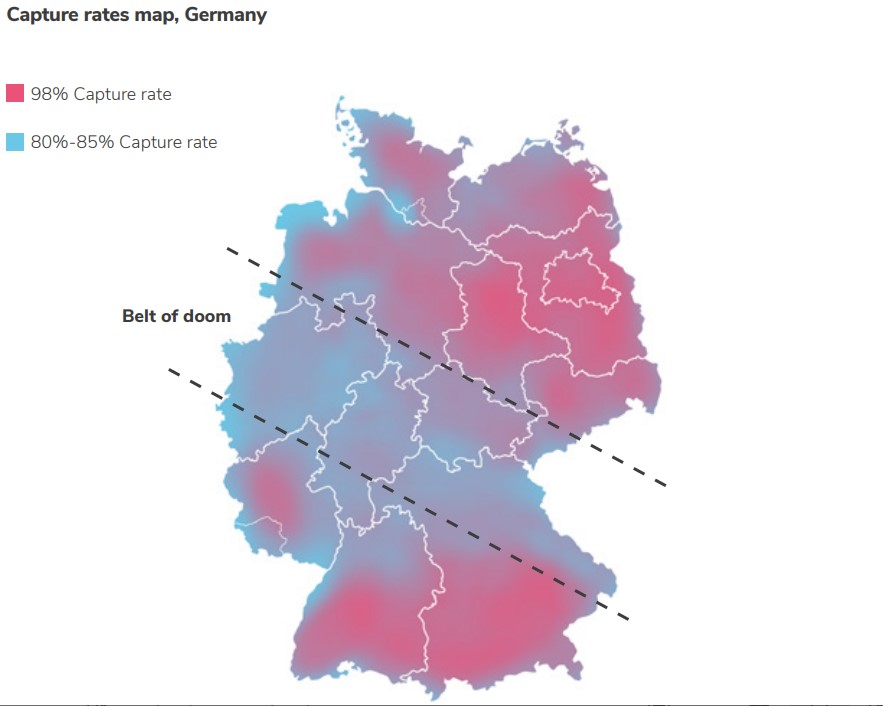

High power prices in Europe may be obscuring the impacts of price cannibalisation that threatens the future profitability of renewable energy on the continent, with a ‘belt of doom’ observed in Germany and Spain at risk of 30% cannibalisation rates by 2030.

That’s according to renewables advisory firm Pexapark’s latest report, The Cannibalization Effect: Behind the Renewables’ Silent Risk, which urged renewable energy companies to factor in price cannibalisation into their considerations.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“As renewables’ contribution to the energy mix continues to increase, predominantly providing electricity on an intermittent basis, there is a risk that generators will be eating into their own revenues,” said Pexapark, which looked at Germany, Sweden and Spain for its report.

The firm found that in Spain, capture rates were at risk of “consistently falling below the baseload rates”, potentially resulting in price cannibalisation of up to 30%.

“As the country is also leading the European PPA Market, offtakers have strongly lowered pricing of Pay-as-Produced (PAP) PPAs, due to concerns of future cannibalisation,” said the report.

Elsewhere, in Germany, Pexapark has demarcated a ‘belt of doom’ across the middle of the country in which capture rates are the lowest, almost 20% less than other locations. It gives the example of the mountainous south of the country in which wind power deployment is lower, resulting in capture rates being higher.

Although it does note how “when estimating revenues, it’s not only the capture price that matters, but also expected volume” and that “when such data are merged with location-specific production yield estimations, investors can realise a more accurate financial model around the investment case of a new project.”

Pexapark advised: “Better visibility of capture factors is one of the important aspects in the active management of cannibalisation.

“Historical and forecasted capture rates are a key input factor in PPA analytics thereby helping decision support on PPA structures, energy risk reporting and the quantification and modelling of cannibalization offsetting strategies like investment in energy storage.”

Its COO and co-founder Luca Pedretti said that “while the current focus for renewable energy investors and operators is around unprecedented levels of market prices and price volatility, the active management of cannibalisation risk has become equally important as part of comprehensive renewable revenue and risk management.”

Speaking to PV Tech back in February, Pexapark said that European renewable power companies should start signing shorter PPAs as volatile European energy prices throw the market into uncertainty and disarray.

PV Tech Premium then conducted a closer examination of the impact of European energy prices on PPA and merchant trading strategies, which can be accessed here.