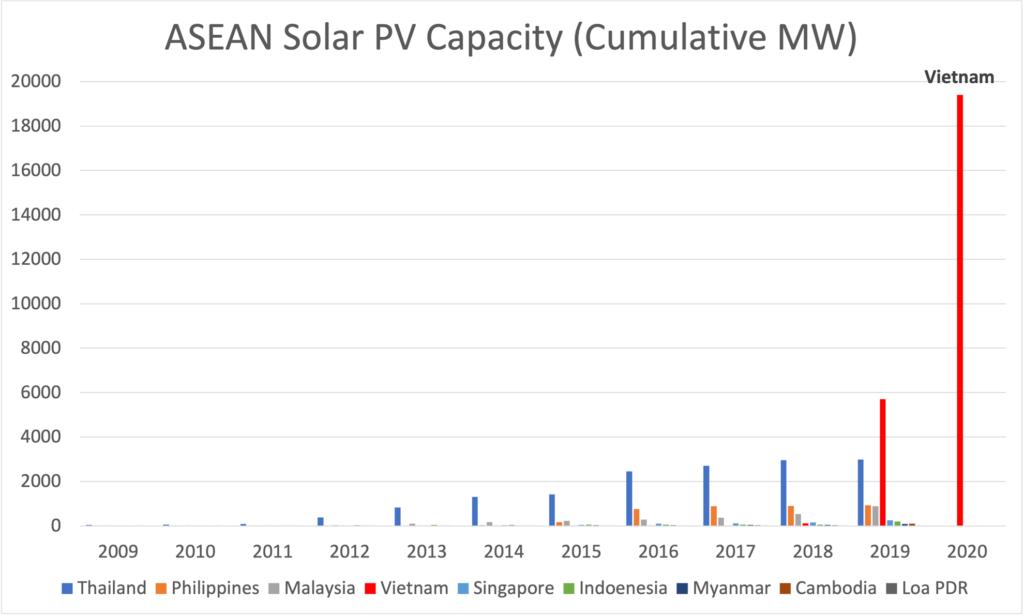

Vietnam’s year-end solar installation figure of 9GW captured headlines in January 2021. But how did Vietnam grow its cumulative solar installations from a 2018 base of 106MWp, according to International Renewable Energy Agency (IRENA) Renewable Capacity Statistics, to year end 2020 cumulative PV capacity of over 19.4GWp?

In a word, policy. The uncapped solar Feed-in Tariff (FIT) incentive policies to be more specific.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The original FIT1

On 11 April 2017, Vietnam’s Prime Minister approved Decision No: 11 /2017/QD-TTg on support mechanisms for the development of solar power projects in Vietnam, launching the original FIT policy. The Solar FIT program required utility company Vietnam Electricity (EVN) to purchase electricity from grid-connected solar projects over a period of 20 years at 2,086 Vietnamese Dong (VND) per kWh, excluding VAT, Value Added Tax, equivalent to US$0.0935 per kWh based on the State Bank of Vietnam exchange rate at the time and therefore subject to exchange rate risk.

The PPA (Power Purchase Agreement) follows a template issued by the Vietnam Ministry of Industry and Trade (MOIT). To qualify, on-grid solar projects were required to use solar cells with greater than 16% efficiency or modules with greater than 15% efficiency and achieve COD (Commercial Operation Date) by 30 June 2019.

On-grid solar projects, typically ground mounted, also required approval for inclusion into the Power Development Master Plan while rooftop solar projects did not. Solar projects below 50MWp needed approval from MOIT, and solar projects 50MWp or greater in capacity required Prime Ministerial approval for inclusion into the Power Development Master Plan.

Vietnam’s original FIT policy created a solar ground mount boom with 2019 installations of about 5.317GWp from a cumulative 2018 solar base of 106MWp, making Vietnam the solar PV leader of ASEAN.

However, the solar ground mount boom also created high voltage grid congestion in Ninh Thuan and Binh Thuan Provinces, leading to solar project curtailments still being mitigated, worked through, and resolved until today.

FIT2 takes to the rooftops

After the expiration of the original FIT policy (FIT1) on 30 June 2019, Vietnam digested the solar growth and considered new incentive policies with a focus on rooftop solar to generate electricity where it is needed without concerns of grid congestion.

During the initial wave of COVID-19 in Vietnam, the Prime Minister issued Decision No. 13/2020/QD-TTg on the mechanism for encouraging the development of solar power on 6 April 2020, setting the policy framework for Vietnam’s tremendous rooftop solar market.

Dubbed ‘FIT2’, the new incentive policy paid 1,943VND per kWh (US$0.0838 per kWh), based on the State Bank of Vietnam exchange rate at the time, over a period of 20 years with COD achieved by year end 31 December 2020. The FIT2 rates for ground mount and floating solar projects were USD$0.0709/ kWh and USD $0.0769/kWh respectively with the same term and COD deadline.

