Opening bids for the largest centralised procurement tender in China’s PV history have come in, with 51GW each of PV modules and inverters on the table.

The massive tender, initiated by PowerChina, attracted 58 PV module companies, setting a record high for the number of participating companies.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

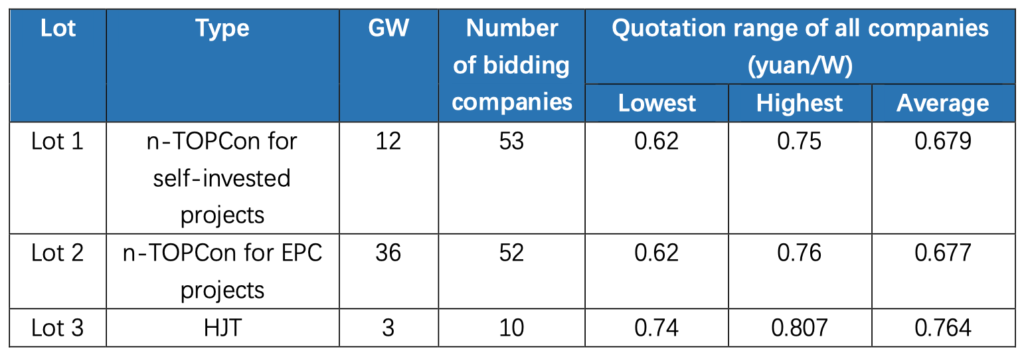

According to the tender documents, the PV module group purchase is divided into three lots. Two lots totalling 48GW are for TOPCon modules – one is 12GW of self-invested projects, and the other is 36GW of engineering, procurement and construction (EPC) projects. Lot 3 is for 3GW of HJT modules. Back contact modules are not included in this tender. Inverters are divided into four lots, covering box-type inverters, >300kW string inverters and 10-150kW string inverters.

In terms of module quotations, the lowest quote for TOPCon module was RMB0.62/W (US$0.085) and the highest was RMB0.76/W, averaging at RMB0.679/W. The lowest quote for HJT modules was RMB0.74/W and the highest RMB0.807/W, averaging at RMB0.764/W. In view of the price difference between the two, HJT has a certain premium over TOPCon in average price.

It is worth noting that this group procurement will effectively reduce module inventory in the PV industry, but it has also led to some companies grabbing orders at low prices.

According to the bidding results, more than 50 companies participated in the tender for the 48GW TOPCon module procurement and more than one-third of the two lots of TOPCon modules were quoted below RMB0.68/W, most of which were from second-tier module manufacturers.

Tier-1 module companies represented by Trina Solar, JA Solar, Canadian Solar and Jinko Solar are relatively self-disciplined; quotations from these companies are all higher than RMB0.68/W and are around RMB0.703/W.

This is the largest centralised bidding for PV modules by Chinese PV companies since the minimum price initiative of China PV Industry Association (CPIA) in October. CPIA once stated that bids below RMB0.68/W are considered “illegal”. Even so, there are still companies that do not comply with the initiative in their bids.

Cao Renxian, chairman of Sungrow, previously said at the annual PV industry conference that: “Now companies within the industry are losing money in general, with no profits or extremely low gross margins. What resources and funding do you have for innovation? Companies that bid below cost are no different from committing suicide.”

According to the tender procedure, opening bids in this tender are only for framework contracts, and the quoted price is not the final one. There will still be a second round of bidding. PV Tech will continue to monitor the follow-up progress.