In August, two prefecture-level counties in China’s Hainan province successively issued notices to suspend the approval of decentralised PV projects.

Since the beginning of this year, the province of Shanxi, the region of Inner Mongolia and several other provinces and cities in China have announced the suspension, or cessation, of the filing and approval of new distributed solar projects.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“It is mainly because the power grid can’t take so much load,” a local energy bureau staff member said. It is reported that a local power supply department issued an early warning about the grid load, hence, the energy bureau decided to suspend the approval of decentralised PV projects.

The staff member stated that the approval is currently suspended rather than stopped. Once the power grid is upgraded to adapt to more loads, the approval process will be resumed. “However, upgrading of the power grid is not simple,” said the staff member. “It requires a lot of capital investment.”

Growth in decentralised power

Since 2021, when new installations in the distributed solar sector exceeded those of centralised PV for the first time, decentralised PV has been seen as a promising market with significant potential.

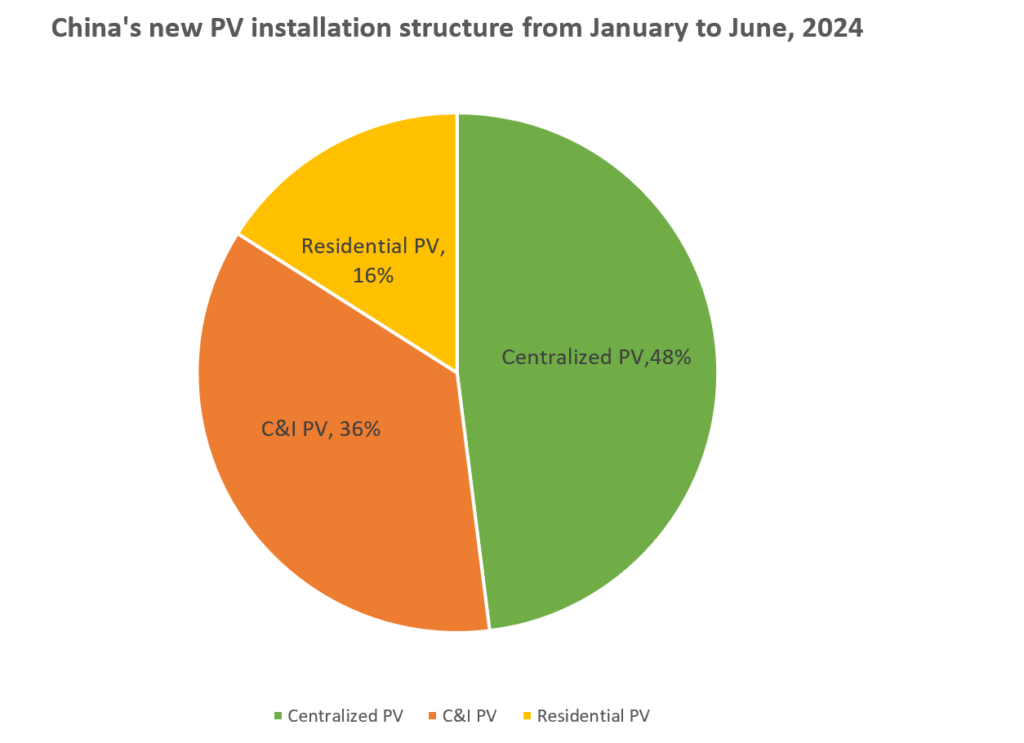

Statistics from China’s National Energy Administration show that in H1 of 2024, new grid-connected domestic PV capacity reached 102.48GW, of which centralised PV accounted for 49.6GW, equal to 48.4%. This is shown in the graph below, as is the fact that decentralised PV accounted for 52.88GW, equal to nearly 52%.

Within these new decentralised installations, the residential PV sector saw additions of 15.85GW of capacity, while the rate of installations in the commercial and industrial (C&I) sector increased at a faster rate, with 37.03GW added in H1 this year.

While this sustained growth means that decentralised PV has become the driving force behind China’s PV installations, the construction of a large number of decentralised PV power plants has raised the question of how these projects can connect to local grids.

Delays and doubts

In many parts of China, it is necessary to file for approval before the construction of C&I and residential PV projects with the local power supply office, a process that can be subject to delays.

Taking the filing and grid-connection reference process of decentralised PV projects in Hunan Province as an example, during the grid-connection stage of residential projects, petitioners must submit grid connection application materials to local power grid companies. After accepting the materials, the local power grid company provides feedback on the project’s access scheme, according to the information of available capacity released by the provincial power grid company.

At present, local power grids in various provinces and cities in China are having to manage the remaining accessible grid capacity. To support the growth of decentralised PV projects, some local grid capacities have been dynamically adjusted, but this can prove a challenge.

The installed capacity of decentralised PV varies from one region to another and the policy differences in different provinces and cities can also be huge. For example, in areas with a large number of decentralised PV power grids, grids have become less stable and more difficult to manage. Therefore, the application process for new decentralised PV projects has become stricter.

In view of the current grid challenges, the processing period for filing grid-connection permission for new decentralised PV projects in many places has been extended, which also has impacted the start-up, grid-connection and power generation time of new projects.

Global grid challenges

These questions reflect growing concern over the capacity of the world’s grids to handle such a rapid rate of new renewable energy project commissioning. Earlier this year, consultancy firm DNV estimated that the world’s grid capacity will need to grow to 2.5 times its current size by 2050, which would require investment to reach close to one trillion dollars.

This need is particularly pressing in key solar markets, such as the US, which has around 1TW of new solar and storage capacity currently awaiting grid connections, and Europe, which is lacking around 200GW of capacity for new solar installations.

China’s national government is aware of the problem, and will need to take action to alleviate the situation. Du Zhongming, director of the Electrical Power Department of China’s National Energy Administration, said that the problem related to decentralised PV is mostly found on the distribution network.

To meet the requirements of large-scale development of new decentralised projects, the existing distribution network will need to be strengthened, a strong and flexible grid structure will have to be built and the dispatching and operation mechanism will need to be improved. By 2025, the distribution network will be able to absorb around 500 million kilowatts of new decentralised power additions.