Initial FIT2 expectations were for an extension of the FIT1 rate of 2,086VND per kWh (US$0.0935/kWh) for rooftop solar. However, FIT2 did provide a special FIT1 extension for certain grid-connected solar projects in Ninh Thuan Province not exceeding 2000MW in capacity already included in the Power Development Master Plan and achieving COD by 31 December 2020.

An important ingredient of the FIT2 policy included clarity on corporate PPAs for rooftop solar systems enabling electricity transactions between a rooftop solar developer and a private company.

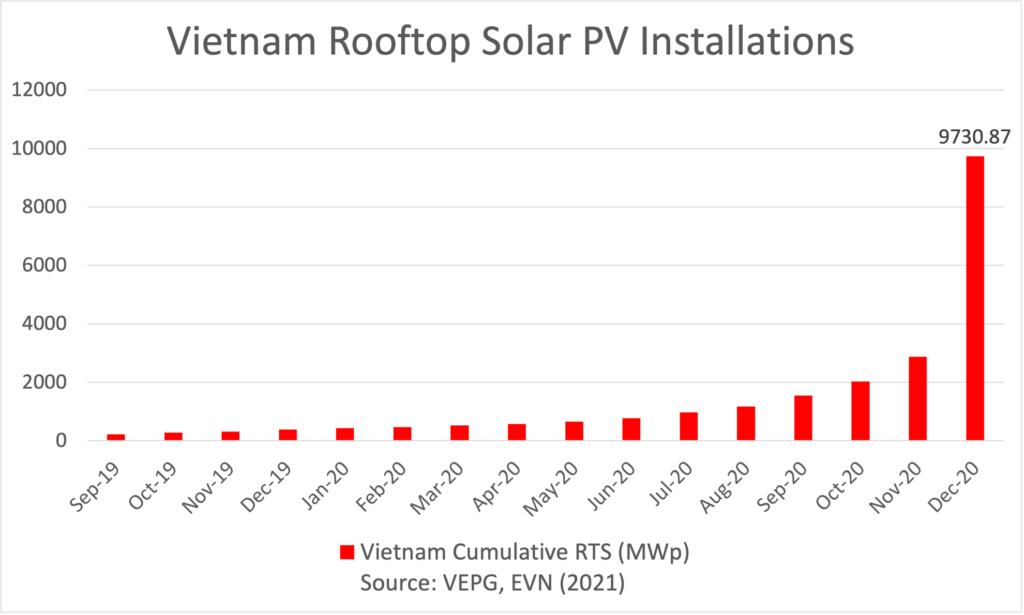

Vietnam’s 2020 rooftop solar boom has seen further revisions upward, with an additional 148MWp added to the total 9.731GWp over the past month as the state-owned EVN reviewed the data per the latest Viet Nam Energy Partnership Group (VEPG) report.

Throughout 2020 rooftop solar installations in Vietnam grew by a significant 2,474%, rising from a 2019 base of 378MWp to 9.731GWp, spread across 105,212 systems. Per the inset chart, Vietnam rooftop solar installations grew steadily in H1 2020 despite the pandemic and a nationwide lockdown period imposed in the country. Rooftop solar growth continued to accelerate throughout Q3 2020, and cumulative Vietnam rooftop solar reached an impressive 2.876GWp by end of November 2020, with monthly installations of some 851MWp.

Credit: VEPG, EVN (2021)

While most forecasted a few GWp range of rooftop solar installations in the last month, December 2020 saw Vietnam rooftop solar installations skyrocket by 6.855GWp, dominated by the commercial and industrial (C&I) segment with 5.792GWp and 392.6MWp each respectively. Per TuoiTre Online, in the final three days of December 2020 before the FIT2 policy expired, Vietnam added 19,209 PV systems, equivalent to about 4.4419 GWp of capacity, according to the revised figures. All these systems required EVN third party testing for grid connection and executed PPAs with EVN to participate in FIT2.

Furthermore, a 31 December 31 2020 notice from the MOIT revealed cumulative PV capacity to have reached 16.449GWp (13.160 GWac) by year end, implying another 1.549GWp of ground mount and floating solar projects also achieved COD under FIT2 in 2020.

However, 38 solar projects or 2.888GWac did not qualify for FIT2. Perhaps some of these did not meet the rooftop solar requirements. MOIT clarified the rooftop solar definition back in September as a number of agricultural rooftops were built for the sole purpose of installing solar. The late year surge may have included these structures modified by constructing walls in order to qualify for the FIT2. These projects appear to be included in the 19.400GWp 2020 cumulative PV capacity number from Vietnamese news sources, citing EVN.

