It is no secret that Europe’s energy market is in crisis. It’s a product of a myriad of factors but the way it is dealt with will shape Europe’s energy apparatus for years to come. Many different solutions or strategies to overcome the crisis have been proposed, ranging from greater fossil fuel extraction to an accelerated renewables rollout. These actions, however, will take many months and even years to bear fruit, while in the here and now asset owners and offtakers need to decide how to play the new market in front of them.

Do they increase the proportion of their trade on merchant power markets to exploit the high prices or stick to locking in long-term power purchase agreements (PPA) that ensure a more stable, predictable revenue stream?

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

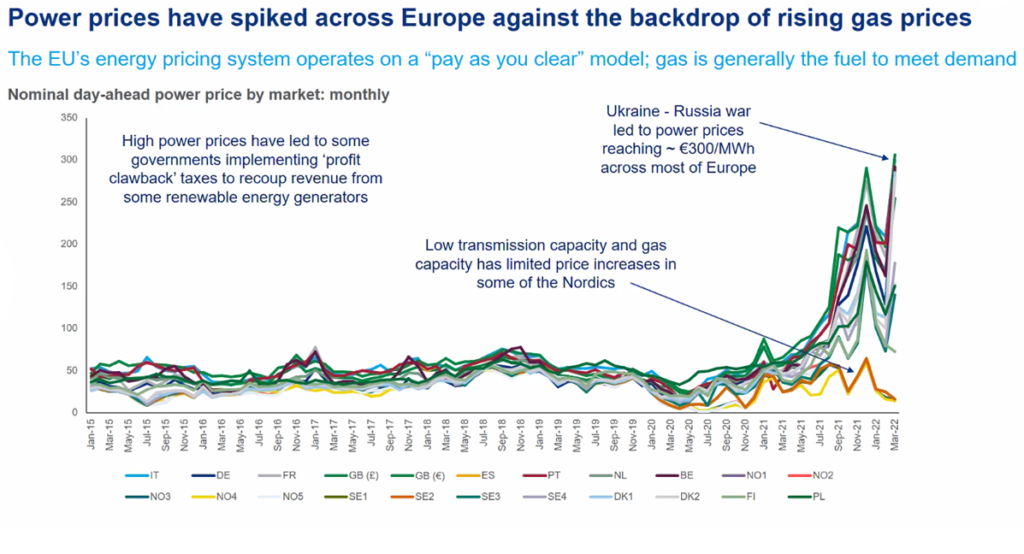

Market predictions the deciding factor

The key consideration here is where companies and markets think prices will go. Prices are now at their highest point in years – currently spot market prices are averaging around €300/MWh (US$327/MWh), up from around €50/MWh (US$54/MWh) at the end of 2019.

Nobody expects power prices to drop back to normal levels anytime soon and the evolution of power prices this year and next will depend on a few factors such as coal and gas prices, the weather, unplanned nuclear outages, renewable generation and power demand, says Kesavarthiniy Savarimuthu, European power analyst at BloombergNEF (BNEF).

And, with European gas reserves still low, do not expect the competition for resources to drop off. “Between gas consumption and restocking of storages, substantial LNG volumes will be required throughout the summer to attain comfortable storage levels until Q4 2022,” says Werner Trabesinger, head of quantitative products at renewables advisory firm Pexapark.

According to ING forecasts, future baseload energy prices for European economies such as France, Germany, Belgium and the Netherlands will remain elevated about €150/MWh (US$163/MWh) for the whole of 2022, dipping in the summer months but rising again to around €175/MWh (US$190/MWh) as we move into winter.

What it means for PPA contracts and merchant trading

The European renewable PPA market is “more competitive than ever” as prices surged 8.1% in Q1 2022 and 27.5% year-over-year, according to LevelTen Energy. Prices, which were expected to level off this year before the Ukraine conflict, have now climbed for a fourth consecutive quarter.

Strong demand for renewable power has created a shortage of project options for offtakers and the P25 index – an aggregation of the lowest 25% of solar offers – rose by 4.1% and now sits at €49.92/MWh (US$54.1/MWh), a rise of 20% (€8.32/MWh) year-on-year, noted LevelTen’s European Q1 2022 PPA Price Index.

LevelTen said the war in Ukraine, EU governments moving clean energy targets forward, supply chain disruptions and high demand for renewables have put upward pressure on European PPA prices.

But what does this mean for generators’ revenue streams and the proportion of their power they intend to sell via PPAs versus trading on spot markets?

Ultimately, there is no right or wrong answer to this question, says Phil Grant partner in the Global Power Generation unit at energy consultants Baringa. “This is a decision based on the portfolio of projects an individual developer or independent power producer (IPP) has,” he says, adding that it’s not a simple binary choice given the complex commercial structures underpinning many projects.

“It’s ultimately a risk question and a shareholder expectation question,” says Grant. “You could see identical portfolios of assets making very different decisions simply because of the capital structure that underpins them.”

If you’re owned by an infrastructure or a pension fund or a listed renewable vehicle then taking away risk and locking in three to five year PPA contracts could be prudent, while bigger institutions, large energy companies and established trading houses might accept greater exposure given their ability to effectively monetise their portfolios, suggests Grant.

According to Pietro Radoia, senior analyst at BNEF, investor appetite for merchant risk is increasing, partly due to an expectations mismatch between sellers and offtakers over long-term PPAs.

When it comes to corporate offtakers, Grant says that it is unlikely that these entities are going to be locking in long-term contracts (which he puts at three to five years) at today’s power prices given the expectation that prices will start to fall again next year, with the industry already shifting to shorter PPAs amid a lack of consensus on future pricing.

“You can earn money earlier through more market-based solutions and hedges then you can on a long-term PPA”, notes Gregor McDonald, head of trading and PPAs at European Energy AS.

“In the more liquid markets, the PPA simply doesn’t look as good as it used to if you can earn as much money in five years on wholesale markets as you could in 10 years through a PPA,” he adds.

If you’re a European generator or offtaker, these are uncertain times. The decisions made today could well impact your business for many years to come. Experts PV Tech spoke to advised considering your financial underpinning, appetite for risk, capacity to monetise portfolios and ability to act at speed when deciding on the balance of PPA versus merchant trading.

The impact of Europe’s energy crisis on PPA prices and revenue streams will be examined in more depth in the upcoming edition of PV Tech Power, published later this month.