Major polysilicon producer Daqo Clean Energy has reported strong financial results for Q3 2022 as the demand for its solar grade polysilicon remains strong and it continues to land large supply contracts.

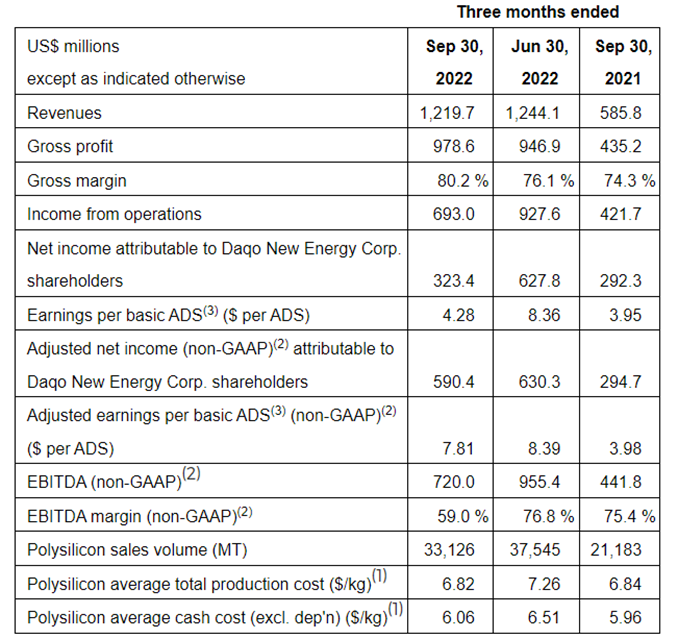

The company brought in US$979 million gross profit in Q3, up from US$947 in the previous quarter. Its polysilicon production volume was 33,401MT in Q3, compared to 35,326MT in Q2, despite a scheduled annual maintenance. Its average total production cost for polysilicon dropped to US$6.82/kg in Q3 from US$7.26/kg in the previous quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The increase in gross profit and gross margin compared to Q2, in which Daqo saw its profits triple, was primarily due to lower production costs and higher average selling prices (ASP), according to Daqo’s CFO Ming Yang.

“With higher ASP and lower production cost, Q3 gross margin continued to improve, and reached 80% as compared to 76% in Q2 this year,” said Daqo CEO Longgen Zhang.

“In particular, after further process improvements, our mono-grade polysilicon reached 99.9% of production in September, which was record-breaking for the Company.”

Despite seeing its polysilicon sales volume drop in Q3 – it fell 11.8% on last quarter – Daqo was able to achieve similar revenues, with the company noting this was due to a 10% rise in the ASP of polysilicon.

This rise can in part be explained by massive demand for polysilicon from across the solar industry when compared to previous years. For the 9 months ending 30 September 2022, net cash provided by Daqo’s operating activities was US$1.7 billion, compared to US$653 million in the same period of 2021.

On a conference call with analysts, Yang said he expected the ASP for polysilicon to stay at “a fairly high level”, which he put at around US$36/kg to US$38/kg.

“Q4 is typically a peak season here in China in terms of installations. And we’re tracking the Chinese installations for this year is expected to double in 2022 versus 2021,” he explained.

“I think the range of estimate provided by the Chinese Photovoltaic Industry Association and National Energy Administration is expecting China to be 85GW to 100GW this year,” said Yang, adding that “we could see a lot of activity in Q4” given the close relationship between polysilicon and modules pricing.

Earlier this week, signed a polysilicon supply agreement with a company – most likely TCL Zhonghuan – for 432,000MT of solar grade polysilicon worth up to US$18 billion. And earlier this month it signed a five-year polysilicon supply agreement with solar wafer manufacturer Shuangliang Silicon Materials.

The Company expects to produce approximately 30,000MT to 32,000MT of polysilicon in Q4 2022 and approximately 130,000MT to 132,000MT of polysilicon in the full year 2022, inclusive of the impact of the Company’s annual facility maintenance.

Conference call information taken from Seeking Alpha.