While FIT1 and its successor have driven solar to new heights in Vietnam, the country has been crafting more focused policies to incentivise renewables for the past few years.

The solar auction program

Solar auctions have been proposed in Vietnam for the direct sale of electricity to EVN, transitioning solar farms away from blunt feed-in tariff policy mechanisms. FITs have led to concentrated development of solar farms in Vietnam’s highest solar resource provinces, Ninh Thuan and Binh Thuan, stressing high voltage transmission line capacity and resulting in curtailment for many solar farms. Also, local Provincial People’s Committee approval authority for solar projects below 50MWp in capacity resulted in numerous solar farms approved with capacities just below that mark.

The initial Solar Auction Pilot Program, outlined in a 25 September 2020 (No: 7200/BCT-ĐL) MOIT Draft Decision, was expected to begin in 2020 and continue through May 2021 as a transition phase to the launch of a national solar auction program. While total capacity for the pilot program is capped at 1GWp, only 60% of the participating projects total capacity will be selected to ensure a competitive process, and a single investor cannot exceed 20% of the total selected capacity. Pilot Program participants are limited to ground mount or floating solar farm projects already included in the Power Development Master Plan and not eligible for FIT2.

Projects bidding the lowest tariff price and meeting all other program criteria will be selected to sign a PPA with EVN until the above capacity constraints are reached. However, the proposed solar project tariff must not exceed the FIT2 tariff rates for ground mount and floating solar projects. MOIT has proposed that the model PPA for FIT2 apply to the Pilot Program with the same 20-year PPA term from project COD. PPAs will again be paid in VND and subject to VND to USD exchange rate fluctuation.

Additional project requirements for the Pilot Program include the ability of the EVN grid infrastructure to absorb the project’s proposed capacity, a proposed COD by 30 June 2022, and approval by the local Provincial People’s Committee for participation in the Pilot Program. The project’s tariff as determined by the bidding process would be reduced 5% for each quarter of delay failing to achieve the 30 June 2022 date.

More recently, on 21 January 2021, the Electricity and Renewable Energy Authority of Vietnam (EREA) Draft Decision (No. 20/BC-DL) focuses upon investor selection criteria and eligibility requirements for the national solar auction program.

Of course, any of the Draft Decisions are subject to further MOIT review, consultation, and the Vietnam Prime Minister’s final approval and signature.

The direct PPA route

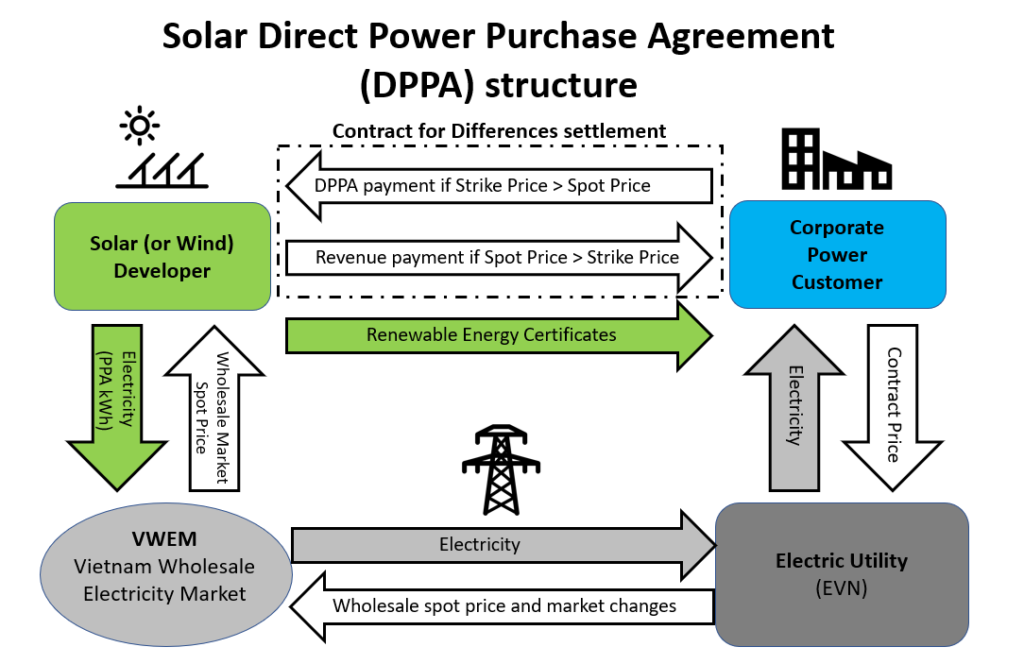

Additionally, Vietnam has proposed a renewable, virtual Direct Power Purchase Agreement (DPPA) program allowing factories and businesses to meet prospective 100% renewable energy goals from private firms through a financial arrangement.

