A patchwork implementation of the EU’s power revenue cap could stall renewables development and dent investment, according to LevelTen Energy, a provider of renewables transaction infrastructure.

EU ministers agreed last week to cap market revenues at €180/MWh (US$177/MWh) for ‘inframarginal’ electricity generators, such as solar, that the European Council said “have made unexpectedly large financial gains” in recent months.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Member states have included the possibility for individual countries to set a higher revenue cap, use measures that further limit market revenues and differentiate between technologies.

If each country were to enact different caps and rules, projects could be stalled while developers and investors “will experience a large amount of uncertainty”, LevelTen said in an explainer.

“Different price setting mechanisms across the continent will have an unintended ripple effect on neighbouring markets,” said Kristian Lande, senior director of European analytics at LevelTen Energy.

“Without consensus among 27 countries on the timing and price level, there will be greater uncertainty, which will likely lead to less investment across the board.”

LevelTen also suggested that if non-EU countries, such as the UK and Norway, don’t implement similar caps, renewable generators could be incentivised to sell to those countries.

Set to apply across the EU from 1 December 2022 to 30 June 2023, the revenue cap is projected to collect up to €117 billion (US$116 billion), with the surplus revenues to be channelled to final electricity consumers exposed to high prices.

Consultancy Rystad Energy has warned that the policy could lead to delays in renewables projects and the renegotiation of long-term contracts for plants still under development.

“The renewable industry is Europe’s best shot at producing affordable and secure power, but this policy reduces the private sector power providers’ ability to invest,” said Victor Signes, a renewables analyst at Rystad Energy.

Research from Rystad has suggested that about 60% of total installed renewables capacity in the EU derives its revenues from fixed-rate contracts agreed well before the energy crisis, with only around 40% benefiting from current high prices.

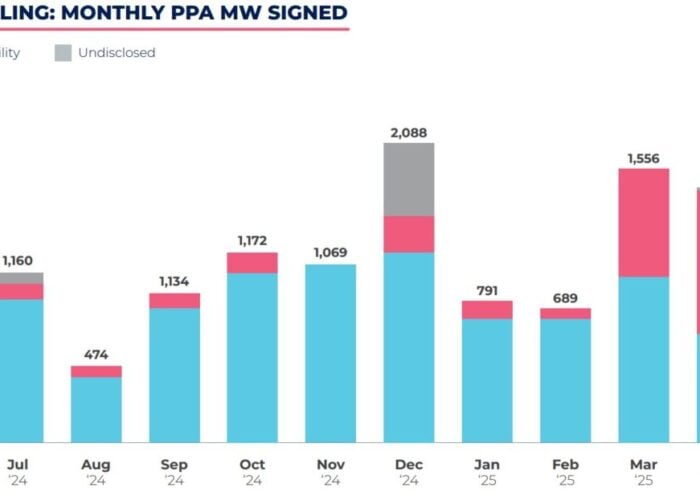

In terms of how the measures will affect power purchase agreement (PPA) supply for corporate offtakers, LevelTen said projects that are nearing commercial operation date will be most impacted, as developers assess the impact the cap will have on project financials, particularly if a portion of the capacity was reserved for the spot market.

According to a LevelTen survey of 19 renewables developers, 42% said the price cap of €180/MWh would not change their PPA offer activity, with the same percentage saying they will continue to submit some offers.

Even with the €180/MWh cap, however, LevelTen said the spot market remains an attractive option for developers that want to capture the full revenue potential of today’s market conditions.