Virtual power plants (VPPs) in California, US, could provide over 7.5GW of capacity, around 15% of peak demand by 2035, according to a report from consultancy the Brattle Group for non-profit, GridLab.

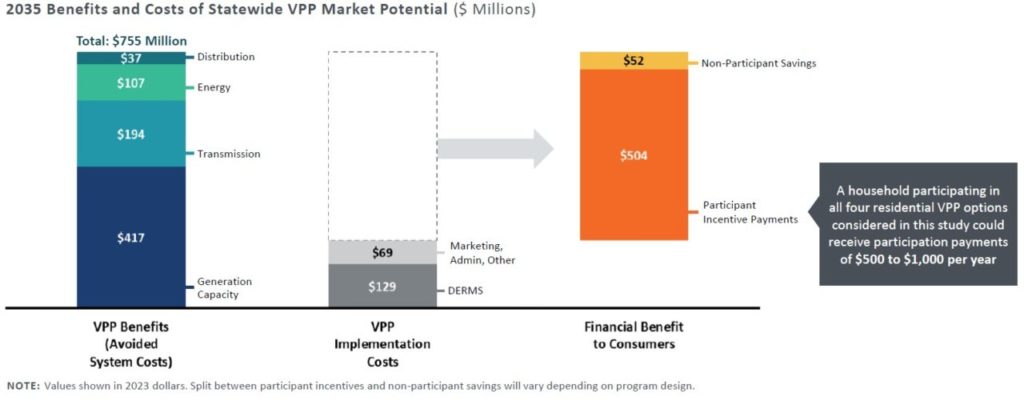

The report, California’s Virtual Power Potential: How Five Consumer Technologies Could Improve the State’s Energy Affordability, looks at the market potential for VPP deployment in the western US state which could save consumers US$550 million per year in California.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Not only could the deployment of VPPs in California generate over half a billion dollars in savings for consumers, but it could also avoid over US$750 million per year in system costs. This would translate to fewer new power plants needed and fewer necessary upgrades in transmission lines, and reduce risks linked to interconnection delays. This is an ever-growing issue in the US, with nearly 1TW of solar PV capacity in interconnection queues by the end of 2022.

A previous report from the Brattle Group estimated that VPPs could save US utilities up to US$35 billion in the next decade with the deployment of 60GW of VPP.

“In the face of rapidly rising utility bills across the state, this report shows the tremendous potential of VPPs to provide affordable, clean generating capacity as well as critical support for grid reliability,” said Ric O’Connell, executive director of Gridlab.

The also report examined five commercially available technologies – smart thermostat-based air-conditioning control, behind-the-meter batteries, residential electric vehicle charging, grid-interactive water heating, and automated demand response systems for large commercial buildings and industrial facilities – which could represent over 7.5GW of capacity, approximately a fivefold increase from the current demand response (DR) in California.

According to the report, new state policies could facilitate the deployment of VPP at the scale highlighted by the Brattle Group. Emerging VPP programmes in California have already proved successful, such as residential solar company Sunrun’s solar-plus-storage programme which provided 27MW of power to the grid for 90 consecutive days.

Ryan Hledik, lead author of the report and Brattle principal, said: “At achievable levels of participation and with technologies that are commercially available today, the potential impact of VPPs in California’s energy transition over the coming decade is simply too big to ignore.”

Increased battery adoption among rooftop PV owners

California’s reform of its net energy metering (NEM3.0) has driven the growth of battery adoption among rooftop solar PV owners. Last year, the attachment rate of batteries to rooftop solar in California increased by nearly 80%. However, PV deployment was down by nearly 70% year-over-year, according to the report.

Since the implementation of NEM3.0 a year ago, solar deployment has been down, a trend that is expected to continue in 2024. Last December, trade association California Solar & Storage Association estimated the impact of NEM3.0 could result in the loss of 17,000 jobs by the end of 2023.