India’s solar module exports to the US and Europe will likely peak in 2025 and experience a decline starting from 2026 as domestic manufacturing plants will be operational in these regions, according to recent research from energy analyst JMK Research.

In its report, New Paradigms of Global Solar Supply Chain, JMK Research stated that the US and Europe play a critical role in the growth of domestic PV manufacturing in India, while the US has been the largest export destination for Indian PV products.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Indian module exports to the US and Europe

In 2023, India is expected to export nearly US$1 billion worth of PV modules to the US, a share of around 97% of the entire global module exports out of India.

JMK Research added that the PV module exports from India to the US had grown exponentially, up 16 times in 2023 compared to 2022, due to ongoing investigations into module imports from Southeast Asian countries in the US. But in May, US president Joe Biden vetoed the proposal by the Senate and the House of Representatives to revoke his two-year waiver on Southeast Asian solar PV imports.

The US also imposed the Uyghur Forced Labor Prevention Act (UFLPA) in response to alleged forced labour in the production of goods – including solar module components – in Xinjiang, China. The UFLPA, along with the EU, is planning to ban products with forced labour in their supply chains from entering, which will grow the exports from India to the US and Europe markets “multi-fold”, according to JMK Research.

However, India’s PV module exports to the US and Europe will likely decline starting from 2026 due to the operation of new domestic manufacturing plants in these regions.

Exports from India after the exponential growth

JMK Research said as exports to the US market will likely dwindle after 2026, Indian solar manufacturing companies should target markets other than the US and Europe, including Africa and South America.

Some countries may try to find alternatives to Chinese imports, which may offer more opportunities to Indian solar module manufacturers.

“The prevailing ‘China+1’ sentiment in securing their supply chains will also be a key driver for the increasing preference for India-based PV products in the global market. However, there might be a possibility of the US formulating a ‘friend-shoring’ agreement under the Quadrilateral Security Dialogue (QUAD) with India, under which the US continues to import a fixed quantum of PV products from India,” the company said.

In addition, the global transition towards hydrogen-based energy sources could also benefit India’s solar module manufacturers. The US committed to shifting one-third of its total hydrogen production to renewable sources by 2030, and this “presents a significant growth prospect for Indian PV exporters to capture this market”, according to JMK Research.

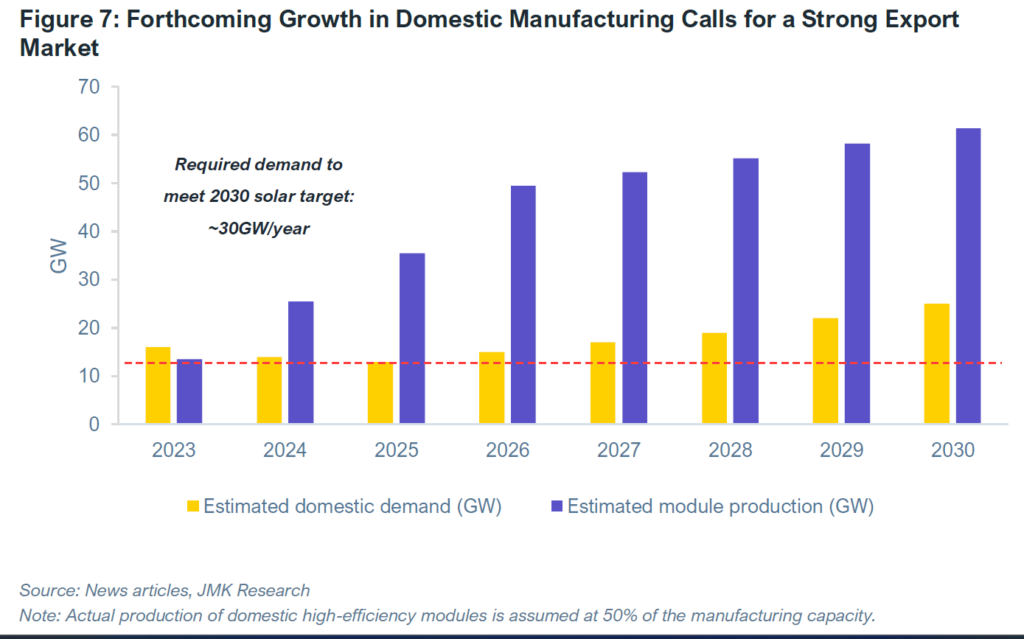

Module production in India

India’s estimated module production will reach over 20GW next year, higher than the estimated domestic demand of more than 10GW. The discrepancy between the estimated domestic demand and estimated module production will continue to increase. Module production will reach about 60GW in 2030 while domestic demand will only increase to over 20GW.

Additionally, several Indian solar module manufacturers announced plans to expand their manufacturing capacities. For example, solar module manufacturer Gautam Solar planned to double its annual module production capacity to 2GW by the end of next year through an investment of INR1.5 billion (around US$17 million). The manufacturing expansion will involve a brand-new facility in the North Indian state of Haryana, around 200km from Delhi, representing a change of direction for the company.

PV Tech Premium published an interview with Gautam Solar CEO Gautam Mohanka last week.

Apart from Gautam Solar, the US International Development Finance Corporation (DFC) also announced plans to invest US$425 million into Tata Power subsidiary TP Solar, which it plans to use to build a 4.3GW solar cell and module manufacturing plant in India.

“An added boost will be the expiry of tariff exemptions under the Free Trade Agreement (FTA) in July 2024, currently granted to PV imports in the US from Southeast Asian nations such as Vietnam and Malaysia,” the company said.