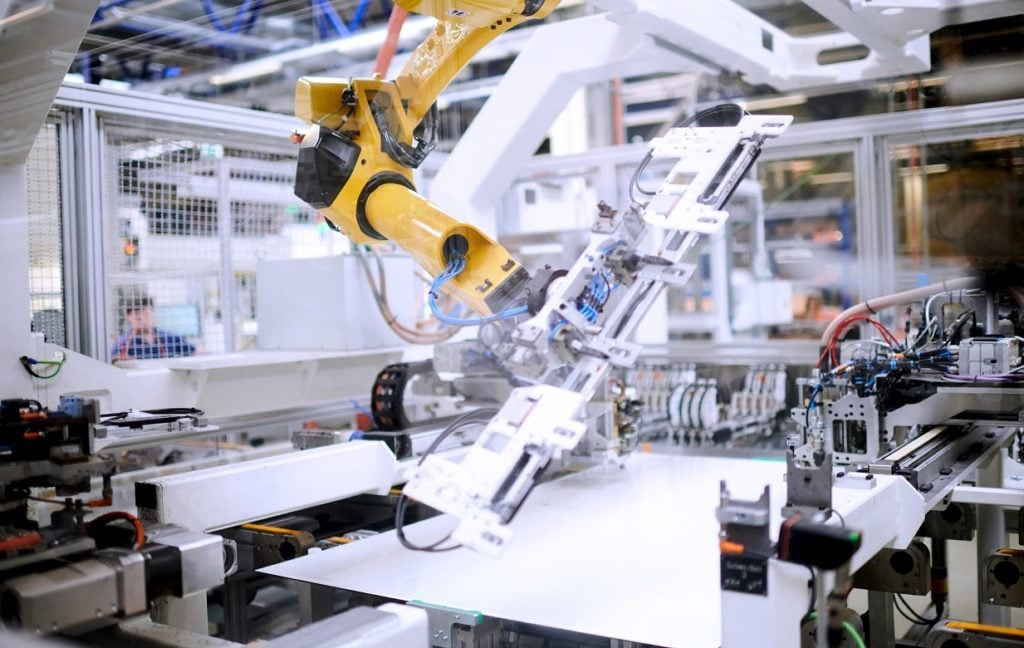

In Q3, plenty of manufacturing announcements were made. For example, thin-film solar PV manufacturer First Solar announced the opening of its fifth US manufacturing facility in Louisiana. The 3.5GW, US$1.1 billion dollar Cadmium Telluride (CdTe) module production factory is expected to be online and producing First Solar’s Series 7 modules in the first half of 2026.

Solar module super league (SMSL) member Trina Solar also planned to build a new module manufacturing facility in the US state of Texas, with a production capacity of 5GW and an investment of US$200 million. Module assembly is expected to be in 2024.

Switzerland-headquartered module manufacturer Meyer Burger also planned to build a solar cell plant in Colorado, the US, with an initial annual capacity of 2GW.

The plant in Colorado will exclusively supply its cell capacity to the company’s US module assembly plant in Goodyear, Arizona which will have its annual capacity increased to 2GW after securing several heterojunction technology (HJT) supply agreements.

Production of the plant is planned to start in Q4 2024. Meyer Burger planned to utilise the benefits of the Advanced Manufacturing Tax Credit 45X, part of the IRA, for solar cell and module manufacturing, which corresponds to a cumulated eligible sum of up to US$1.4 billion to be monetised from the start of production in 2024 until the end of 2032.