Major China-based polysilicon producer Xinte Energy is planning the world’s single largest polysilicon production complex.

The facility, slated for development near the city of Baotou, Inner Mongolia, would produce 200,000MT of polysilicon per annum.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

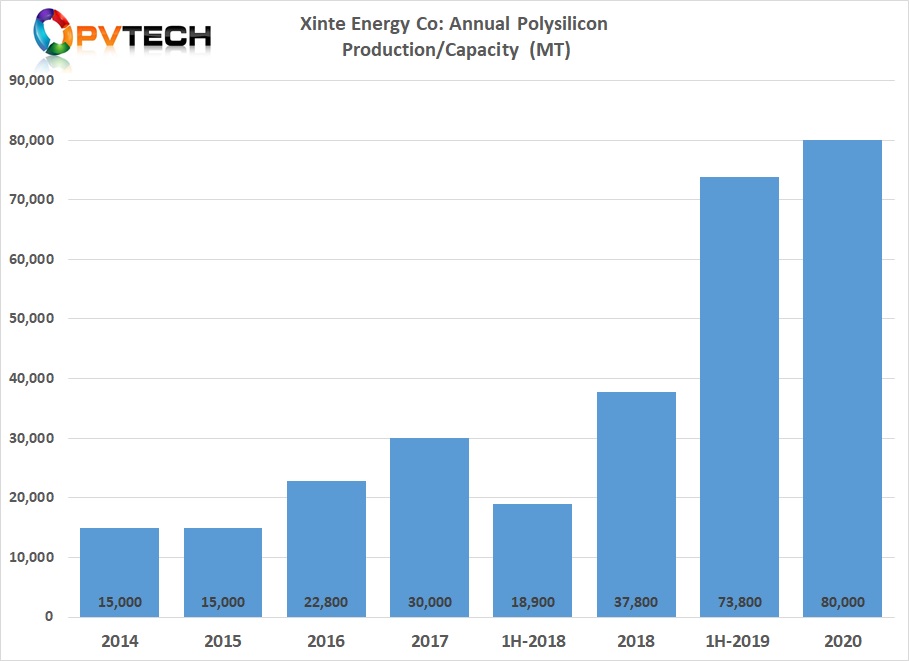

Xinte Energy’s existing major hub for polysilicon production is an 80,000MT facility in Urumqi, Xinjiang.

The plans, which have yet to go through site selection and approval with the Baotou Municipal Government, include an initial polysilicon plant with an annual capacity of 100,000MT, requiring an investment of RMB8.0 billion (US$1.24 billion).

Should the project be ratified this year, Xinte does not expect any significant impact on the company’s operating performance in 2021.

However, after confirmation of the project and construction approval procedures are agreed, groundbreaking and construction could start within one month. The Phase I project is expected to take approximately 18 to 24-months to complete.

With global solar demand forecasted to increase significantly in 2021, reaching anywhere between 150GW to 200GW, polysilicon supply in China is limited with all major cost competitive producers having secured near-term supply contracts and are capacity-constrained until new polysilicon plants are built and ramped.

Market forecasters expect only around 150,000MT of new polysilicon capacity to come on-stream in 2021, with larger amounts not due until later in 2022 and beyond when global solar end market demand could be far exceeding 200GW per annum.

Average polysilicon prices (ASPs) have significantly increased since the second-half of 2020 due to capacity constraints. In reporting third quarter 2020 financial results, polysilicon producer Daqo New Energy said its ASP was US$9.13/kg in Q3 2020, compared to US$7.04/kg in Q2 2020.

Spot market ASPs have hit US$14/kg to US$15/kg in 2021. The strong pricing has led to higher wafer and solar cell prices, impacting margins for PV module manufacturers already being impacted from significantly higher PV glass costs, again due to capacity constraints in China.

Carbon footprint

The Phase I plans by Xinte include building its own power plants to feed the 100,000MT polysilicon plant. Xinte has previously built coal-fired power stations close to coal mines and transmitted electricity to the nearby production plant.

However, Xinte noted that the Baotou plant would require around 10GW of PV and wind power plants to provide electricity, which would be built in tandem with the plant needs.

Not surprisingly, Xinte noted that the second 100,000MT polysilicon plant would be built according to market demand after the initial plant was operational.

The carbon footprint of polysilicon production could become a major issue in relation to downstream PV power plant bidding and potential government policies in the EU, US and other countries, which would impact China-based PV module manufacturers abilities to compete on major overseas projects in the future under ‘Green New Deals’.