Updated: ‘Silicon Module Super League’ (SMSL) member Trina Solar has significantly missed its third quarter 2016 PV module shipment guidance range that makes meeting previous full-year shipment projections almost unattainable.

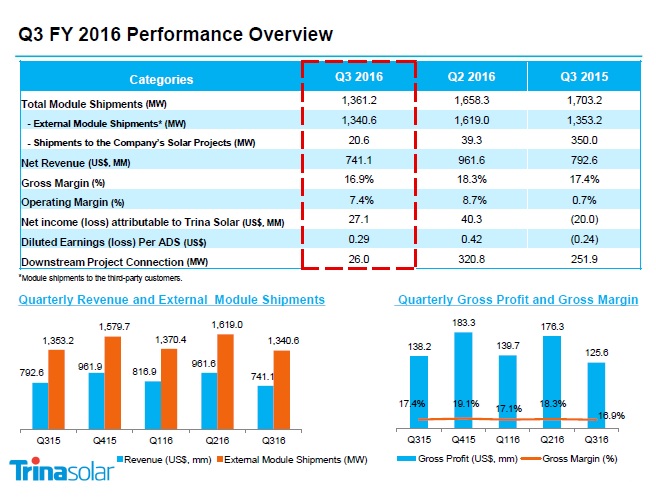

Trina Solar reported third quarter 2016 total PV module shipments of 1,361.2 MW, consisting of 1,340.6MW of external shipments which were recognized in revenue compared to guidance of total shipments of 1,550MW to 1,650MW, of which 30MW to 50MW of PV modules would be shipped to its downstream PV power plant project business. The company shipped 20.6MW to its downstream power projects in the quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The shipment miss at the low-end of guidance was 189MW and 289MW at the high-end of guidance.

Trina Solar claimed the decrease of shipments was primarily due to the signficiant slowdown in demand in China after the subsidy policy adjustments at the end of June, 2016.

Jifan Gao, Chairman and CEO of Trina Solar stated: “Largely as expected, we had a slowdown in the third quarter as a result of an oversupply and increasing inventory levels of modules in the market, as well as weak demand in China following a strong first half of the year as developers rushed to place orders prior to a subsidy policy adjustment. As a result, our total shipments of 1.36 GW came in lower than the bottom end of our guidance.”

The significant miss in shipments could be attributed to the company not accepting ultra-low module price offers in the quarter, something SMSL rival Canadian Solar adopted in the quarter.

Trina Solar’s Gao had said in the company’s second quarter earnings call that due to the weakness in demand in China at the end of the quarter, overcapacity fears and ASP declines the company would, “remain flexible in executing our operational strategy and focus more on strengthening our financial management.”

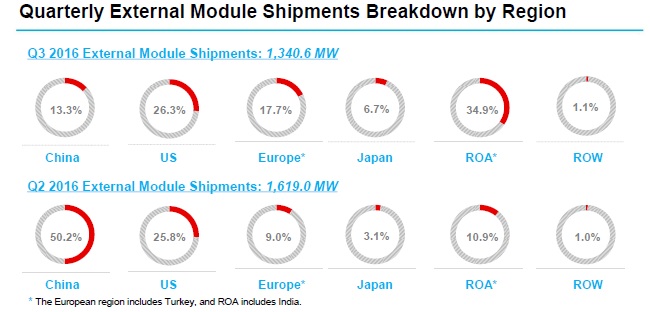

However, the company claimed that it had maintained its leading market position in the US in the quarter and achieve record shipments to Europe, while stating that nearly 30% of shipments in the quarter went to India.

Shipments to India therefore reached a new record quarterly high of 376.MW, with cumulative shipments surpassing 1.5GW.

US shipments in the third quarter were 352MW, down from 418MW in the previous quarter and down from 550MW in the first quarter of 2016.

Trina Solar has shipped a total of 1,320MW of modules to the US in the first nine months of 2016, while SMSL rival JinkoSolar has shipped a total of 1,661MW in the same period.

Module shipments to Europe reached 237MW, up 63.5% sequentially and 280.8% year-over-year.

The big difference was China, which had accounted for 50.2% of shipments in the second quarter but only 13.3% of shipments in the third quarter. This equated to only 178.2MW, compared to 812.7MW in the second quarter of 2016.

Also of significance is the fact the company has provided fourth quarter and possibly revised full-year shipment guidance in releasing third quarter results. Trina Solar had recently said it would not be holding an earnings call for its third quarter financial results, citing the impending privatisation plans.

Trina Solar had previously reiterated full-year shipments to be in the range of 6.3 GW to 6.55GW.

However, the third quarter miss would require shipments of at least 1,858MW in the fourth quarter to meet the low-end of guidance. The company had achieved record shipments of 1,776.3MW in the fourth quarter of 2015.

Financials

With the major shipment miss, Trina Solar reported third quarter revenue of US$741.1 million, which included US$60.6 million in revenues from electricity generated by its downstream solar power business and connected operations. Total net revenues in the second quarter of 2016, were US$961.6 million, a 22.9% decline from the previous quarter.

Gross profit was US$125.6 million, compared with US$176.3 million in the second quarter of 2016. Gross margin was 16.9%, compared with 18.3% in the second quarter of 2016 and 17.4% in the third quarter of 2015.

Trina Solar said that the sequential and year-over-year decreases in gross margin were mainly due to module ASP declines that occurred at a faster rate than the reduction in manufacturing costs in the quarter.

Operating income was US$54.9 million, compared with US$83.7 million in the second quarter of 2016.

Trina Solar said that the sequential and year-over-year decreases in gross margin were mainly due to module ASP declines that occurred at a faster rate than the reduction in manufacturing costs in the quarter.

Manufacturing update

Trina Solar did not report any quarterly increase in annualized in-house manufacturing capacities in the third quarter of 2016. Therefore silicon ingot production capacity remained at 2.3GW and wafer capacity at 1.8GW. Solar cell capacity remained at around 5GW and module assembly capacity stood at 6GW.

PV projects update

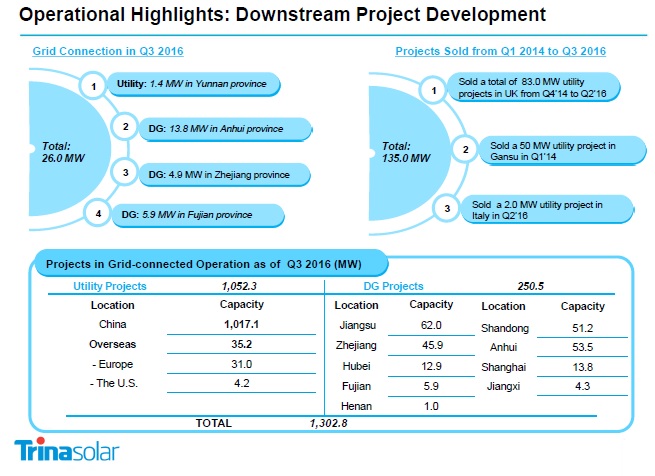

Trina Solar reported that it had connected a total of 26MW of PV projects to the grid in China in the third quarter, including 1.4MW of utility projects and 24.6MW of DG projects.

Cumulative downstream solar projects in grid-connected operation totalled 1,302.8MW, which included 1,267.6MW in China, 4.2MW in the US and 31MW in Europe. The 1,267.6MW of projects in China consisted of 1,017.1MW of utility projects and 250. 5MW of DG projects.