Also known as a synthetic DPPA, a corporate customer (off-taker) enters into a DPPA with a solar project developer to purchase off-site renewable electricity at an agreed upon quantity, strike price, and contract term. In return, the corporate customer also obtains the Renewable Energy Certificates (RECs) generated by the contracted electricity. Otherwise, the corporate customer continues to purchase power normally through their energy provider or utility, EVN in this case, whose energy mix includes the solar project.

Credit: Edgar Gunther

The solar project developer sells the project’s electricity to the utility via the Vietnam Wholesale Electricity Market (VWEM) at the spot price. The DPPA contract is settled between the corporate customer and the solar project developer through a Contract for Differences (CfD). If the spot price is less than the strike price, the corporate customer pays the solar project developer the difference; and vice versa, the solar project developer pays the corporate customer the difference if the spot price is higher than the strike price.

The DPPA revenue stream enables the solar project developer to finance the project and provides the corporate customer a hedge from rising electricity prices. But as with other contracts with EVN, solar project developers are concerned about curtailment, termination, and force majeure event risks.

The innovative policy mechanism has been developed by the MOIT and Electricity Regulatory Authority of Vietnam (ERAV) with the support of the United States Agency for International Development (USAID).

Last January, MOIT issued Proposal No. 544/TTr-BCT and Draft Decision on the approval of a pilot program for the direct power purchase agreement (DPPA) mechanism between renewable energy power generation companies and power consumers. The proposed pilot for off-site renewable energy projects was sized between 400MW and 1000MW and established certain criteria for project developers and corporate customers to participate.

Project developers need to register for the DPPA Pilot Program, have an on-grid installed system capacity greater than 30MW, be included in the Power Development Master Plan with zero or low risk of grid congestion, and have sufficient financial and technical capability and experience in renewable energy project development and operations.

Corporate customers also need to register for the DPPA Pilot Program, purchase electricity at 22kV or higher voltage level, have sufficient financial and technical capability with priority given to corporate customers having international commitments regarding the environment, climate change, and sustainable development.

Multinational brands and foreign direct investors are strong advocates for the DPPA program to meet sustainability goals and power their complex supply chains with renewable energy. According to Nikkei Asia, Nike and H&M joined 29 fashion brands in a letter to Vietnamese Prime Minister Nguyen Xuan Phuc last December urging the country to approve DPPAs between corporate customers and renewable energy project developers.

A DPPA Pilot Program was expected last year but may yet debut in 2021 as technical and legal issues are resolved before the introduction. A new draft or final mechanism is required to kickstart the DPPA Pilot Program. However, an extensive legal roadmap remains to be navigated, including legal amendments for the VWEM and DPPA mechanisms, conversion of the National Load Dispatch Center (NLDC) into an Independent System Operator, and amendments to Electricity Law and Pricing Law possibly stretching the implementation into 2022 and beyond.

Future FIT prospects, self-consumption, and floating solar

Prospects for the extension of the rooftop solar FIT policy have now dimmed, and EVN has stated new PPAs for rooftop solar power would stop with the expiration of the FIT2 policy. Thus far, a new decision on solar FIT policy has not even been drafted.

In my opinion, a regional FIT for northern and north central Vietnam would promote solar PV in areas that have lagged behind others in installations. In addition, a new FIT could incentivise solar and wind plus storage to address peak power demand in Vietnam from 5:30-6:30pm.

Released on 2 October 2020, Resolution No.140/NQ-CP Promulgating the Government’s Action Programme for implementing Resolution no. 55-NQ/TW dated 11/02/2020 of Politburo regarding orientations of the Vietnamese National Energy Development Strategy until 2030, with a vision till 2045, provides insights on solar and renewable strategic priorities. In particular, the following goals are outlined:

- Study to develop, propose incentive mechanisms for developing RE-based electricity for self-consumption (with priority for rooftop solar power).

- Study to develop, propose incentive mechanisms for developing floating solar power.

Development of an “Incentive mechanism for development of distributed solar power projects for self-consumption” is targeted for the 2020-2022 timeframe.

According to TuoiTre Online, EVN has already expressed concerns regarding excess solar generation on weekends and holidays. Even during weekdays, EVN has observed the duck curve phenomenon between 10:00am and 2:00pm from excess solar electricity generation impacting the grid power system. By contrast, peak power demand in Vietnam from 5:30-6:30pm cannot be addressed by solar.

The NLDC (A0), still an EVN subsidiary, said renewable energy including solar and wind could not be fully utilised during low load hours, weekends, or over the Tet (Vietnamese Lunar New Year) holiday week. Sure enough, some industrial rooftop solar systems were instructed by A0 to curtail their output over this year’s Tet holiday week.