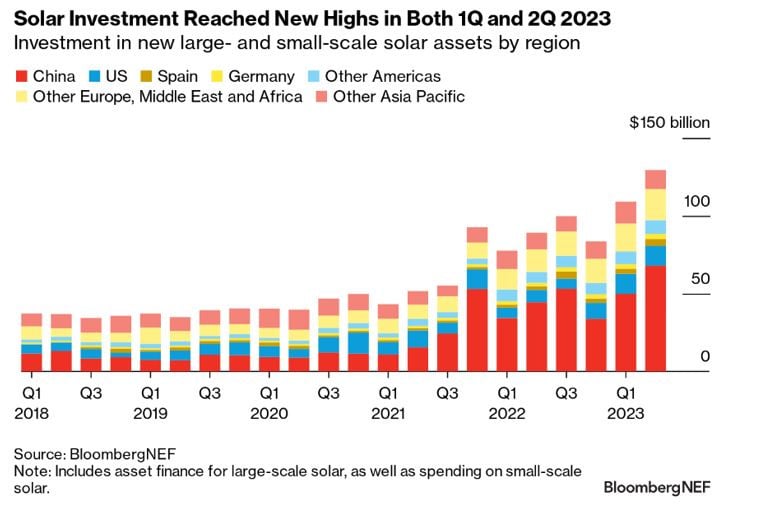

Global investment in solar in the first half of 2023 increased by 43% year-on-year (YoY) to reach US$239 billion, but renewable energy investment was still far below the required amount to reach the net zero goal by 2050.

According to BloombergNEF’s 2H 2023 Renewable Energy Investment Tracker report, a total of US$239 billion was invested in large- and small-scale solar systems, making up two-thirds of total global renewable energy investment over the first half of the year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

China continued to be the largest investor in solar as it accounted for roughly half of all large- and small-scale solar investments in 1H 2023. Reasons for the dominance included lower module prices, a robust rooftop PV market, and the commissioning of China’s energy megabases, which aim to develop large-scale wind and solar installations mainly in desert areas.

The US was the second largest investor solar, spending US$25.5 billion in large and small-scale solar during 1H 2023. Although the investment from the US was far lower than that of China, this was already a 75% increase from H1 2022 as supply chain constraints eased and clarity grew around the Inflation Reduction Act (IRA).

Germany, Poland and the Netherlands also saw record-breaking investment, with demand driven by Russia’s invasion of Ukraine and the subsequent energy crisis in Europe. Saudi Arabia also saw impressive growth thanks to the NEOM PV plant for dedicated hydrogen production.

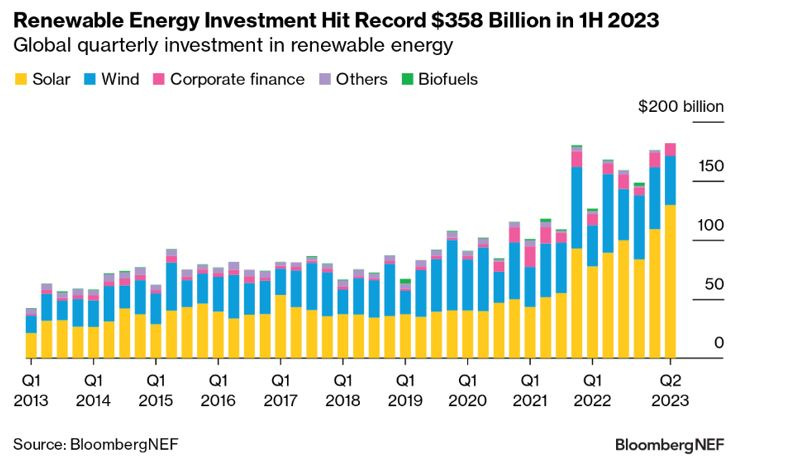

Other than solar, global new investment in renewable energy surged to US$358 billion in H1 2023, a 22% rise compared to the same period of last year and an all-time high for any six-month period. Of the total amount, US$335 billion was for project deployment through asset finance and small-scale solar, up 14% YoY.

Moreover, venture capital and private equity expansion commitments to renewable energy companies reached US$10.4 billion in H1 2023, increasing by 25%. New equity raised on the public markets totalled US$12.7 billion during H1, up 25% YoY.

However, the record investment in H1 2023 was still below the amount required to keep global warming well below 2°C by 2050. According to BloombergNEF’s New Energy Outlook, the world needs to spend US$8.3 trillion on renewable energy deployment from 2023 to 2030.

Therefore, US$590 billion should be invested in asset finance and small-scale solar in a six-month period, meaning that the investment in H1 2023 still needs to increase by 76% to reach the required amount.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.