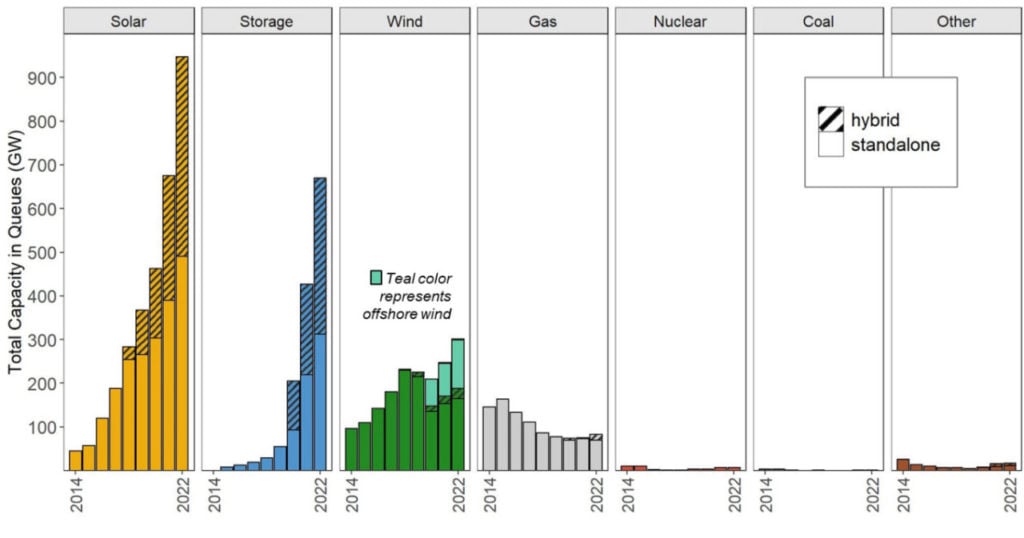

Nearly 1TW of solar PV capacity was in US interconnection queues at the end of 2022, according to a research from Lawrence Berkeley National Laboratory (LBNL).

With 947GW of generating capacity awaiting connectivity, solar had the largest share of generation capacity in the queue. Combined with wind, both technologies reached more than 1,250GW of capacity awaiting transmission access, nearly the same amount as the entire US power fleet currently installed.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In total, renewables and storage totalled nearly 2TW of interconnection queues by the end of 2022, up 40% from last year when 930GW of zero-carbon capacity was awaiting transmission access.

The sum of solar, wind and storage capacity queuing for a connection would exceed the amount necessary for the US to reach 90% of electricity from zero-carbon resources by 2035.

Despite slow-downs from two of the largest grid operators – CAISO and PJM – the demand for grid access did not slow down in 2022. Due to the major influx of new interconnection requested in 2021, CAISO halted new requests in 2022, in order to process its backlog. Whereas PJM paused any new interconnection reviews until at least 2025, according to LBNL.

Moreover, hybrid projects account for a large and increasing share of proposed projects, most notably in California Independent System Operator (CAISO) and the non-ISO West markets. There were 457GW of solar hybrid projects – mainly solar and storage – in the queue, while more than half of the battery storage capacity waiting for transmission access was paired with some form of generation, primarily solar.

“The interconnection queues illustrate both the opportunity and challenges of electric sector decarbonisation in the US,” said Joseph Rand, energy policy researcher at Berkeley Lab and lead author of the study.

“On the one hand, we see unprecedented interest and investment in clean energy development. On the other hand, the increasing delays and high withdrawal rates point to a major barrier for developers of these projects,” added Rand.

The ever growing backlog of renewable projects awaiting connection has become a major bottleneck for developing these projects as they take more time to complete the interconnection study process and come online, with most of the interconnection requests ending up cancelled or withdrawn.

Despite the more than 2TW of interconnection queues registered at the end of 2022, the major backlog for projects to get grid clearance showed that only 21% of the projects – and 14% of capacity – who sought capacity between 2000 and 2017 ended up reaching commercial operations.

More recent projects have been taking much more time and until later stages of the interconnection process to determine whether to cancel or withdraw the application.

“Later-stage withdrawals can be more costly for developers and can disrupt assumptions built into other projects’ interconnection studies, potentially delaying other projects”, said co-author Rose Strauss, of Berkeley Lab.

The timeline from grid request to commercial operation takes on average more than three years nowadays. At the beginning of the century, between 2000-2007, projects took more than two years, while those built in 2018-2022 can take more than four years.

Last year, the North American Electric Reliability Corporation (NERC) wrote for PV Tech Premium about the key considerations – and difficult balance – of managing grid connection from a transmission operator’s point of view.