Microinverter supplier Enphase Energy reported yet another jump in both shipments and revenue in Q4, with recent supply deals in the US and Europe expected to grow sales even further.

The company also said that while the coronavirus outbreak in China was not expected to have a major impact on its operations in Q1 2020, it was preparing to expedite product shipments through air freight depending on how the logistics situation in the country materializes.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

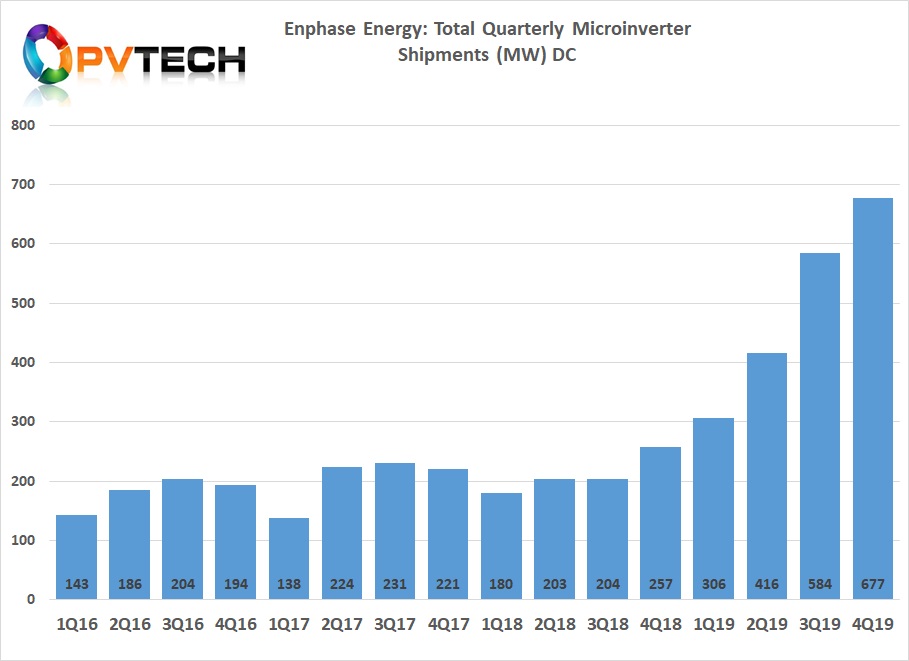

Enphase confirmed shipments for the three-month period ended 31 December 2019 to have stood at more than 2.1 million units, equivalent to ~677MW (DC) of microinverter shipments.

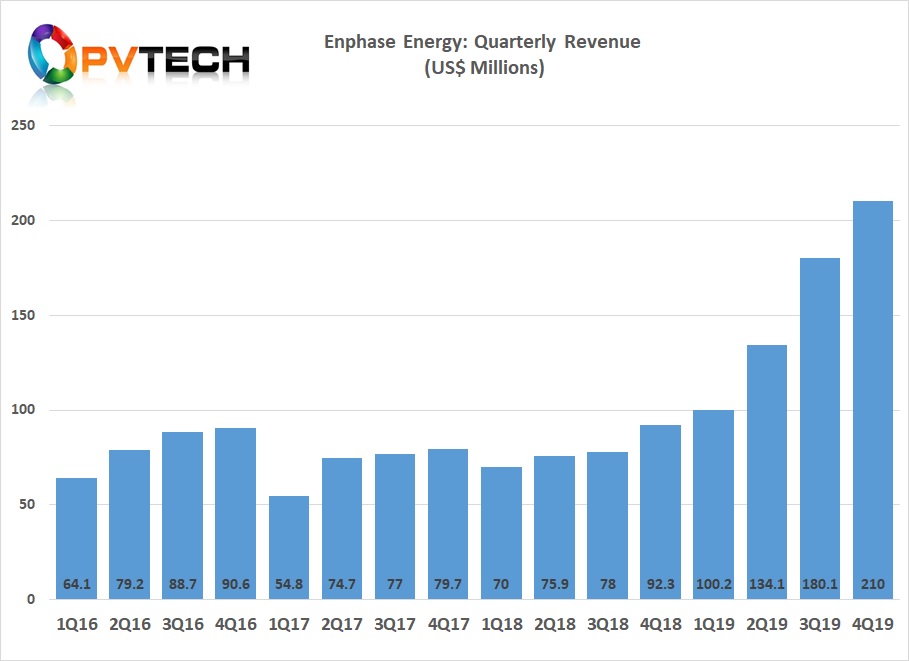

This constituted a 17.6% sequential leap on the ~1.8 million microinverters shipped in Q3 2019, leading to a spike in quarterly revenue to US$210 million. Q3 revenue for the California-headquartered firm stood at US$180 million, while revenue in Q4 2018 stood at US$92 million.

The significant majority of Enphase’s revenue (92%) continued to derive from the US, with international revenues amounting to 8%, despite “excellent progress” being made in Europe.

Those quarterly figures were enough to send full-year revenue to US$624.3 million, nearly double the US$316.2 million Enphase recorded in 2018.

And the company expects that growth trajectory to continue into 2020 on the back of a handful of supply deals lined up since the start of the year.

Enphase secured supply deals with US roofing and solar supplier Petersen-Dean and German residential roofing specialist Creaton in January and February 2020 respectively.

The company is now guiding towards revenue in the region of US$200 – 210 million for Q1 2020, including US$44.5 million worth of revenue from ITC safe harbor shipments.

President and chief executive at Enphase, Badri Kothandaraman, meanwhile confirmed that shipments of the company’s new Encharge battery storage system and Ensemble energy management technology remain on track to commence next month.

He added the company had been left pleased by pre-order numbers and had been ramping up installer training in anticipation of the product launch.

In a conference call with analysts held after the results announcement, Kothandaraman did not provide specific figures for the firm’s Q1 2020 shipment guidance, but stressed it was “fully booked for the first quarter to the midpoint of guidance”.

The firm’s Q1 guidance therefore, including safe harbor shipments, will reflect a base revenue drop of around 8%, a result which Kothandaraman described as “pretty good” considering seasonality.

Coronavirus impact

Kothandaraman also spoke candidly during the conference call about the impact of the recent coronavirus has had on the company’s activity since the turn of the year. He stressed that while the company remained cautious of the virus and was watching its impact carefully, Enphase do not see it having a “big impact” to Q1 performance at this stage.

He said that while the firm’s contract manufacturing facility in China is now steadily ramping back up to capacity following the Chinese New Year, coupled with its component supply chain, Enphase is seeing “some indications” that outbound logistics from China are constrained by the virus outbreak.

This could, however, lead to the firm needing to expedite some product through air freight from China and preparations were already underway should that need arise.

That echoes with what other solar component manufacturers have said, including the likes of Korea-based Hanwha Solutions, who last week confirmed that two major module assembly plants had been temporarily shut down as a result of raw materials and component shortages emanating from China-based suppliers.