US thin-film manufacturer First Solar recorded an operating loss of US$68 million in Q3 2022, which it put down to ongoing supply chain disruptions.

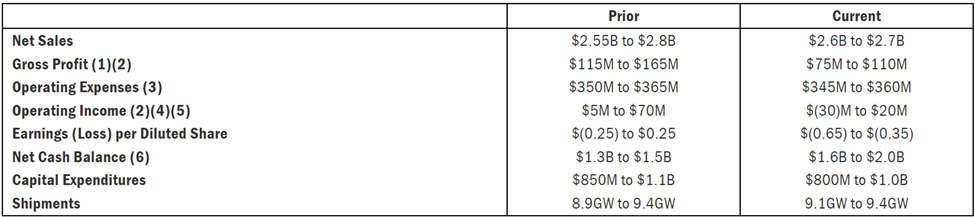

During Q3, First Solar recorded net sales of US$629 million, up US$8 million on the previous quarter, while its operating loss for Q3 stood at US$68 million, compared to an operating income of US$145 million in the previous quarter, which it said was skewed by the sales of its Japanese business unit.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

At the time of its Q1 guidance, First Solar warned of a “challenging 2022 from an earning standpoint” as it grappled with persistent logistical issues.

In Q3, the company shipped roughly 2.8GW of its thin-film modules and produced 2.4GW. Its year-to-date bookings now stand at 43.7GW, with 16.6GW booked since its previous earnings call. Last week alone, First Solar sold 4GW of its thin-film PV modules in two deals with Swift Current Energy and renewables asset manager Arevon.

“Our focus continues to be on setting the stage for long-term growth, and from this point of view, 2022 has so far proven to be foundational,” said Mark Widmar, CEO of First Solar, which completed the sale of its Australia and Japan operations and maintenance (O&M) businesses in Q3.

First Solar’s earning presentation showed that it had a fleet-wide Q3 capacity utilisation of 112%, with 26.6MW produced per day, with an average module from the company containing 465W.

Alongside its Q3 results, the company also announced that it plans to investUS$270 million in a new research and development (R&D) facility in Perrysburg, Ohio, as it continues its global PV manufacturing expansions. It previously announced in August that it would invest up to US$1.2 billion to expand its manufacturing operations in the US, including setting up a vertically integrated factory in the country’s Southeast with an annual capacity of 3.5GWdc.

In July, before the passing of the Inflation Reduction Act, First Solar said it would consider expanding its US manufacturing base if key tax incentives were put in place, at which point it would “pivot quickly to reevaluate US manufacturing expansion”.

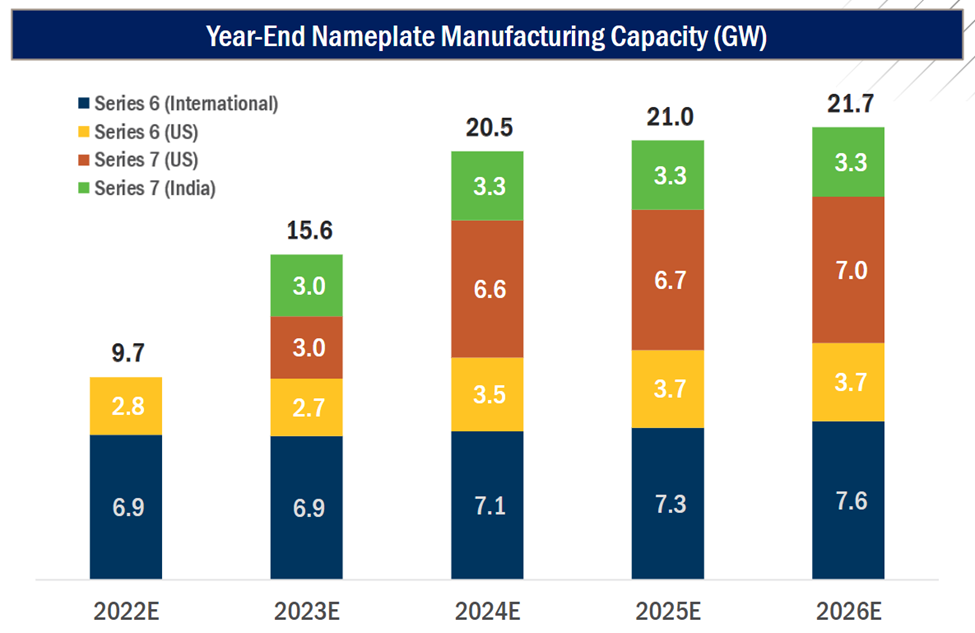

The company is also currently building its first manufacturing facility in India, scheduled to begin operations next year, in addition to its facilities in the US, Vietnam and Malaysia. Once all its current projects are complete, First Solar expects a global annual manufacturing capacity of over 20GW in 2025, with more than 10GW of this made in the US (see graph below).